Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Please Answer All These Questions. Equity is commonly defined as residual rights to the company assets after deducting all liabilities (1 Point) O A.

.

.

Please Answer All These Questions.

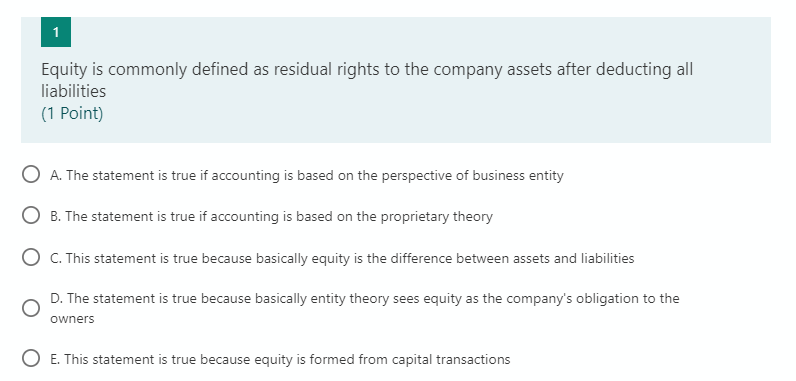

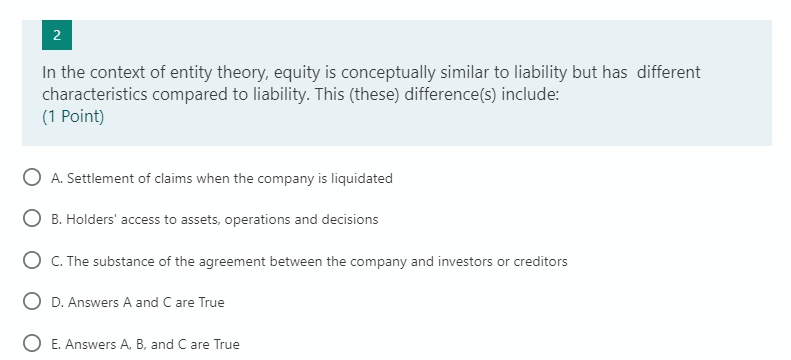

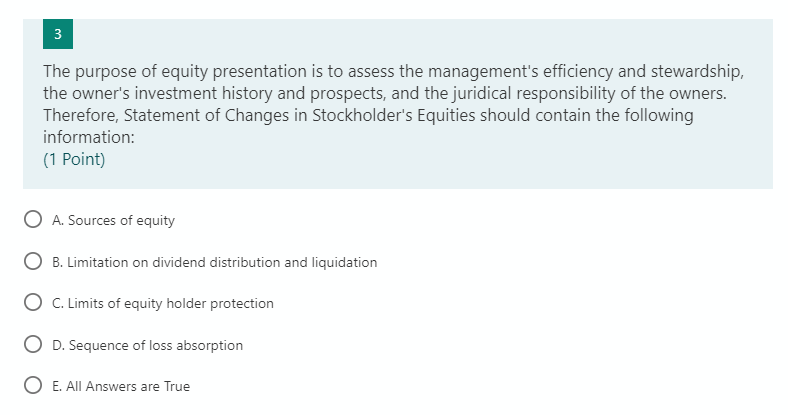

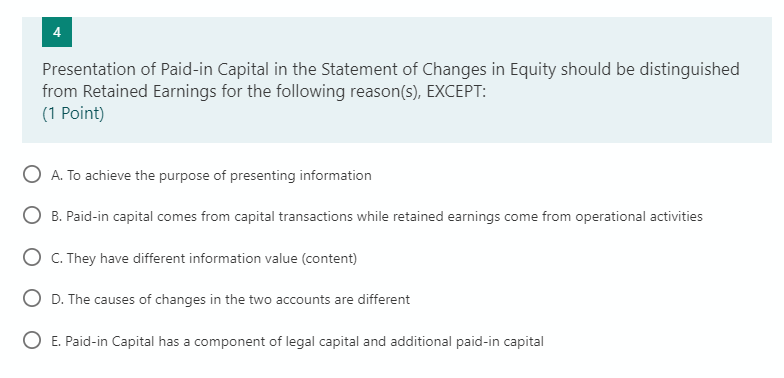

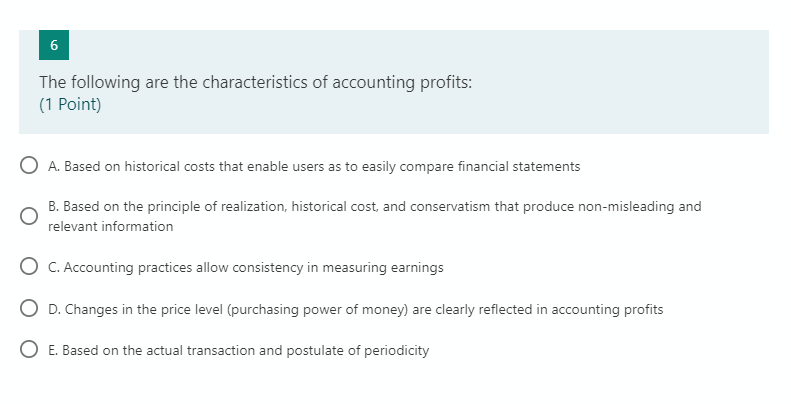

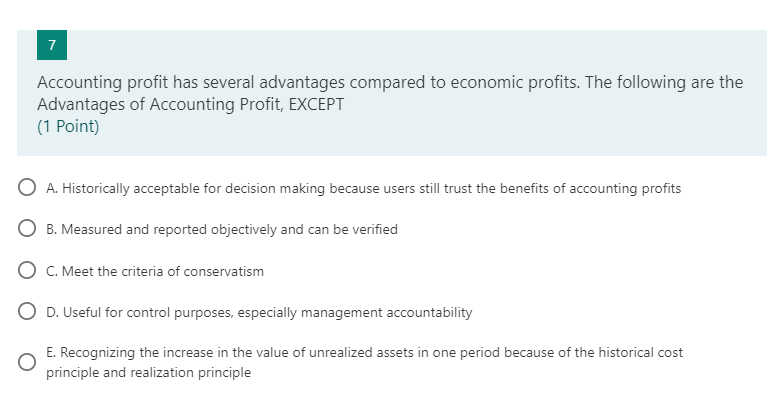

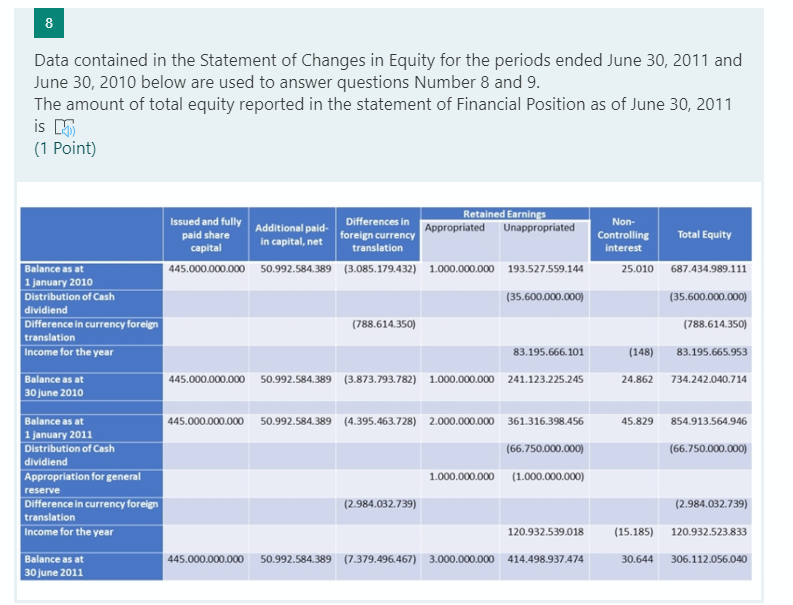

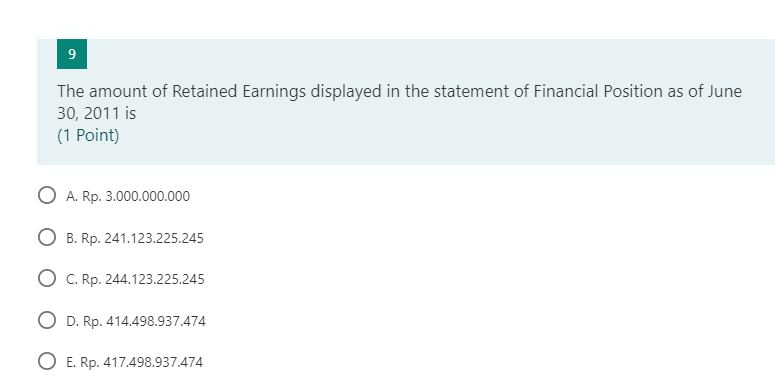

Equity is commonly defined as residual rights to the company assets after deducting all liabilities (1 Point) O A. The statement is true if accounting is based on the perspective of business entity O B. The statement is true if accounting is based on the proprietary theory C. This statement is true because basically equity is the difference between assets and liabilities D. The statement is true because basically entity theory sees equity as the company's obligation to the owners O E. This statement is true because equity is formed from capital transactions In the context of entity theory, equity is conceptually similar to liability but has different characteristics compared to liability. This (these) difference(s) include: (1 Point) O A. Settlement of claims when the company is liquidated O B. Holders' access to assets, operations and decisions O C. The substance of the agreement between the company and investors or creditors O D. Answers A and Care True O E. Answers A, B, and Care True The purpose of equity presentation is to assess the management's efficiency and stewardship, the owner's investment history and prospects, and the juridical responsibility of the owners. Therefore, Statement of Changes in Stockholder's Equities should contain the following information: (1 Point) O A. Sources of equity O B. Limitation on dividend distribution and liquidation O C. Limits of equity holder protection O D. Sequence of loss absorption O E. All Answers are True Presentation of Paid-in Capital in the Statement of Changes in Equity should be distinguished from Retained Earnings for the following reason(s), EXCEPT: (1 Point) O A. To achieve the purpose of presenting information O B. Paid-in capital comes from capital transactions while retained earnings come from operational activities O C. They have different information value (content) O D. The causes of changes in the two accounts are different O E. Paid-in Capital has a component of legal capital and additional paid-in capital The following are the characteristics of accounting profits: (1 Point) OA A. Based on historical costs that enable users as to easily compare financial statements B. Based on the principle of realization, historical cost, and conservatism that produce non-misleading and relevant information O C. Accounting practices allow consistency in measuring earnings O D. Changes in the price level (purchasing power of money) are clearly reflected in accounting profits O E. Based on the actual transaction and postulate of periodicity Accounting profit has several advantages compared to economic profits. The following are the Advantages of Accounting Profit, EXCEPT (1 Point) O A. Historically acceptable for decision making because users still trust the benefits of accounting profits O B. Measured and reported objectively and can be verified O C. Meet the criteria of conservatism O D. Useful for control purposes, especially management accountability E. Recognizing the increase in the value of unrealized assets in one period because of the historical cost principle and realization principle Accounting profit has several advantages compared to economic profits. The following are the Advantages of Accounting Profit, EXCEPT (1 Point) O A. Historically acceptable for decision making because users still trust the benefits of accounting profits O B. Measured and reported objectively and can be verified O C. Meet the criteria of conservatism O D. Useful for control purposes, especially management accountability E. Recognizing the increase in the value of unrealized assets in one period because of the historical cost principle and realization principle Data contained in the Statement of Changes in Equity for the periods ended June 30, 2011 and June 30, 2010 below are used to answer questions Number 8 and 9. The amount of total equity reported in the statement of Financial Position as of June 30, 2011 is m (1 Point) Retained Earnings Appropriated Unappropriated Issued and fully paid share capital Differences in foreign currency translation Additional paid- in capital, net Non- Controlling interest Total Equity 445.000.000.000 50.992.584.389 (3.085.179.432) 1.000.000.000 193.527.559.144 25.010 687.434.989.111 (35.600.000.000) (35.600.000.000) Balance as at 1 january 2010 Distribution of Cash dividiend Difference in currency foreign translation Income for the year (788.614.350) (788.614.350) 83.195.666.101 (148) 83.195.665.953 Balance as at 30 June 2010 445.000.000.000 50.992.584.389 (3.873.793.782) 1.000.000.000 241.123.225.245 24.862 734.242.040.714 445.000.000.000 50.992.584.389 (4.395.463.728) 2.000.000.000 361.316.398.456 45.829 854.913.564.946 (66.750.000.000) (66.750.000.000) Balance as at 1 january 2011 Distribution of Cash dividiend Appropriation for general reserve Difference in currency foreign translation Income for the year 1.000.000.000 (1.000.000.000) (2.984.032.739) (2.984.032.739) 120.932.539.018 (15.185) 120.932.523.833 Balance as at 30 june 2011 445.000.000.000 50.992.584.389 (7.379.496.467) 3.000.000.000 414.498.937.474 30.644 306.112.056.040 The amount of Retained Earnings displayed in the statement of Financial Position as of June 30, 2011 is (1 Point) O A. Rp. 3.000.000.000 O B. Rp. 241.123.225.245 O C. Rp. 244.123.225.245 O D. Rp. 414.498.937.474 O E. Rp. 417.498.937.474 The components of other comprehensive income include the following elements, EXCEPT: (1 Point) O A. difference in fixed asset revaluation O B. Remeasurement of defined benefit programs O C. Exchange Rate Due to Financial Statement Translation O D. Changes in value of investment available for sales O E. The effective portion of gains from hedging of cash flowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started