Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all these questions clearly, step-by-step Q.1 Abdullah is a self employed auditor and received the following income in 2010/2011 Bank Saving interest 6400

Please answer all these questions clearly, step-by-step

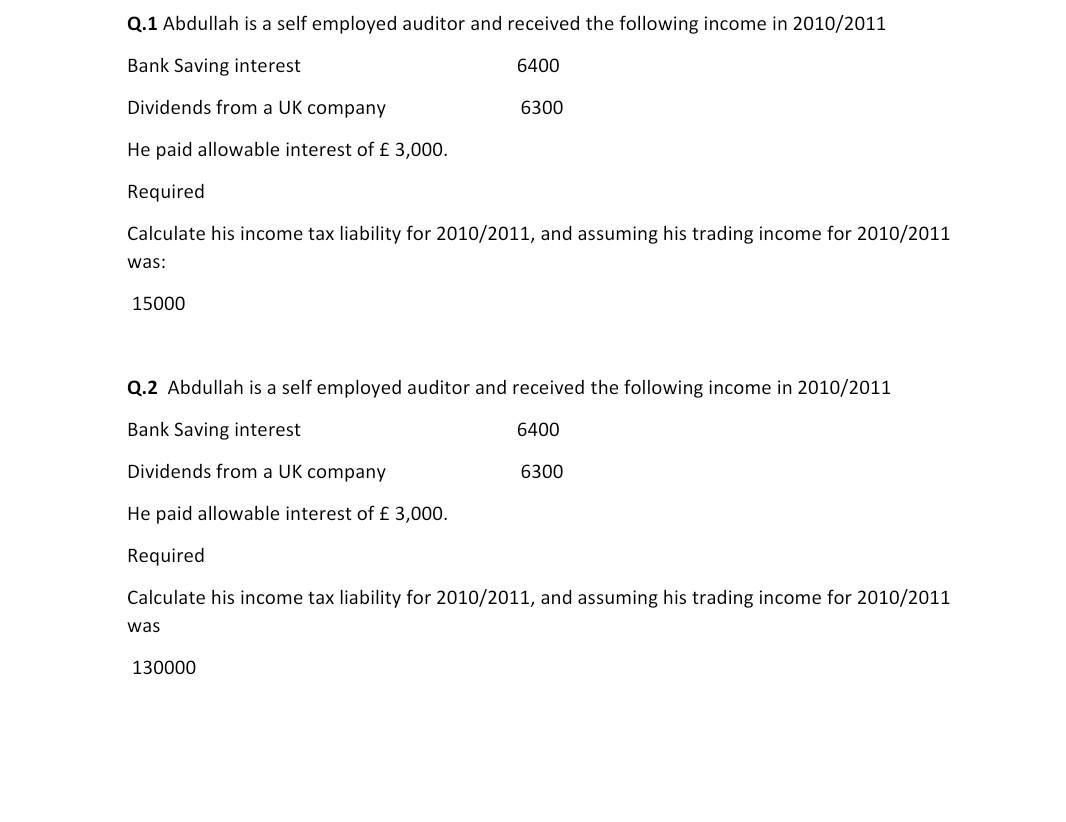

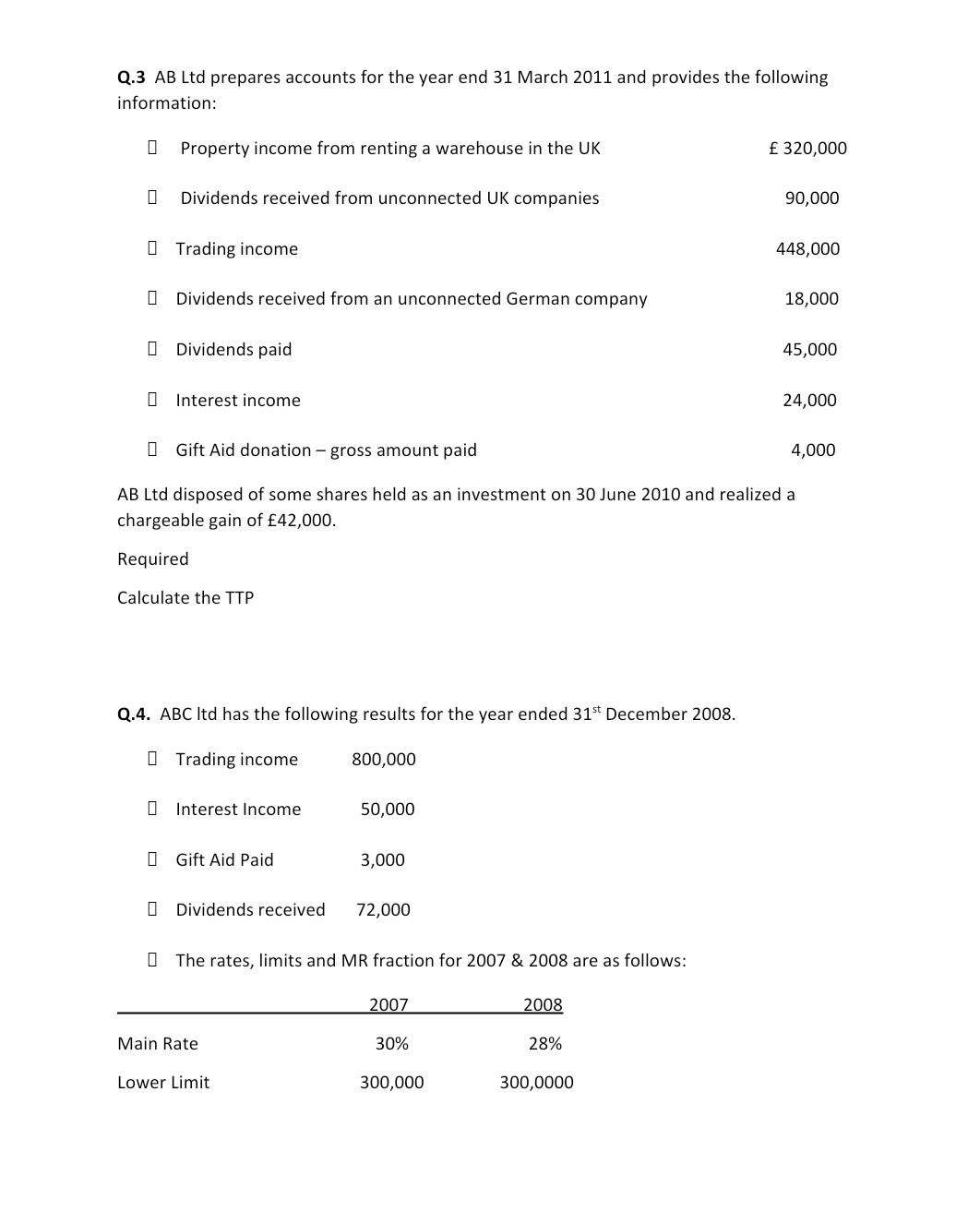

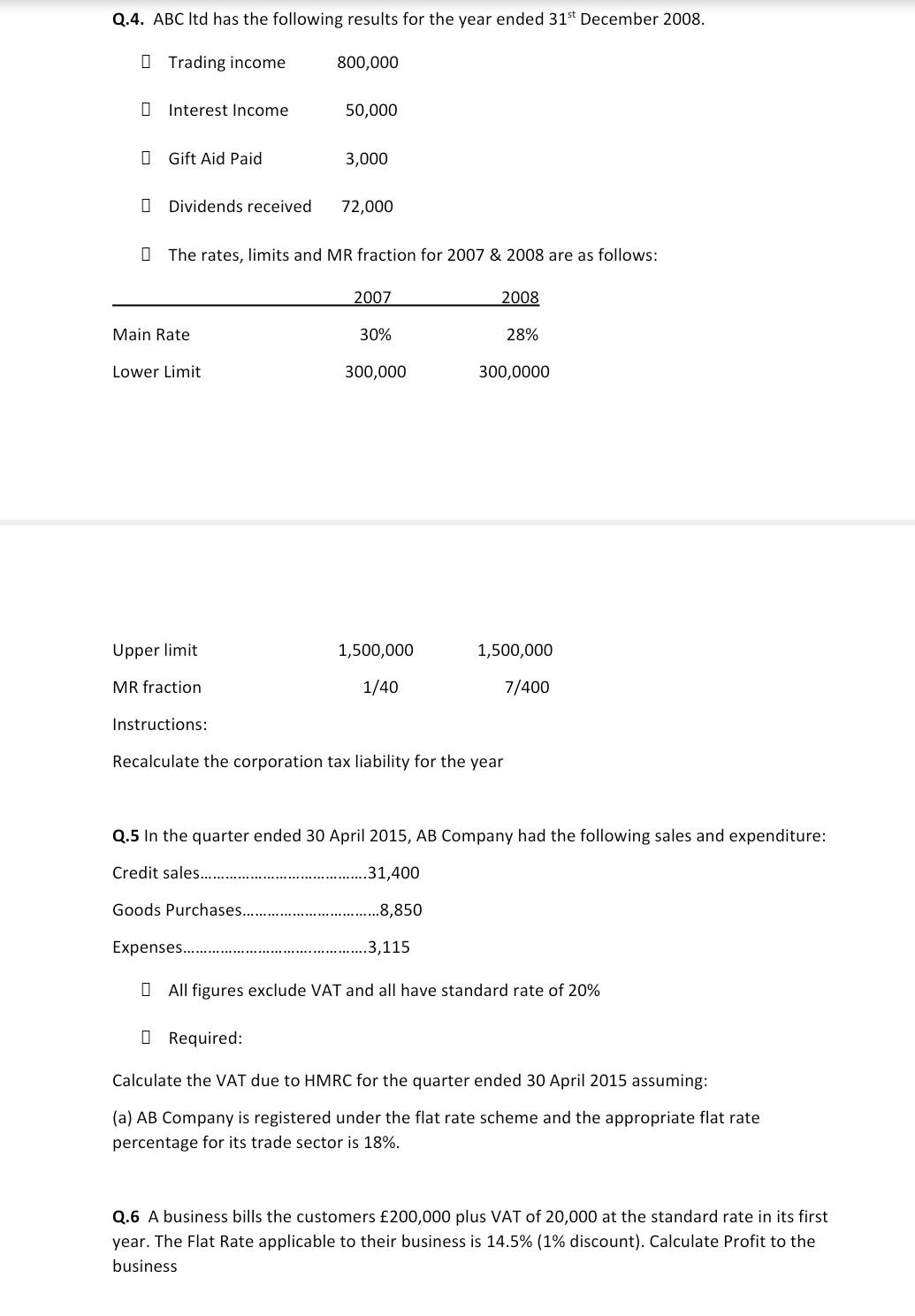

Q.1 Abdullah is a self employed auditor and received the following income in 2010/2011 Bank Saving interest 6400 Dividends from a UK company 6300 He paid allowable interest of 3,000. Required Calculate his income tax liability for 2010/2011, and assuming his trading income for 2010/2011 was: 15000 Q.2 Abdullah is a self employed auditor and received the following income in 2010/2011 Bank Saving interest 6400 Dividends from a UK company 6300 He paid allowable interest of 3,000. Required Calculate his income tax liability for 2010/2011, and assuming his trading income for 2010/2011 was 130000 Q.3 AB Ltd prepares accounts for the year end 31 March 2011 and provides the following information: Property income from renting a warehouse in the UK 320,000 Dividends received from unconnected UK companies 90,000 O Trading income 448,000 O Dividends received from an unconnected German company 18,000 O Dividends paid 45,000 Interest income 24,000 Gift Aid donation - gross amount paid 4,000 AB Ltd disposed of some shares held as an investment on 30 June 2010 and realized a chargeable gain of 42,000. Required Calculate the TTP Q.4. ABC Itd has the following results for the year ended 31st December 2008. Trading income 800,000 O Interest Income 50,000 Gift Aid Paid 3,000 O Dividends received 72,000 0 The rates, limits and MR fraction for 2007 & 2008 are as follows: 2007 2008 Main Rate 30% 28% Lower Limit 300,000 300,0000 Q.4. ABC Itd has the following results for the year ended 31st December 2008. | Trading income 800,000 Interest Income 50,000 Gift Aid Paid 3,000 O Dividends received 72,000 The rates, limits and MR fraction for 2007 & 2008 are as follows: 2007 2008 Main Rate 30% 28% Lower Limit 300,000 300,0000 Upper limit 1,500,000 1,500,000 MR fraction 1/40 7/400 Instructions: Recalculate the corporation tax liability for the year Q.5 In the quarter ended 30 April 2015, AB Company had the following sales and expenditure: Credit sales... .31,400 Goods Purchases..... .8,850 Expenses...... .3,115 O All figures exclude VAT and all have standard rate of 20% 0 Required: Calculate the VAT due to HMRC for the quarter ended 30 April 2015 assuming: (a) AB Company is registered under the flat rate scheme and the appropriate flat rate percentage for its trade sector is 18%. Q.6 A business bills the customers 200,000 plus VAT of 20,000 at the standard rate in its first year. The Flat Rate applicable to their business is 14.5% (1% discount). Calculate Profit to the businessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started