Answered step by step

Verified Expert Solution

Question

1 Approved Answer

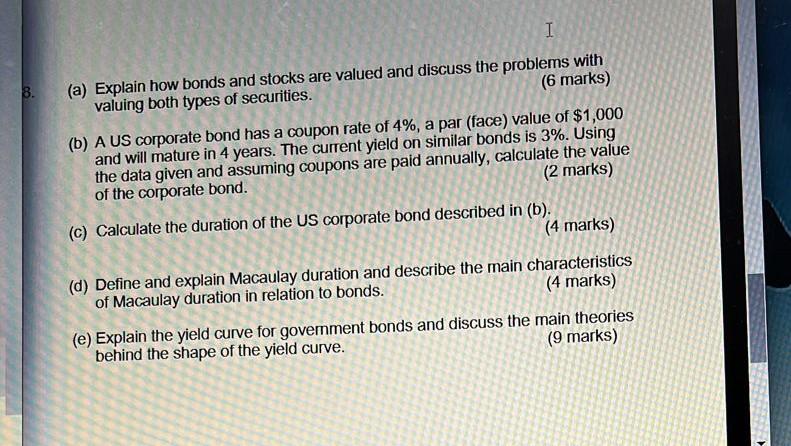

Please answer asap I 8. (a) Explain how bonds and stocks are valued and discuss the problems with valuing both types of securities. (6 marks)

Please answer asap

I 8. (a) Explain how bonds and stocks are valued and discuss the problems with valuing both types of securities. (6 marks) (b) A US corporate bond has a coupon rate of 4%, a par (face) value of $1,000 and will mature in 4 years. The current yield on similar bonds is 3%. Using the data given and assuming coupons are paid annually, calculate the value of the corporate bond. (2 marks) (c) Calculate the duration of the US corporate bond described in (b). (4 marks) (d) Define and explain Macaulay duration and describe the main characteristics (4 marks) of Macaulay duration in relation to bonds. (e) Explain the yield curve for government bonds and discuss the main theories (9 marks) behind the shape of the yield curveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started