Answered step by step

Verified Expert Solution

Question

1 Approved Answer

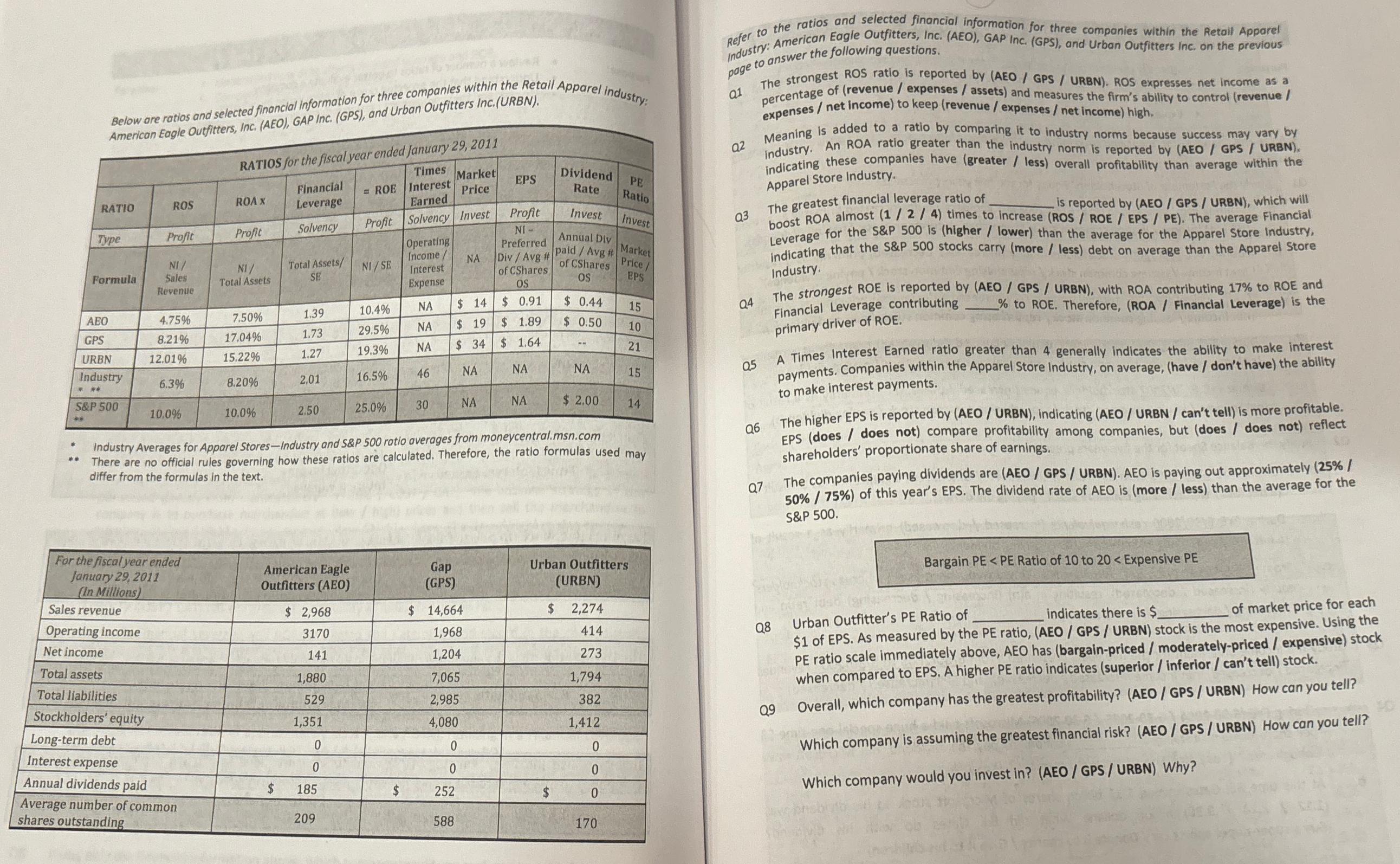

Please answer as much as possible. Financial Statement Analysis Below ore ratios and se/ectedfinancia/ information for three companies within the Retai/ Apparel Indus t w.

Please answer as much as possible. Financial Statement Analysis

Below ore ratios and se/ectedfinancia/ information for three companies within the Retai/ Apparel Indus t w. American Eagle Outfitters, Inc. (AEO), GAP Inc. (GPS), and urban Outfitters Inc.(URBN). RATIOSfor theftscalycar endedJanuaty 29, 2011 Refer to the ratios and selected financial information for three companies within the Retail Apparel Industry: American Eagle outfitters, Inc. (AEOL GAP Inc. (GPS), and Urban Outfitters Inc. on the previous page to answer the following questions. The strongest ROS ratio is reported by (AEO / GPS / URBN). ROS expresses net income as a percentage of (revenue / expenses / assets) and measures the firm's ability to control (revenue I expenses / net income) to keep (revenue / expenses / net income) high. 'RATIO Formula AEO GPS URBN Industry 500 ROS front Sales Revenue 8.21% 12.01% 6.3% 10.0% ROAX Pm/it M/ Total Assets 7.50% 17.04% 15.22% 8.20% 10.0% Financial Leverage Solvency Total AS-sets/ SE 1.39 1.73 1.27 2,01 2.50 Times Market Dividend EPS ROE Interest Price Rate Earned Ratio Profit Solvency Invest Profit Invest NI/SE 10.4% 29.5% 19.3% 16.5% 25.0% Operating Income / NA Interest Expense $ 14 $ 19 $ 34 46 30 Annual Div Preferred Div / Avg# paid / Markel of CShares Price / of CSharcs EPs os $ 0.91 $ 0.44 15 $ 1.89 $ 0.50 10 $ 1.64 21 15 $ 2.00 14 Industry Averages for Appare/ Storesindustry and S&P 500 ratio overages from moneycentra/.msn. corn There are no official rules governing how these ratios are calculated. Therefore, the ratio formulas used may differ from the formulas In the text. For t-hefiscalyear ended Januaty29,2011 In Millions Sales revenue Operating income Net income Total assets Total liabilities Stockholders' equity Long-term debt In terest expense Annual dividends paid A verage number of common shares outstandin American Eagle Outfitters (AEO) $ 2,968 3170 141 1,880 529 1,351 185 209 Gap (GPS) 14,664 1,968 1,204 7,065 2,985 4,080 252 588 Urban Outfitters (URBN) $ 2,274 414 273 1,794 382 1,412 0 170 a2 Q9 Meaning is added to a ratio by comparing it to industry norms because success may vary by industry. An ROA ratio greater than the industry norm is reported by (AEO I GPS I URBN), indicating these companies have (greater / less) overall profitability than average within the Apparel Store Industry. The greatest financial leverage ratio of is reported by (AEO / GPS I URBN), which will boost ROA almost (1 / 2 / 4) times to increase (ROS / ROE / EPS I PE). The average Financial Leverage for the S&P 500 is (higher / lower) than the average for the Apparel Store Industry, indicating that the 500 stocks carry (more / less) debt on average than the Apparel Store Industry, The strongest ROE is reported by (AEO / GPS / URBN), with ROA contributing 17% to ROE and Financial Leverage contributing to ROE. Therefore, (ROA / Financial Leverage) is the primary driver of ROE. A Times Interest Earned ratio greater than 4 generally indicates the ability to make interest payments. Companies within the Apparel Store Industry, on average, (have / don't have) the ability to make interest payments. The higher EPS is reported by (AEO / URBN), indicating (AEO / URBN I can't tell) is more profitable. EPS (does / does not) compare profitability among companies, but (does I does not) reflect shareholders' proportionate share of earnings. The companies paying dividends are (AEO / GPS / URBN). AEO is paying out approximately (25% I 50% / 75%) of this year's EPS. The dividend rate of AEO is (more / less) than the average for the 500. Bargain PE < PE Ratio of loto 20 < Expensive PE Urban Outfitter's PE Ratio of of market price for each indicates there is $ $1 of EPS. As measured by the PE ratio, (AEO / GPS / URBN) stock is the most expensive. Using the PE ratio scale immediately above, AEO has (bargain-priced / moderately-priced / expensive) stock when compared to EPS. A higher PE ratio indicates (superior I inferior I can't tell) stock. Overall, which company has the greatest profitability? (AEO / GPS / URBN) How can you tell? Which company is assuming the greatest financial risk? (AEO I GPS I URBN) How can you tell? Which company would you invest in? (AEO / GPS / URBN) Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started