Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer as possible 1. Alice, age 20, has just received an inheritance of $17,000. A finance major, Alice knows the importance of the time

Please answer as possible

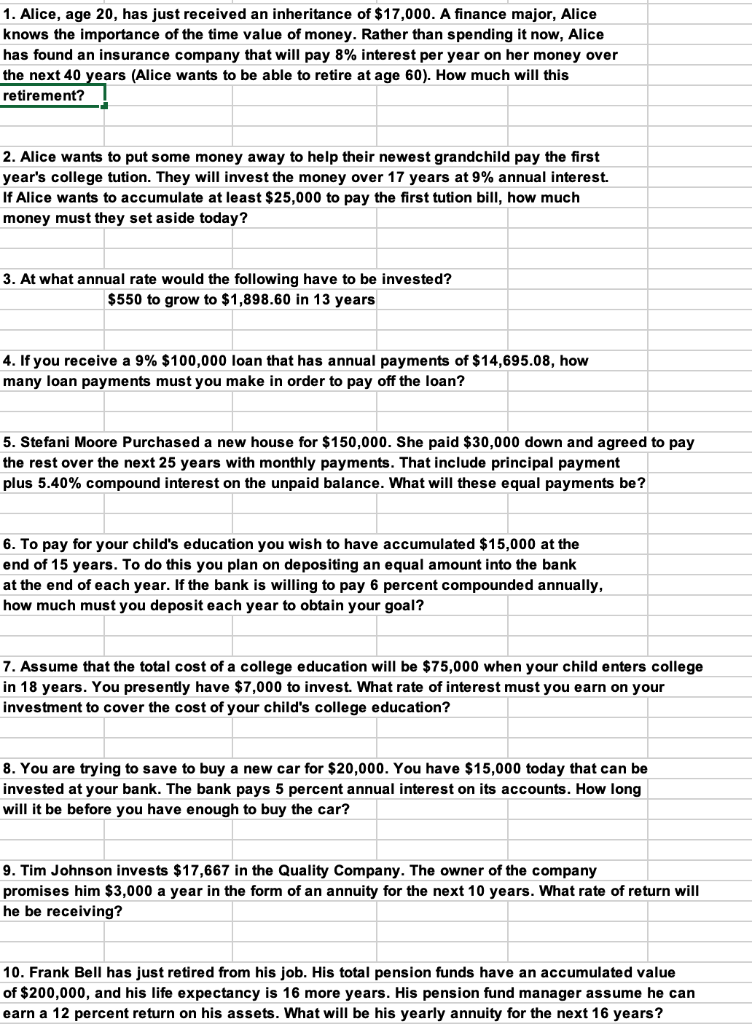

1. Alice, age 20, has just received an inheritance of $17,000. A finance major, Alice knows the importance of the time value of money. Rather than spending it now, Alice has found an insurance company that will pay 8% interest per year on her money over the next 40 years (Alice wants to be able to retire at age 60). How much will this retirement? 2. Alice wants to put some money away to help their newest grandchild pay the first year's college tution. They will invest the money over 17 years at 9% annual interest. If Alice wants to accumulate at least $25,000 to pay the first tution bill, how much money must they set aside today? 3. At what annual rate would the following have to be invested? $550 to grow to $1,898.60 in 13 years 4. If you receive a 9% $100,000 loan that has annual payments of $14,695.08, how many loan payments must you make in order to pay off the loan? 5. Stefani Moore Purchased a new house for $150,000. She paid $30,000 down and agreed to pay the rest over the next 25 years with monthly payments. That include principal payment plus 5.40% compound interest on the unpaid balance. What will these equal payments be? 6. To pay for your child's education you wish to have accumulated $15,000 at the end of 15 years. To do this you plan on depositing an equal amount into the bank at the end of each year. If the bank is willing to pay 6 percent compounded annually, how much must you deposit each year to obtain your goal? 7. Assume that the total cost of a college education will be $75,000 when your child enters college in 18 years. You presently have $7,000 to invest. What rate of interest must you earn on your investment to cover the cost of your child's college education? 8. You are trying to save to buy a new car for $20,000. You have $15,000 today that can be invested at your bank. The bank pays 5 percent annual interest on its accounts. How long will it be before you have enough to buy the car? 9. Tim Johnson invests $17,667 in the Quality Company. The owner of the company promises him $3,000 a year in the form of an annuity for the next 10 years. What rate of return will he be receiving? 10. Frank Bell has just retired from his job. His total pension funds have an accumulated value of $200,000, and his life expectancy is 16 more years. His pension fund manager assume he can earn a 12 percent return on his assets. What will be his yearly annuity for the next 16 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started