Please answer asap!!

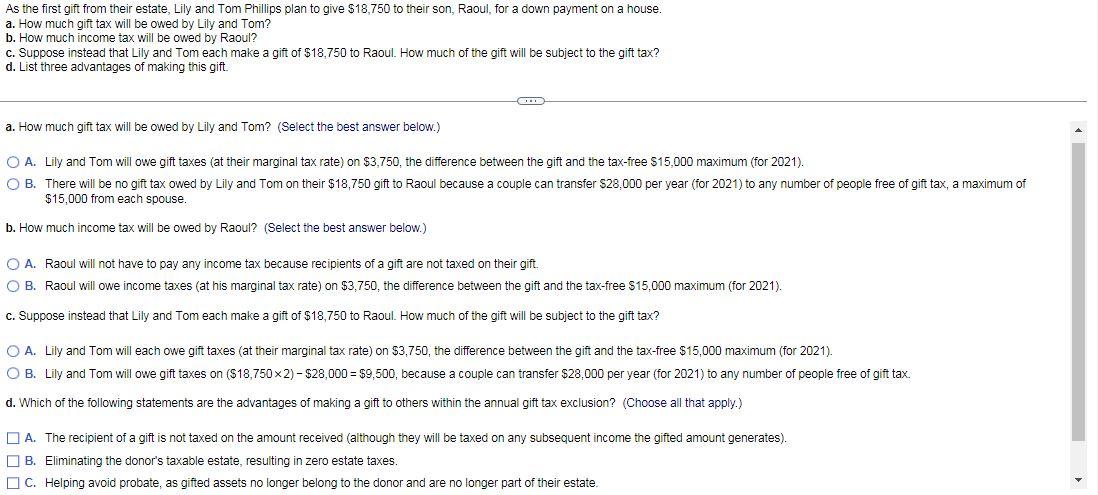

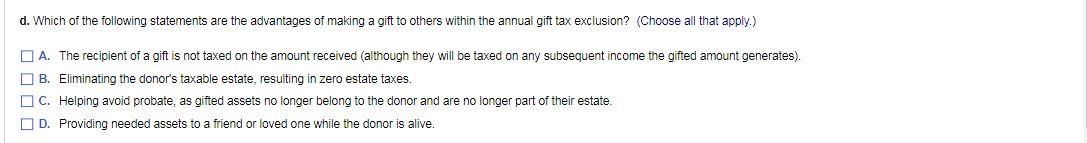

As the first gift from their estate, Lily and Tom Phillips plan to give $18,750 to their son, Raoul, for a down payment on a house. a. How much gift tax will be owed by Lily and Tom? b. How much income tax will be owed by Raoul? c. Suppose instead that Lily and Tom each make a gift of $18,750 to Raoul. How much of the gift will be subject to the gift tax? d. List three advantages of making this gift. a. How much gift tax will be owed by Lily and Tom? (Select the best answer below.) A. Lily and Tom will owe gift taxes (at their marginal tax rate) on $3,750, the difference between the gift and the tax-free $15,000 maximum (for 2021 ). B. There will be no gift tax owed by Lily and Tom on their $18,750 gift to Raoul because a couple can transfer $28,000 per year (for 2021 ) to any number of people free of gift tax, a maximum of $15,000 from each spouse. b. How much income tax will be owed by Raoul? (Select the best answer below.) A. Raoul will not have to pay any income tax because recipients of a gift are not taxed on their gift. B. Raoul will owe income taxes (at his marginal tax rate) on $3,750, the difference between the gift and the tax-free $15,000 maximum (for 2021 ). c. Suppose instead that Lily and Tom each make a gift of $18,750 to Raoul. How much of the gift will be subject to the gift tax? A. Lily and Tom will each owe gift taxes (at their marginal tax rate) on $3,750, the difference between the gift and the tax-free $15,000 maximum (for 2021 ). B. Lily and Tom will owe gift taxes on ($18,7502)$28,000=$9,500, because a couple can transfer $28,000 per year (for 2021 ) to any number of people free of gift tax. d. Which of the following statements are the advantages of making a gift to others within the annual gift tax exclusion? (Choose all that apply.) A. The recipient of a gift is not taxed on the amount received (although they will be taxed on any subsequent income the gifted amount generates). B. Eliminating the donor's taxable estate, resulting in zero estate taxes. C. Helping avoid probate, as gifted assets no longer belong to the donor and are no longer part of their estate. d. Which of the following statements are the advantages of making a gift to others within the annual gift tax exclusion? (Choose all that apply.) A. The recipient of a gift is not taxed on the amount received (although they will be taxed on any subsequent income the gifted amount generates). B. Eliminating the donor's taxable estate, resulting in zero estate taxes. C. Helping avoid probate, as gifted assets no longer belong to the donor and are no longer part of their estate. D. Providing needed assets to a friend or loved one while the donor is alive