please answer ASAP I really need help

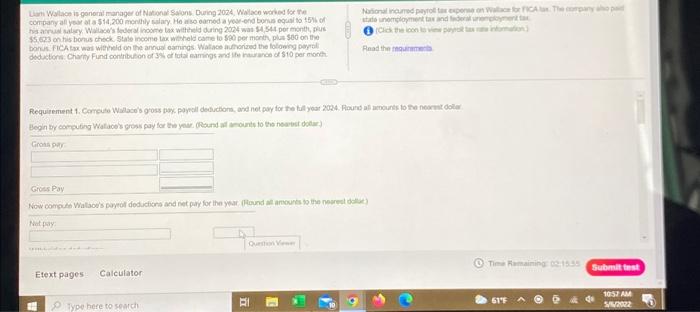

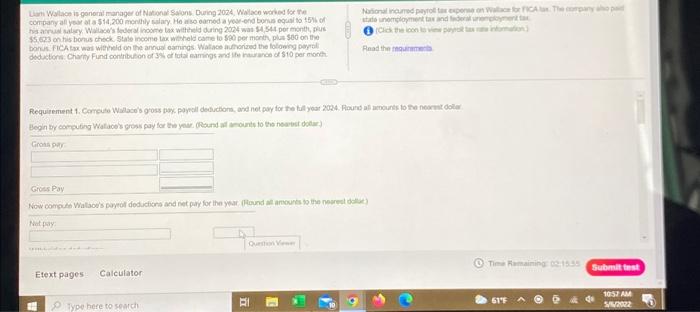

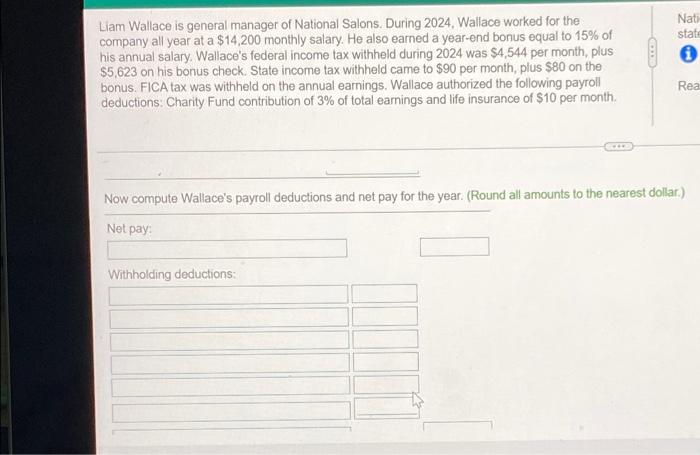

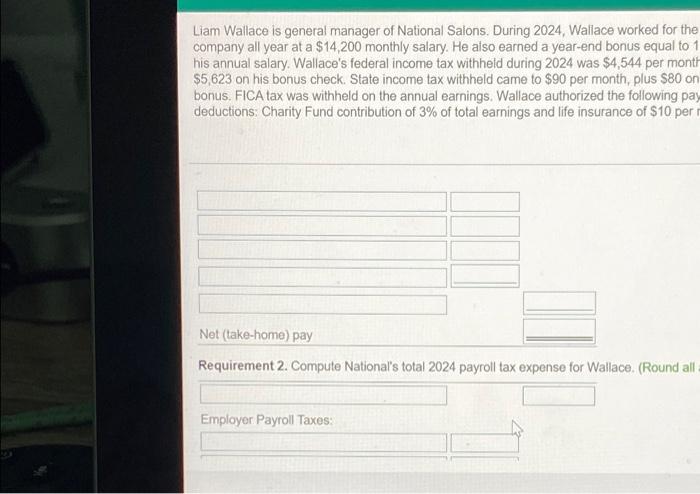

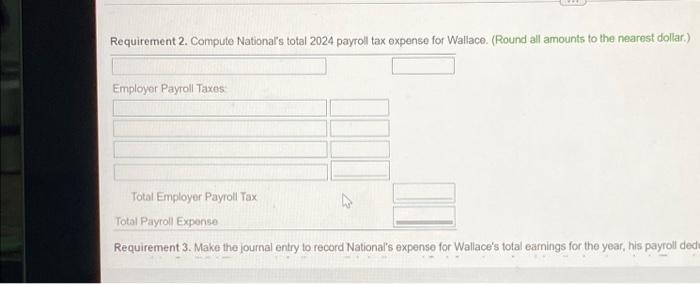

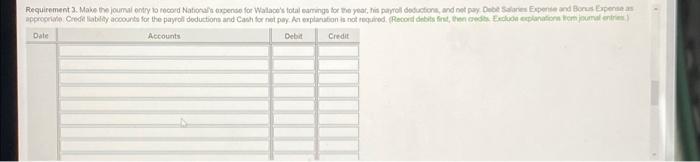

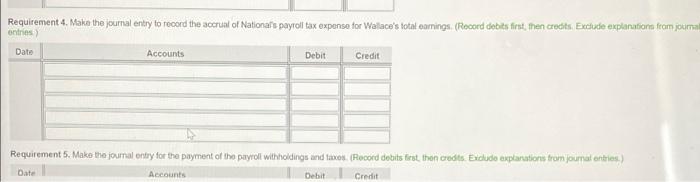

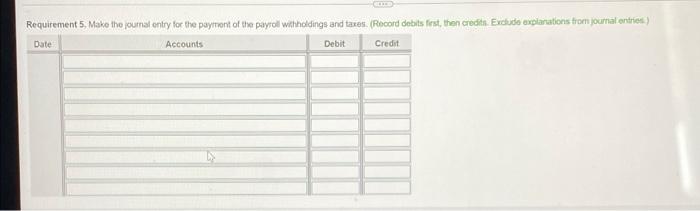

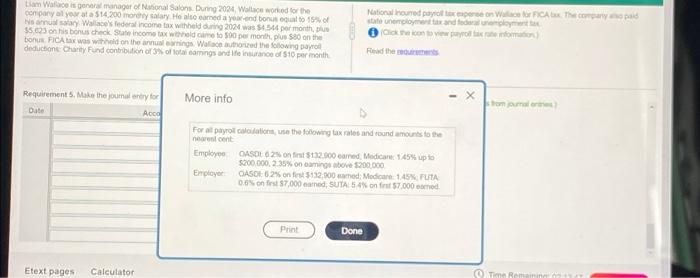

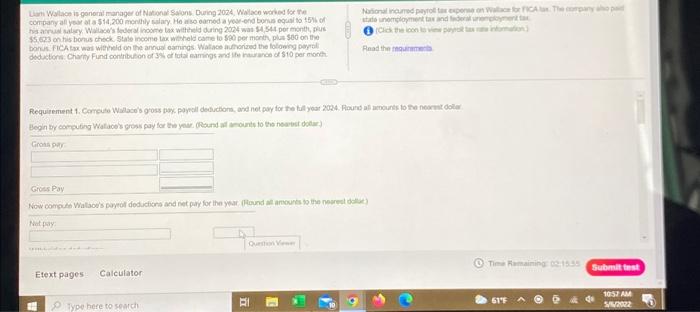

Lam Wallis general manager of National Salons During 2024 We worked for company all yta $14,200 monthly salary. He we comoda yond bonus gusto salary Welcome tax with during 2014 was 454 per month, plus $5623 on his bonus check State income tax who came to 500 per month plus 500 on the bonus FICA was with on the annual Gaming Walzed the folowing pool deduction Chary Fund contribution of total aming and the S10 per month National vered payroll to come App momento de theo Read the Requirement 1. Comuto Wall's goss paypayoll deduction, and not pay for the year 2024. Round us to the normal Begin by computing Wales gross pay for the year Round out to the north Gros Gross Pay Nowcom Watson's portof deduction and repay for the year (Hound amous to the rest Teamming Submit test Etext pages Calculator BI 618 10:52 AM 22 Type here to such Nati state Liam Wallace is general manager of National Salons. During 2024, Wallace worked for the company all year at a $14,200 monthly salary. He also earned a year-end bonus equal to 15% of his annual salary. Wallace's federal income tax withheld during 2024 was $4,544 per month, plus $5,623 on his bonus check. State income tax withheld came to $90 per month, plus $80 on the bonus FICA tax was withheld on the annual earnings. Wallace authorized the following payroll deductions: Charity Fund contribution of 3% of total earnings and life insurance of $10 per month Rea Now compute Wallace's payroll deductions and net pay for the year. (Round all amounts to the nearest dollar.) Net pay Withholding deductions Liam Wallace is general manager of National Salons. During 2024, Wallace worked for the company all year at a $14,200 monthly salary. He also earned a year-end bonus equal to 1 his annual salary. Wallace's federal income tax withheld during 2024 was $4,544 per month $5,623 on his bonus check. State income tax withheld came to $90 per month, plus $80 on bonus. FICA tax was withheld on the annual earnings, Wallace authorized the following pay deductions: Charity Fund contribution of 3% of total earnings and life insurance of $10 per Net (take-home) pay Requirement 2. Compute National's total 2024 payroll tax expense for Wallace, (Round all Employer Payroll Taxes: Requirement 2. Compute National's total 2024 payroll tax expense for Wallace (Round all amounts to the nearest dollar) Employer Payroll Taxes Total Employer Payroll Tax Total Payroll Expense Requirement 3. Make the journal entry to record National's expense for Wallace's total earnings for the year, his payroll ded Requirement 3. Make the journey to record National expense for Walace's total amingo for the year, his paroductions, and not pay Doo Sans Expense and Borus Expenses appropriate Code ability accounts for the payroll deduction and Cash for net pay. An explarutions not required. (Recor debita fint, the education om joumanie Date Accounts Debit Credit Requirement 4. Make the journal entry to record the accrunt of National's payroll tax expense for Wallace's total comings (Record debits first, then credits. Exclude exploration from journal ories Date Accounts Debit Credit Requirement 5. Make the journal entry for the payment of the payroll withholdings and faxes (Record debits first the credits Exclude explanations from ouma entries Date Accounts Debit Credit Requirement 5, Make the journal entry for the payment of the payroll withholdings and taxes (Record debts first, the credits. Exclude explanations from journal entries Date Accounts Debit Credit Liam Wallis general manager of Nahona Salons Dung 2024 Wallace worked for the company atyowata $14.200 more salary He also earned a you and bonus oculto 15 Na aulay Wallace' federal income tax withheld during 2021 was $4544 por month $5.03 on his bonus check State income tax whold me to 500 per month plus 50 on the bonus FICA was whold on the annual ring. Walautord the following payroll deduction Charity Fund contribution of forming and the insurance of 10 per month National round pay to me on TFC.The normand for Click on the Read the mos Requirements. Make the journal and for Date More info somum For of payroll caldation, use the following tax rates and round amounts to the neare cont Employee OASOE 2 on first $132.000 carried Medicare 145% up to $200.000, 2.35% on caming above $200.000 Employer CASOT 62% on fest 132.000 and Medicare 145 PUTA 0.0 on 67,000 earned, SUTA 84% on fut 57.000 Print Done Etext pages Calculator