Answered step by step

Verified Expert Solution

Question

1 Approved Answer

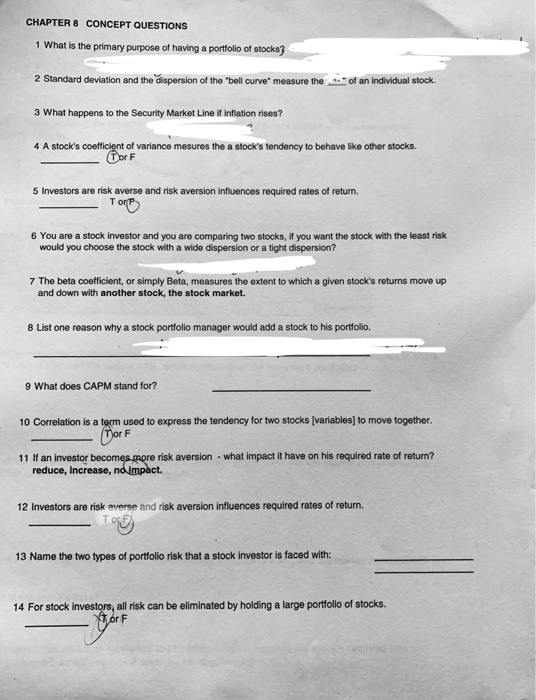

please answer and explain a little for me. Ignore the circled answers because I dont know if I am right or wrong CHAPTER 8 CONCEPT

please answer and explain a little for me. Ignore the circled answers because I dont know if I am right or wrong

CHAPTER 8 CONCEPT QUESTIONS 1 What is the primary purpose of having a portfolio of stocks 2 Standard deviation and the dispersion of the "bell curve measure theof an individual stock. 3 What happens to the Security Market Line it inflation rises? 4 A stock's of variance mesures the a stock's tendency to behave like other stocks. 5 Investors are risk averse and risk aversion influences required rates of return. 6 You are a stock investor and you are comparing two stocks, if you want the stock with the least risk would you choose the stock with a wide dispersion or a tight dispersion? 7 The beta coefficient, or simply Beta, measures the extent to which a given stock's returns move up and down with another stock, the stock market. 8 List one reason why a stock portfolio manager would add a stock to his portfolio. 9 What does CAPM stand for? 10 Correlation is a term used to express the tendency for two stocks [variables] to move together Dor F e risk aversion - what impact it have on his required rate of return? 11 If an investor becomes mor reduce, increase 12 Investors are risk averse and risk aversion influences required rates of return. 13 Name the two types of portfolio risk that a stock investor is faced with: 14 For stock investors, all risk can be eliminated by holding a large portolio of stocks. r F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started