Question: please answer all the questions with proper explanation. 1) Lotus LTD is a company that manufactures shoes It has to decide if the project it

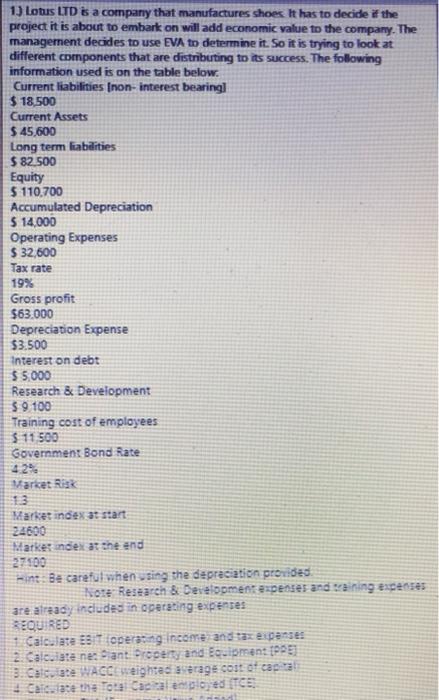

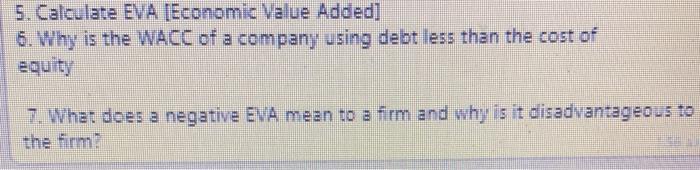

1) Lotus LTD is a company that manufactures shoes It has to decide if the project it is about to embark on will add economic value to the company. The management decides to use EVA to determine it. So it is trying to look at different components that are distributing to its success. The following information used is on the table below. Current liabilities (non-interest bearing) $ 18.500 Current Assets $ 45,600 Long term fiabilities $82.500 Equity $ 110,700 Accumulated Depreciation $ 14,000 Operating Expenses $ 32,600 Tax rate 19% Gross profit $63.000 Depreciation Expense $3.500 Interest on debt $5,000 Research & Development $ 9 100 Training cost of employees $ 11 500 Government Bond Rate Market Rik 13 Marketindex at start 24600 Harker index at the end 27.100 wint. Be careful when using the depreciation provides Nor Research & Development expenses and training expenses are already included in operating expenses *EQUIRED Calc.ste operating income and expenses 2. Calc. are ne: Sant Droperty and Equipment to Calcete WACC weighted a rage cost of cap Calc. 20 tot Called TCE 5. Calculate EVA [Economic Value Added] 6. Why is the WACC of a company using debt less than the cost of equity 7. What does a negative EVA mean to a firm and why is it disadvantageous to the firm: Question 2 Lotus LTD is a company that manufactures shoes. It has to decide if the project it is about to embark on will add economic value to the company. The management decides to use EVA to determine it. So it is trying to look at different components that are distributing to its success. The following information used is on the table below: Current liabilities (non-interest bearing) $ 18,500 Current Assets $ 45,600 Long term liabilities S 82,500 Equity S 110.700 Accumulated Depreciation Operating Expenses S 32,600 $ 14,000 Tax rate Gross profit Depreciation Expense 19% 563.000 $3.500 Interest on debt S 5.000 Research & Development S 9.100 Training cost of employees S 11.500 Government Bond Rate 4.2% Market Risk 13 Market index at start 24600 Market index at the end 27100 Hint: Be careful when using the depreciation provided. Note: Research & Development expenses and training expenses are already included in operating expenses REQUIRED 1. Calculate EBIT (operating income) and tax expenses 2. Calculate net Plant, Property and Equipment (PPE) 3. Calculate WACC( weighted average cost of capital) 4. Calculate the Total Capital employed [TCE]. 5. Calculate EVA (Economic Value Added] 6. Why is the WACC of a company using debt less than the cost of equity 7. What does a negative EVA mean to a firm and why is it disadvantageous to the firm? [ marks 40)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts