please answer all

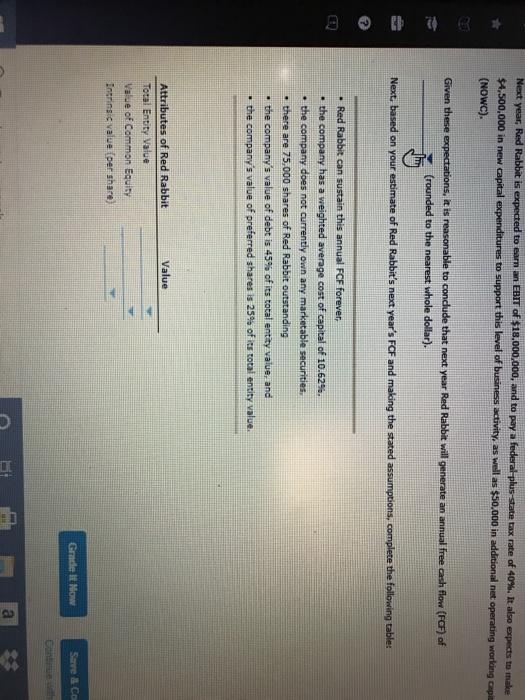

Vor is computed by discounting the firm's expected future free cash flows by its weighted average cost of capital. - A fim's nonoperating assets include its highly marketable short-term securities in which a firm invests its temporarily available excess cash. and its investments in other businesses. Which of the following statements about the FCF valuation model are true? Check all that apply. The model can only be used to value companies--but not their component divisions or other smaller operating units, The FCF valuation model reflects the firm's riskiness-as it affects the company's intrinsic value-via the WACC variable. The model is useful because it examines the relationship between a company's risk, operating profitability, and value of the firm's operations. A company's FCFS are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. Consider the case of Red Rabbit Builders Next year Red Rabbit is expected to earn an EBIT of $18.000.000, and to pay a federal-plus-state tax rate of 40%. It also expects to make $4,500,000 in new capital expenditures to support this level of business activity, as well as 550,000 in additional net operating working capital (NOWC) Given these expectations is reasonable to conclude that next vear Red Rabbit will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar) het based on your estimate of Red Rabbit's next vers FCF and making his stated emption complete the following tables . Re: Rabbit can suht FCE for companhanted stege cost of capital of 1062 maturit Next year, Red Rabbit is expected to earn an EBIT of $18,000,000, and to pay a federal-plus-state tax rate of 40%. It also expects to make $4,500,000 in new capital expenditures to support this level of business activity, as well as $50,000 in additional net operating working capi (NOWC). Given these expectations, it is reasonable to condude that next year Red Rabbit will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Red Rabbit's next year's FCF and making the stated assumptions, complete the following tables Red Rabbit can sustain this annual FCF forever, the company has a weighted average cost of capital of 10.62%. the company does not currently own any marketable securities, there are 75,000 shares of Red Rabbit outstanding - the company's value of debt is 45% of its total entity value, and the company's value of preferred shares is 25% of its total entity value. Value Attributes of Red Rabbit Total Entity Value Value of Common Equity Intrinsic value (per share Grade it Now Save CO