Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all the questions You are currently only invested in the Natasha Fund (aside from risk-free securities). It has an expected return of 13%

Please answer all the questions

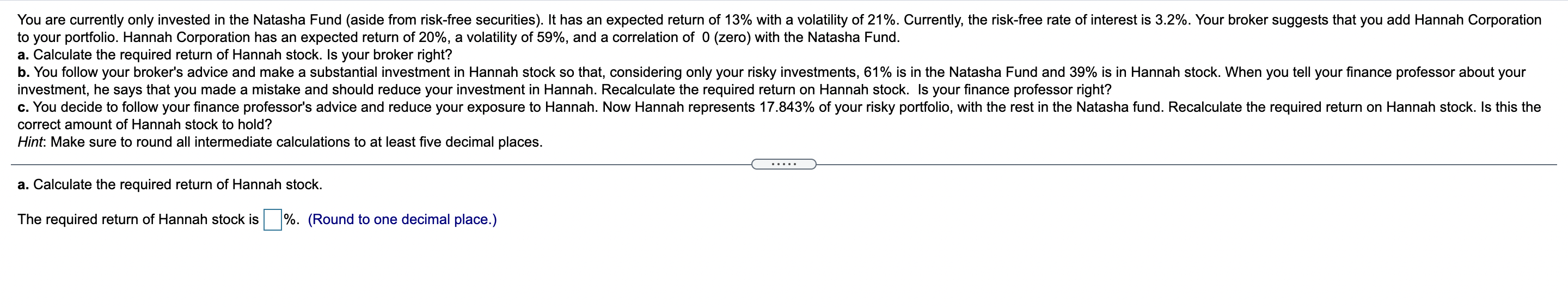

You are currently only invested in the Natasha Fund (aside from risk-free securities). It has an expected return of 13% with a volatility of 21%. Currently, the risk-free rate of interest is 3.2%. Your broker suggests that you add Hannah Corporation to your portfolio. Hannah Corporation has an expected return of 20%, a volatility of 59%, and a correlation of 0 (zero) with the Natasha Fund. a. Calculate the required return of Hannah stock. Is your broker right? b. You follow your broker's advice and make a substantial investment in Hannah stock so that, considering only your risky investments, 61% is in the Natasha Fund and 39% is in Hannah stock. When you tell your finance professor about your investment, he says that you made a mistake and should reduce your investment in Hannah. Recalculate the required return on Hannah stock. Is your finance professor right? c. You decide to follow your finance professor's advice and reduce your exposure to Hannah. Now Hannah represents 17.843% of your risky portfolio, with the rest in the Natasha fund. Recalculate the required return on Hannah stock. Is this the correct amount of Hannah stock to hold? Hint: Make sure to round all intermediate calculations to at least five decimal places. a. Calculate the required return of Hannah stock. The required return of Hannah stock is %. (Round to one decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started