please answer and explane , thank you in advance ,

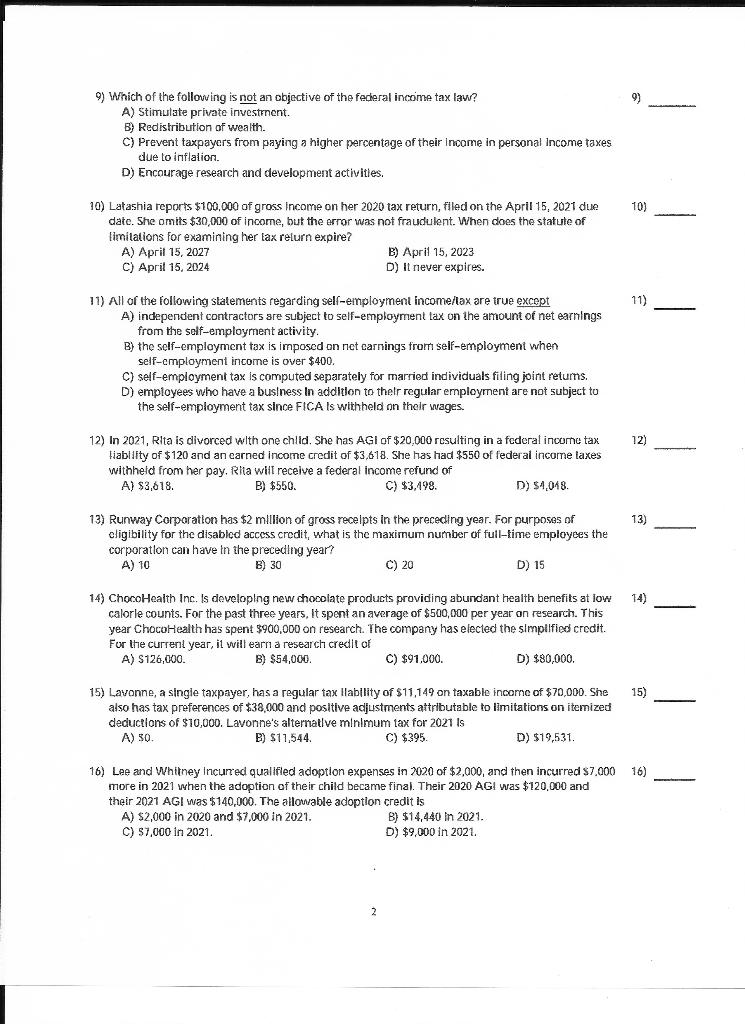

9) Which of the following is not an objective of the federal income tax law? A) Stimulate private investment. B) Redistribution of wealth. C) Prevent taxpayers from paying a higher percentage of their income in personal Income taxes due to inflalion. D) Encourage research and development activities. 10) 10) Latashia reports $100,000 of gross Income on her 2020 tax return, Filed on the April 15, 2021 due date. She omits $30,000 of income, but the error was not fraudulent. When does the statute of limitations for examining her fax return expire? A) April 15, 2027 B) April 15, 2023 C) April 15, 2024 D) It never expires. 11) 11) All of the following statements regarding self-employment income tax are true except A) independent contractors are subject to self-employment tax on the amount of net earnings from the self-employment activity. B) the self-employment tax is imposed on net carnings from self-employment when self-employment income is over $400. C) self-employment tax is computed separately for married individuals filing joint retums. D) employees who have a business In addition to thelr regular employment are not subject to the self-employment tax since FICA Is withheld on their wages. 12) 12) In 2021, Rita is divorced with one chlid. She has AGI of $20,000 resulting in a federal income tax liability of $120 and an carned income credit of $3,618. She has had $550 of federal income taxes withheld from her pay, Rita will receive a federal income refund of A) $3,618. B) $550. C) $3.498. D) $4.018 13) 13) Runway Corporation has $2 million of gross receipts in the preceding year. For purposes of cligibility for the disabled access credit, what is the maximum number of full-time employees the corporation can have in the preceding year? A) 10 B) 30 C) 20 D) 15 14) 14) ChocoHealth Inc. is developing new chocolate products providing abundant health benefits at low calorle counts. For the past three years. It spent an average of $500,000 per year on research. This year ChocoHealth has spent $900,000 on research. The company has elected the simplified credit. For the current year, it will earn a research credit of A) S126,000. B) $54,000 C) $91.000. D) $80,000. 15) 15) Lavonne, a single taxpayer, has a regular tax liability of $11,149 on taxable income of $70,000. She also has tax preferences of $38,000 and positive adjustments attributable to limitations on itemized deductions of $10,000. Lavonne's alternative minimum tax for 2021 Is A) SO. B) $11,544 C) $395 D) $19,531 16) 16) Lee and Whitney incurred qualifled adoption expenses in 2020 of $2,000, and then incurred $7,000 more in 2021 when the adoption of their child became final. Their 2020 AGI was $120,000 and their 2021 AGI was $140,000. The allowable adoption credit is A) $2,000 in 2020 and $7,000 in 2021. B) $14,440 in 2021. C) 57,000 in 2021. D) $9,000 in 2021. 2