Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer and I will gladly give a thumbs up! Prat Corp. started the 2018 accounting period with $33,000 of assets (all cash). $13,500 of

Please answer and I will gladly give a thumbs up!

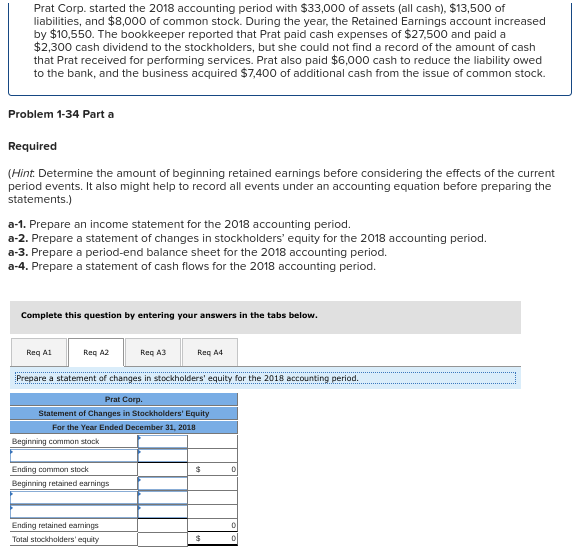

Prat Corp. started the 2018 accounting period with $33,000 of assets (all cash). $13,500 of liabilities, and $8,000 of common stock. During the year, the Retained Earnings account increased by $10,550. The bookkeeper reported that Prat paid cash expenses of $27,500 and paid a $2,300 cash dividend to the stockholders, but she could not find a record of the amount of cash that Prat received for performing services. Prat also paid $6,000 cash to reduce the liability owed to the bank, and the business acquired $7,400 of additional cash from the issue of common stock. Problem 1-34 Part a Required (Hint: Determine the amount of beginning retained earnings before considering the effects of the current period events. It also might help to record all events under an accounting equation before preparing the statements.) a-1. Prepare an income statement for the 2018 accounting period. a-2. Prepare a statement of changes in stockholders' equity for the 2018 accounting period. a-3. Prepare a period-end balance sheet for the 2018 accounting period. 2-4. Prepare a statement of cash flows for the 2018 accounting period. Complete this question by entering your answers in the tabs below. Reg A1 Reg A3 Reg A4 Prepare a statement of changes in stockholders' equity for the 2018 accounting period, Prat Corp. Statement of Changes in Stockholders' Equity For the Year Ended December 31, 2018 Beginning common stock Ending common stock Beginning retained earnings Ending retained eamings Total stockholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started