Answered step by step

Verified Expert Solution

Question

1 Approved Answer

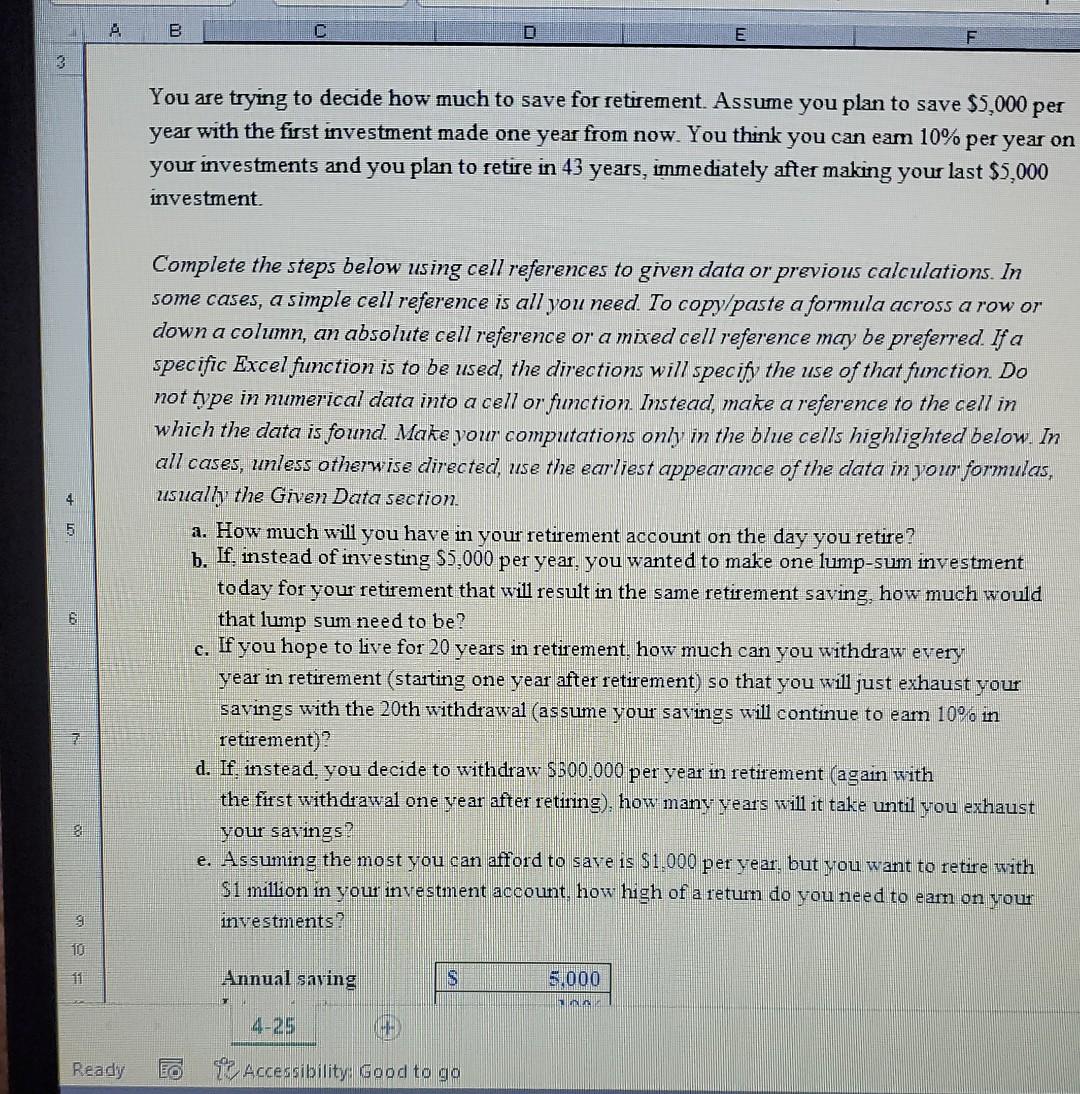

please answer and cell reference. ty! B C 3 You are trying to decide how much to save for retirement. Assume you plan to save

please answer and cell reference. ty!

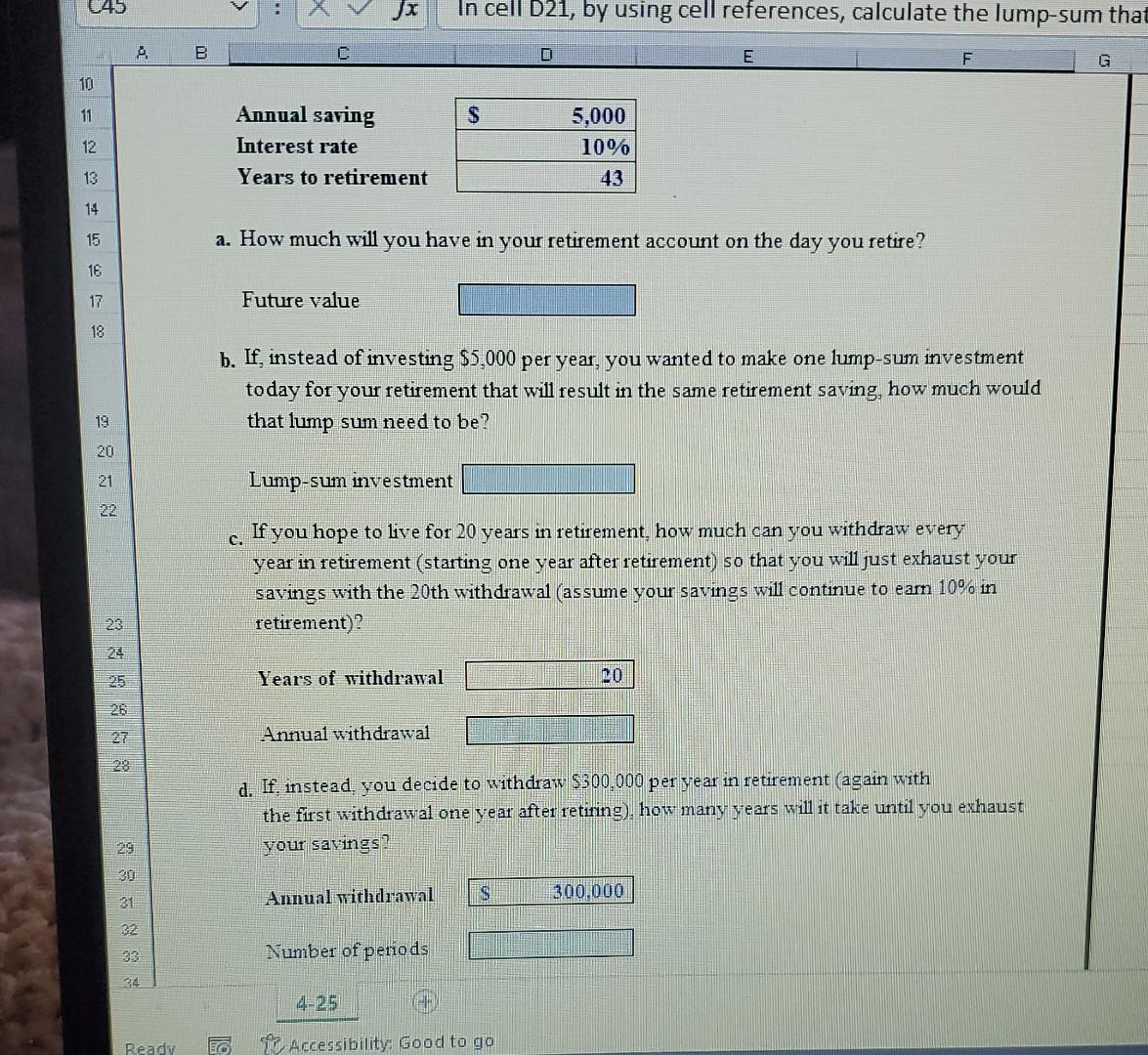

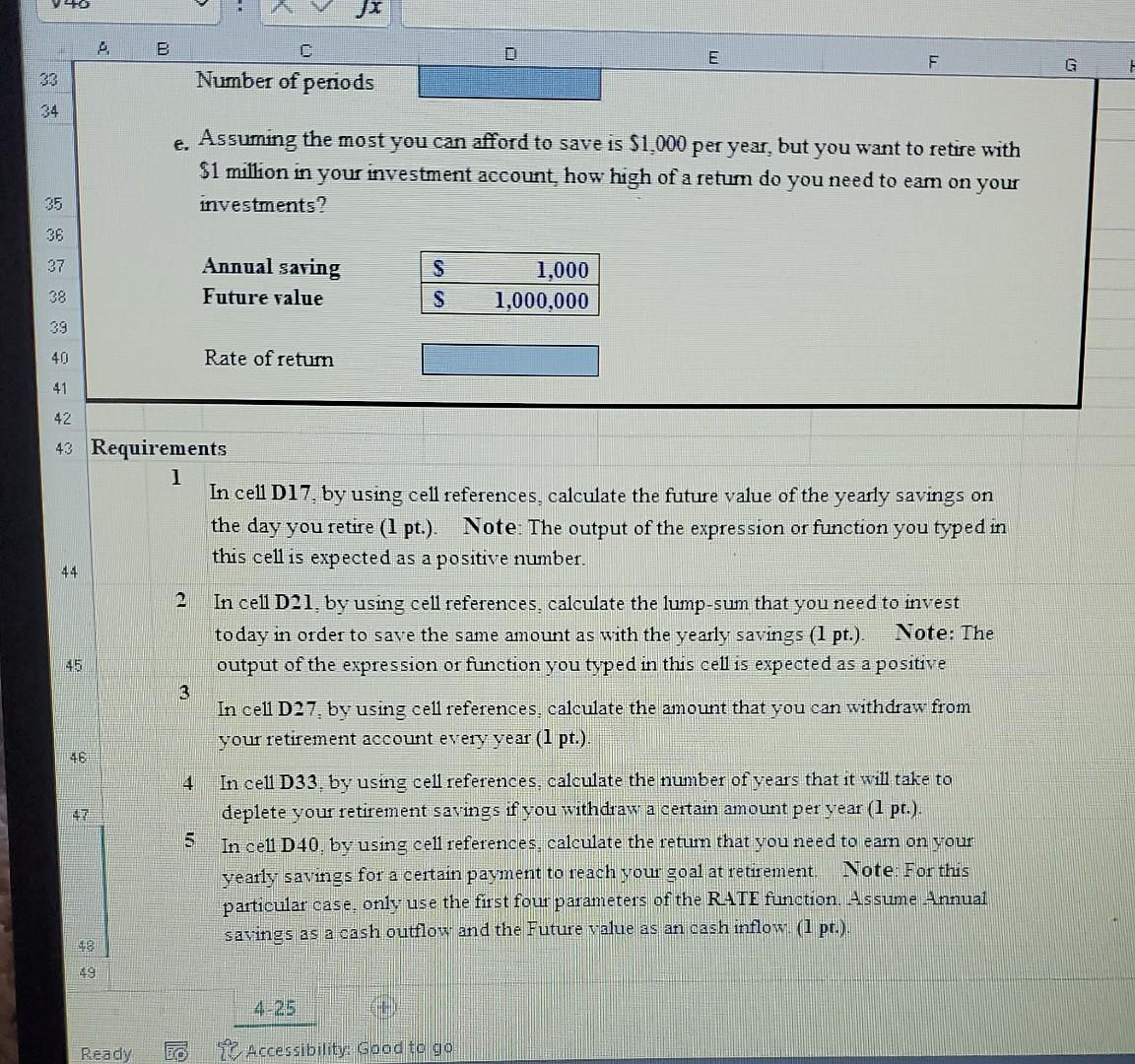

B C 3 You are trying to decide how much to save for retirement. Assume you plan to save $5,000 per year with the first investment made one year from now. You think you can eam 10% per year on your investments and you plan to retire in 43 years, immediately after making your last $5,000 investment. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need to copy paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20th withdrawal (assume your savings will continue to earn 10% in retirement)? d. If, instead, you decide to withdraw $500,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? e. Assuming the most you can afford to save is $1,000 per year, but you want to retire with $1 million in your investment account how high of a retum do you need to earn on your investments? 9 100 11 Annual saving S 5.000 4-25 Ready Accessibility: Good to go 45 Jx In cell D21, by using cell references, calculate the lump-sum that B E G 10 11 S 12 Annual saving Interest rate Years to retirement 5,000 10% 43 13 14 15 a. How much will you have in your retirement account on the day you retire? 16 17 Future value 18 b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? 19 20 21 Lump-sum investment 22 C. If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20th withdrawal (assume your savings will continue to earn 10% in retirement)? 23 Years of withdrawal LO Annual withdrawal 2009 d. If, instead, you decide to withdraw $300.000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? Annual withdrawal S 300.000 Number of periods 34 4-25 Ready TO Accessibility: Good to go B C E F G F Number of periods 34 e. Assuming the most you can afford to save is $1,000 per year, but you want to retire with $1 million in your investment account how high of a retum do you need to eam on your investments? 35 36 37 Annual saving Future value S S 1,000 1,000,000 38 39 40 Rate of return 41 44 42 43 Requirements 1 In cell D17, by using cell references, calculate the future value of the yearly savings on the day you retire (1 pt.). Note: The output of the expression or function you typed in this cell is expected as a positive number. 2 In cell D21. by using cell references, calculate the lump-sum that you need to invest today in order to save the same amount as with the yearly savings (1 pt.). Note: The output of the expression or function you typed in this cell is expected as a positive 3 In cell D27. by using cell references, calculate the amount that you can withdraw from your retirement account every year (1 pt.). 45 46 4 5. In cell D33. by using cell references, calculate the number of years that it will take to deplete your retirement savings if you withdraw a certain amount per year (1 pr.). In cell D40, by using cell references, calculate the retun that you need to eam on your yearly savings for a certain payment to reach your goal at retirement Note. For this particular case, only use the first four parameters of the RATE function. Assume Annual savings as a cash outflow and the Future value as an cash inflow. (1 pr.). 18 49 4-25 Ready Accessibility: Good to goStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started