Answered step by step

Verified Expert Solution

Question

1 Approved Answer

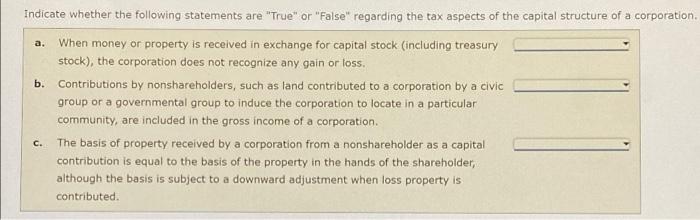

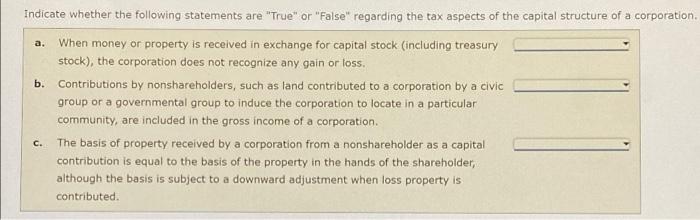

PLEASE ANSWER ASAP a. b. Indicate whether the following statements are True or False regarding the tax aspects of the capital structure of a corporation.

PLEASE ANSWER ASAP

a. b. Indicate whether the following statements are "True" or "False" regarding the tax aspects of the capital structure of a corporation. When money or property is received in exchange for capital stock (including treasury stock), the corporation does not recognize any gain or loss. Contributions by nonshareholders, such as land contributed to a corporation by a civic group or a governmental group to induce the corporation to locate in a particular community, are included in the gross income of a corporation C. The basis of property received by a corporation from a nonshareholder as a capital contribution is equal to the basis of the property in the hands of the shareholder, although the basis is subject to a downward adjustment when loss property is contributed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started