please answer all these

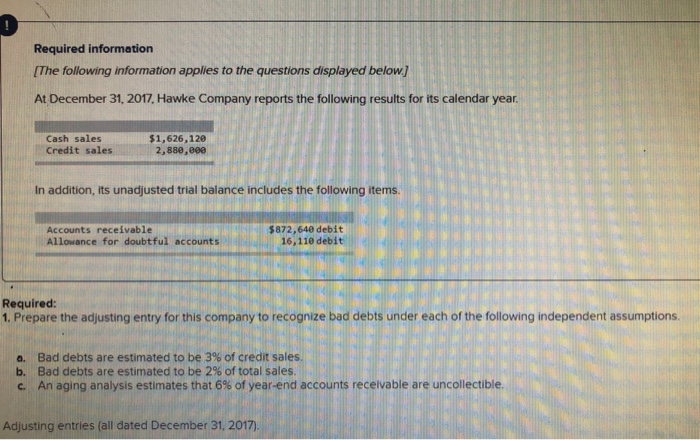

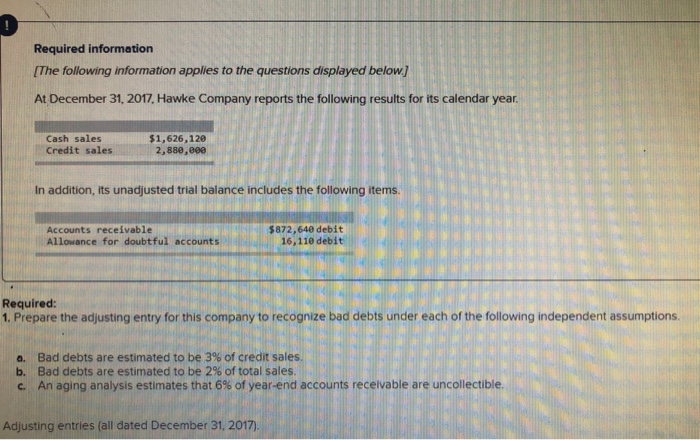

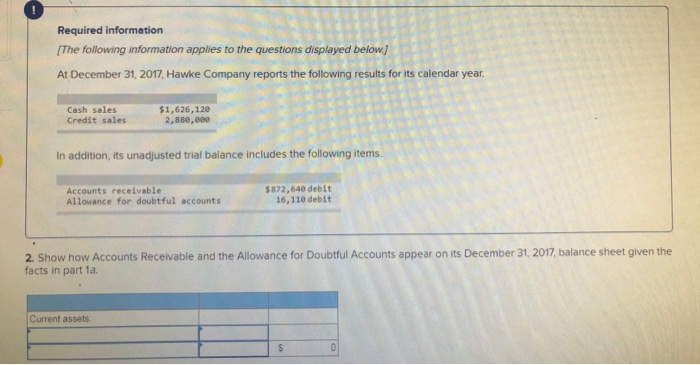

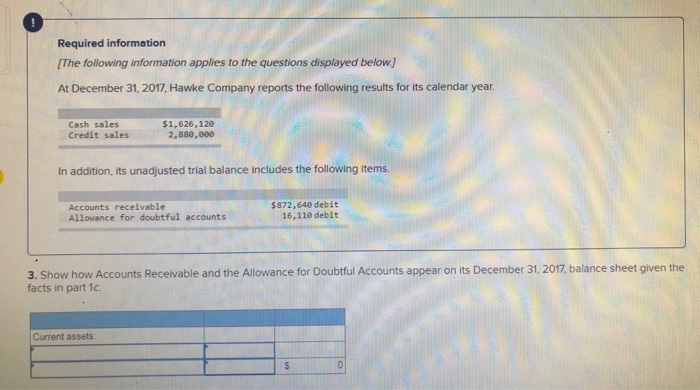

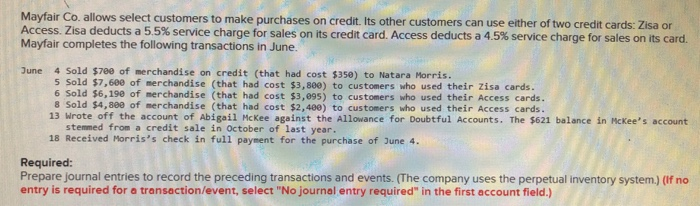

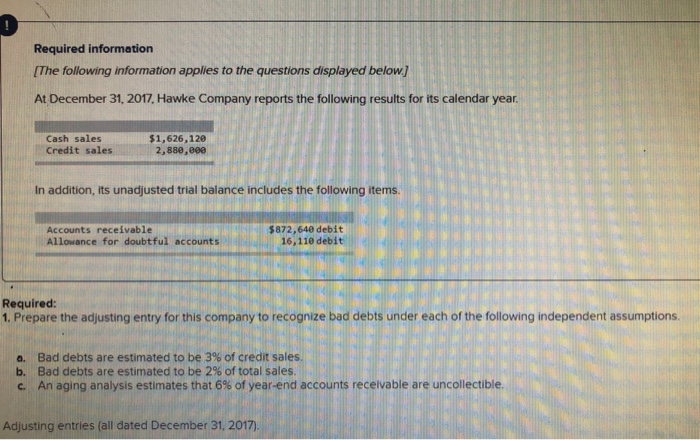

Required information [The following information applies to the questions displayed below) At December 31, 2017, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,626, 120 2,880,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $872,640 debit 16,11debit Required: 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. a. Bad debts are estimated to be 3% of credit sales. b. Bad debts are estimated to be 2% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31, 2017) Required information The following information applies to the questions displayed below.) At December 31, 2017, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,626,120 2,880,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $872,640 debit 16. 110 debit 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet given the facts in part 1 Current assets: Required information The following information applies to the questions displayed below) At December 31, 2017, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,626,120 2,880, eee In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $872, 640 debit 16, 110 debit 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet given the facts in part 1c. Current assets $ 0 Mayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5,5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $780 of merchandise on credit (that had cost $350) to Natara Morris. 5 Sold $7,620 of merchandise (that had cost $3,800) to customers who used their Zisa cards. 6 Sold 56,190 of merchandise (that had cost $3,095) to customers who used their Access cards. 8 Sold $4,800 of merchandise (that had cost $2,400) to customers who used their Access cards.. 13 Wrote off the account of Abigail Mckee against the Allowance for Doubtful Accounts. The $621 balance in McKee's account stemmed from a credit sale in October of last year. 18 Received Morris's check in full payment for the purchase of June 4. Sredt sellisel Monde cost 2,95 Required: Prepare journal entries to record the preceding transactions and events. The company uses the perpetual inventory system.) (If no entry is required for a transaction/event, select "No journal entry required in the first account field.)