Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer and show all work on excel. You are making a buying-vs-renting decision. You have the following information: RENT! BUY The house you like

Please answer and show all work on excel.

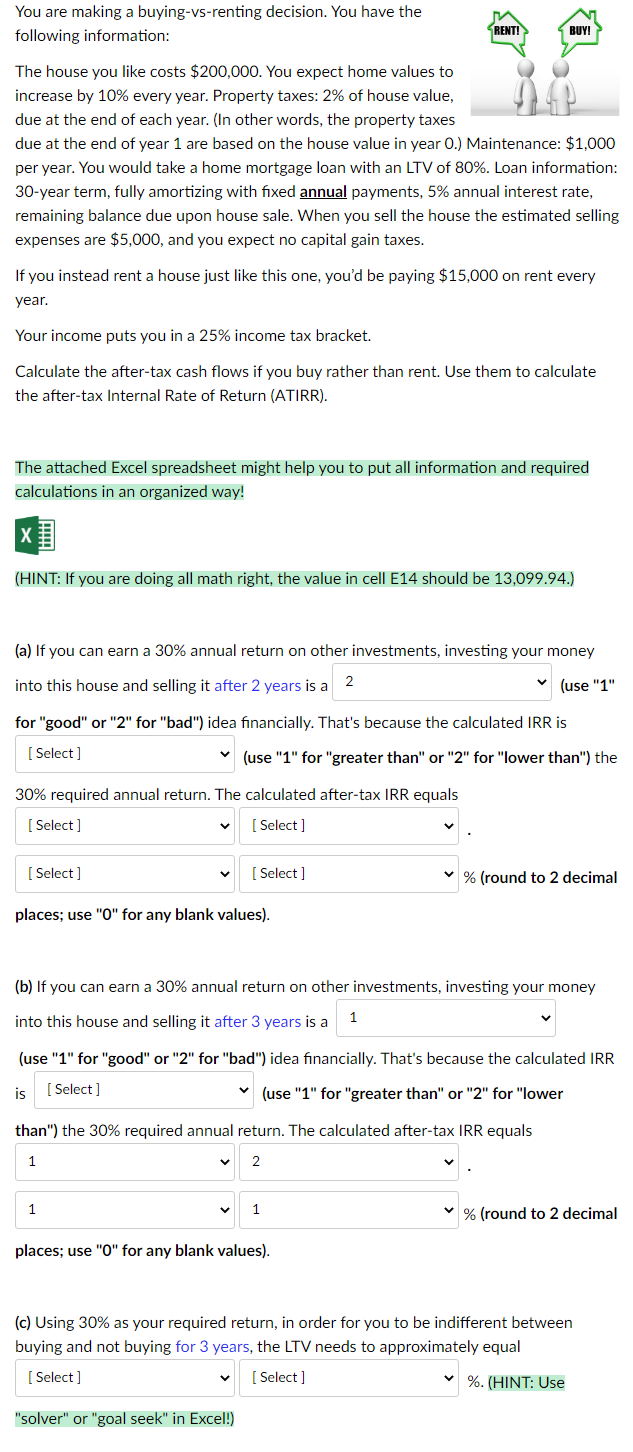

You are making a buying-vs-renting decision. You have the following information: RENT! BUY The house you like costs $200,000. You expect home values to increase by 10% every year. Property taxes: 2% of house value, due at the end of each year. (In other words, the property taxes due at the end of year 1 are based on the house value in year 0.) Maintenance: $1,000 per year. You would take a home mortgage loan with an LTV of 80%. Loan information: 30-year term, fully amortizing with fixed annual payments, 5% annual interest rate, remaining balance due upon house sale. When you sell the house the estimated selling expenses are $5,000, and you expect no capital gain taxes. If you instead rent a house just like this one, you'd be paying $15,000 on rent every year. Your income puts you in a 25% income tax bracket. Calculate the after-tax cash flows if you buy rather than rent. Use them to calculate the after-tax Internal Rate of Return (ATIRR). The attached Excel spreadsheet might help you to put all information and required calculations in an organized way! (HINT: If you are doing all math right, the value in cell E14 should be 13,099.94.) (a) If you can earn a 30% annual return on other investments, investing your money into this house and selling it after 2 years is a 2 (use "1" for "good" or "2" for "bad") idea financially. That's because the calculated IRR is (Select] (use "1" for "greater than" or "2" for "lower than") the 30% required annual return. The calculated after-tax IRR equals [ Select] [Select] V [ Select] [ Select] % (round to 2 decimal places; use "O" for any blank values). (b) If you can earn a 30% annual return on other investments, investing your money into this house and selling it after 3 years is a (use "1" for "good" or "2" for "bad") idea financially. That's because the calculated IRR is [Select] (use "1" for "greater than" or "2" for "lower than") the 30% required annual return. The calculated after-tax IRR equals 1 2 1 1 % (round to 2 decimal places; use "O" for any blank values). (c) Using 30% as your required return, in order for you to be indifferent between buying and not buying for 3 years, the LTV needs to approximately equal [Select ] [Select ] %. (HINT: Use "solver" or "goal seek" in Excel!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started