Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer Answer all THREE (3) Questions. Show all the steps you take to reach your answer. Total marks: 100 Question 1 [30 marks] Suppose

please answer

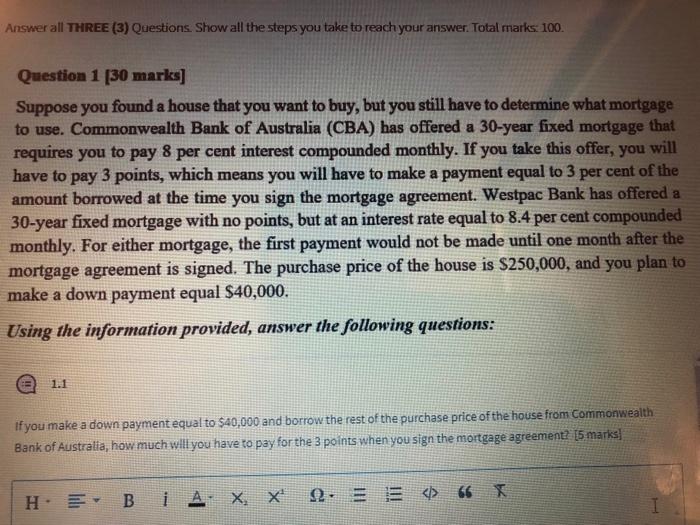

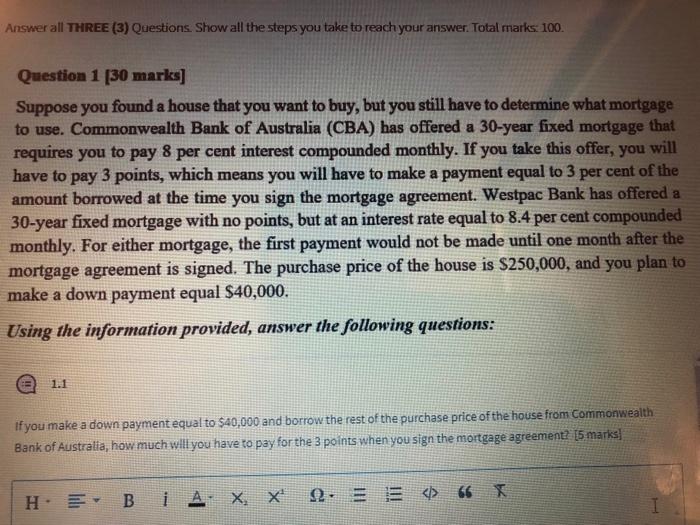

Answer all THREE (3) Questions. Show all the steps you take to reach your answer. Total marks: 100 Question 1 [30 marks] Suppose you found a house that you want to buy, but you still have to determine what mortgage to use. Commonwealth Bank of Australia (CBA) has offered a 30-year fixed mortgage that requires you to pay 8 per cent interest compounded monthly. If you take this offer, you will 8 have to pay 3 points, which means you will have to make a payment equal to 3 per cent of the amount borrowed at the time you sign the mortgage agreement. Westpac Bank has offered a 30-year fixed mortgage with no points, but at an interest rate equal to 8.4 per cent compounded monthly. For either mortgage, the first payment would not be made until one month after the mortgage agreement is signed. The purchase price of the house is $250,000, and you plan to make a down payment equal $40,000. Using the information provided, answer the following questions: 11 If you make a down payment equal to $40,000 and borrow the rest of the purchase price of the house from Commonwealth Bank of Australia, how much will you have to pay for the 3 points when you sign the mortgage agreement? (5 marks] H.B i A X, X 2. E 66 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started