Answered step by step

Verified Expert Solution

Question

1 Approved Answer

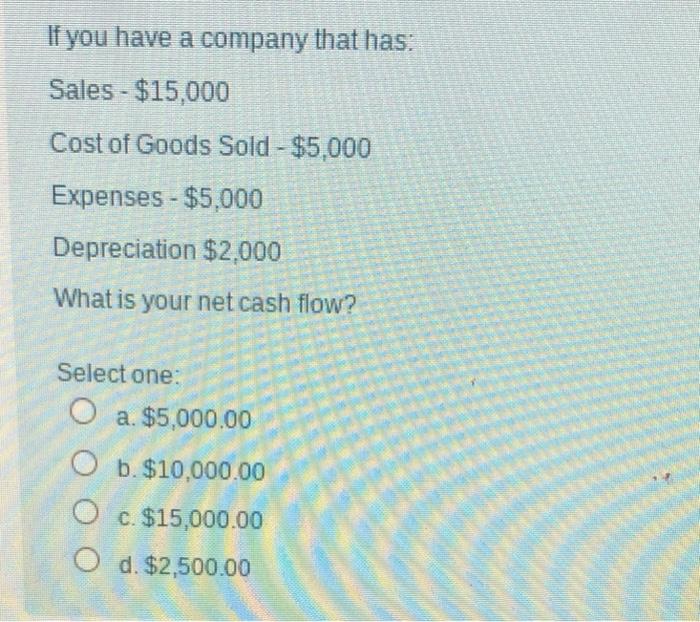

please answer as soon as possible please What is your net cash flow? Select one: a. $5,000.00 b. $10,000.00 c. $15,000.00 d. $2,500.00 When considering

please answer as soon as possible please

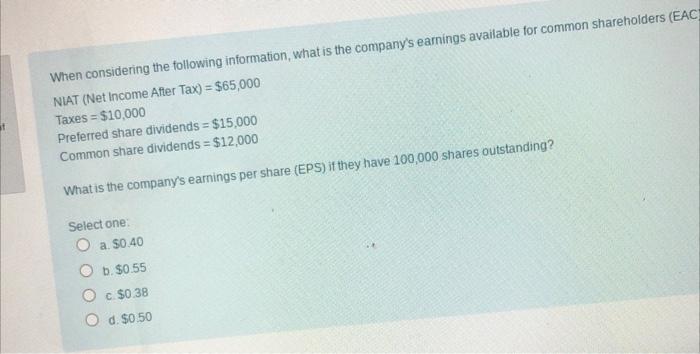

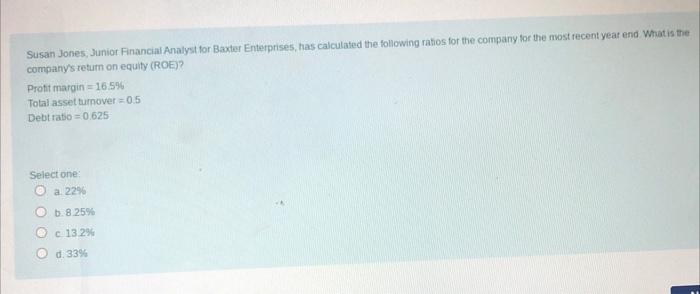

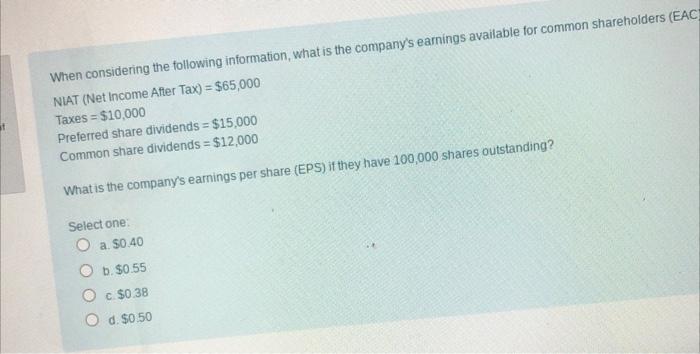

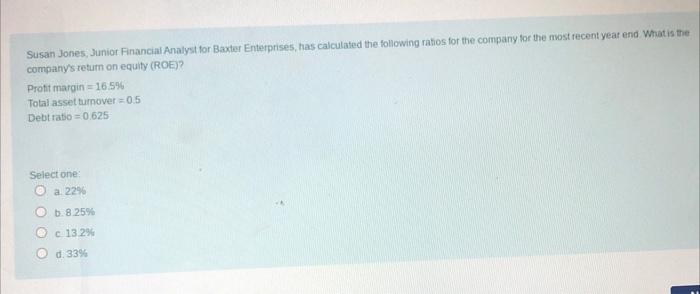

What is your net cash flow? Select one: a. $5,000.00 b. $10,000.00 c. $15,000.00 d. $2,500.00 When considering the following information, what is the company's earnings available for common shareholders (EAC NIAT (Net Income After Tax) =$65,000 Taxes =$10,000 Preferred share dividends =$15,000 Common share dividends =$12,000 What is the company's eamings per share (EPS) it they have 100,000 shares outstanding? Select one: a. $0.40 b. $0.55 c. $0.38 d. $0.50 Susan Jones, Junior. Financial Analyst for Baxter Enterprises, has calculated the following ratios for the company for the most tecent yeat end What is the companys retum on equity (ROE)? Protit margin =16.5% Total asset turnover =0.5 Debt tato =0.625 Select one: a. 229 b. 8.25% c 132% d. 33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started