Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all. will upvote thanku. True or False. The dividend growth model can be used to value any public company stock because all public

please answer all. will upvote thanku.

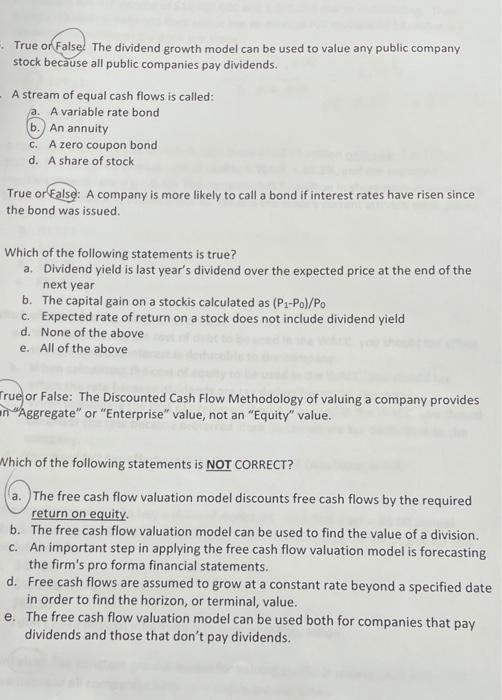

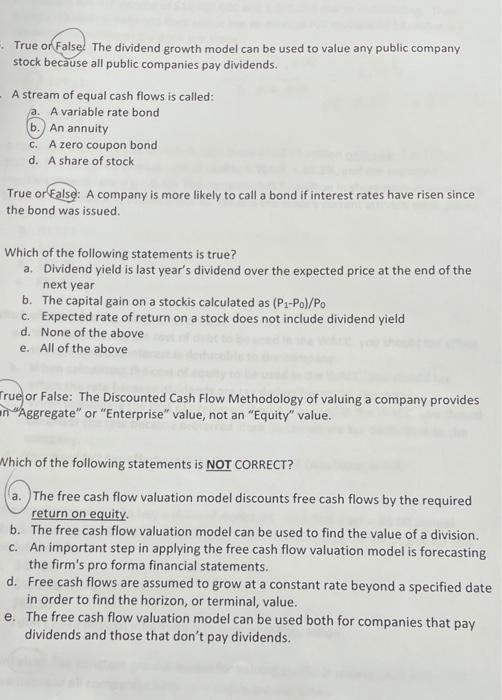

True or False. The dividend growth model can be used to value any public company stock because all public companies pay dividends. A stream of equal cash flows is called: a. A variable rate bond b. An annuity c. A zero coupon bond d. A share of stock m True or False: A company is more likely to call a bond if interest rates have risen since the bond was issued. Which of the following statements is true? a. Dividend yield is last year's dividend over the expected price at the end of the next year b. The capital gain on a stockis calculated as (P1-P)/P. c. Expected rate of return on a stock does not include dividend yield d. None of the above e. All of the above True or False: The Discounted Cash Flow Methodology of valuing a company provides an Aggregate" or "Enterprise" value, not an "Equity" value. Which of the following statements is NOT CORRECT? a. The free cash flow valuation model discounts free cash flows by the required return on equity b. The free cash flow valuation model can be used to find the value of a division. c. An important step in applying the free cash flow valuation model is forecasting the firm's pro forma financial statements. d. Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value. e. The free cash flow valuation model can be used both for companies that pay dividends and those that don't pay dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started