Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer and some functions used. Will leave Positive Feedback for Correct Answer! A late penalty of 10% will apply to new answers. Intro The

Please answer and some functions used. Will leave Positive Feedback for Correct Answer!

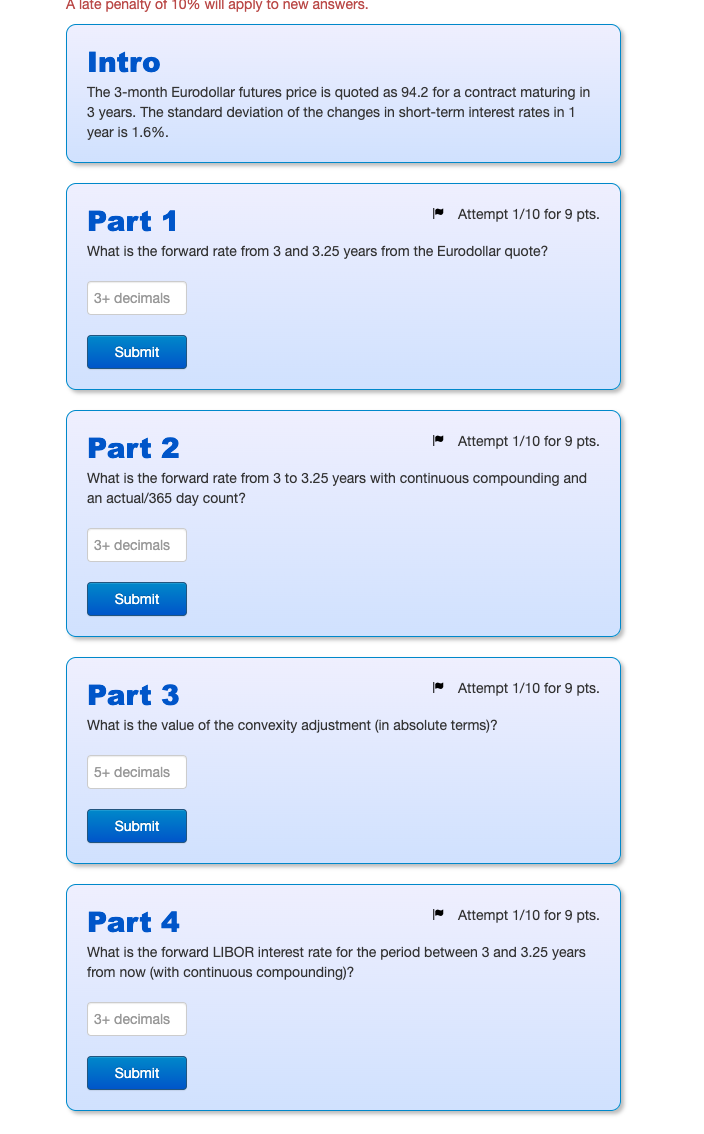

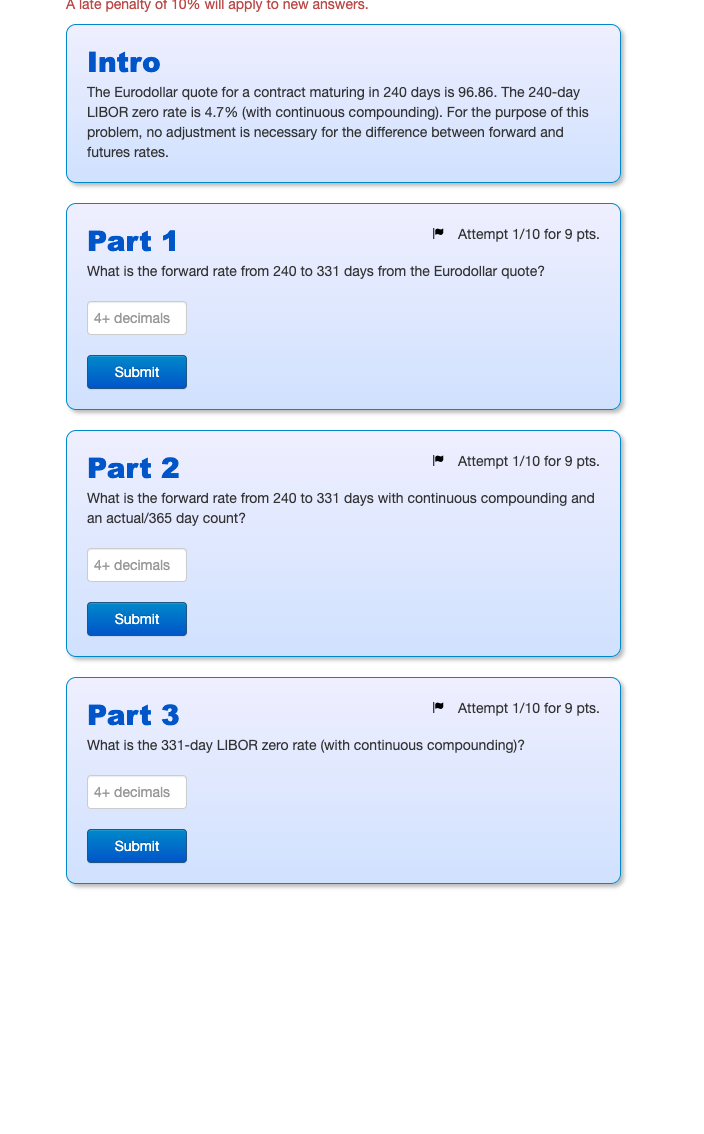

A late penalty of 10% will apply to new answers. Intro The 3-month Eurodollar futures price is quoted as 94.2 for a contract maturing in 3 years. The standard deviation of the changes in short-term interest rates in 1 year is 1.6% Part 1 | Attempt 1/10 for 9 pts. What is the forward rate from 3 and 3.25 years from the Eurodollar quote? 3+ decimals Submit Part 2 Attempt 1/10 for 9 pts. What is the forward rate from 3 to 3.25 years with continuous compounding and an actual/365 day count? 3+ decimals Submit Part 3 Attempt 1/10 for 9 pts. What is the value of the convexity adjustment (in absolute terms)? 5+ decimals Submit Part 4 - Attempt 1/10 for 9 pts. What is the forward LIBOR interest rate for the period between 3 and 3.25 years from now (with continuous compounding)? 3+ decimals Submit A late penalty of 10% will apply to new answers. Intro The Eurodollar quote for a contract maturing in 240 days is 96.86. The 240-day LIBOR zero rate is 4.7% (with continuous compounding). For the purpose of this problem, no adjustment is necessary for the difference between forward and futures rates. Part 1 Attempt 1/10 for 9 pts. What is the forward rate from 240 to 331 days from the Eurodollar quote? 4+ decimals Submit Part 2 Attempt 1/10 for 9 pts. What is the forward rate from 240 to 331 days with continuous compounding and an actual/365 day count? 4+ decimals Submit Attempt 1/10 for 9 pts. Part 3 What is the 331-day LIBOR zero rate (with continuous compounding)? 4+ decimals Submit A late penalty of 10% will apply to new answers. Intro The 3-month Eurodollar futures price is quoted as 94.2 for a contract maturing in 3 years. The standard deviation of the changes in short-term interest rates in 1 year is 1.6% Part 1 | Attempt 1/10 for 9 pts. What is the forward rate from 3 and 3.25 years from the Eurodollar quote? 3+ decimals Submit Part 2 Attempt 1/10 for 9 pts. What is the forward rate from 3 to 3.25 years with continuous compounding and an actual/365 day count? 3+ decimals Submit Part 3 Attempt 1/10 for 9 pts. What is the value of the convexity adjustment (in absolute terms)? 5+ decimals Submit Part 4 - Attempt 1/10 for 9 pts. What is the forward LIBOR interest rate for the period between 3 and 3.25 years from now (with continuous compounding)? 3+ decimals Submit A late penalty of 10% will apply to new answers. Intro The Eurodollar quote for a contract maturing in 240 days is 96.86. The 240-day LIBOR zero rate is 4.7% (with continuous compounding). For the purpose of this problem, no adjustment is necessary for the difference between forward and futures rates. Part 1 Attempt 1/10 for 9 pts. What is the forward rate from 240 to 331 days from the Eurodollar quote? 4+ decimals Submit Part 2 Attempt 1/10 for 9 pts. What is the forward rate from 240 to 331 days with continuous compounding and an actual/365 day count? 4+ decimals Submit Attempt 1/10 for 9 pts. Part 3 What is the 331-day LIBOR zero rate (with continuous compounding)? 4+ decimals SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started