Answered step by step

Verified Expert Solution

Question

1 Approved Answer

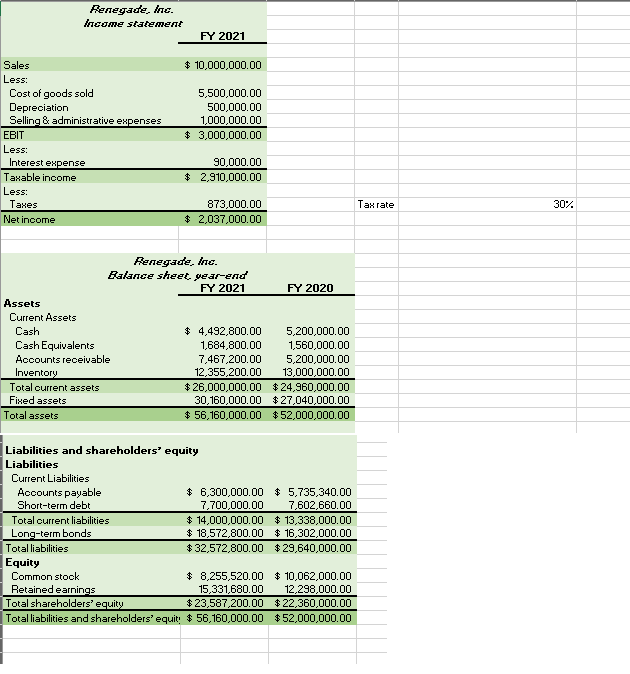

PLEASE ANSWER ASAP I WILL GIVE THUMBS UP IT NEED TO BE IN EXCEL FORMAT Using the financial statement information in the Excel file for

PLEASE ANSWER ASAP I WILL GIVE THUMBS UP

IT NEED TO BE IN EXCEL FORMAT

Using the financial statement information in the Excel file for Renegade, Inc., what is the firm value of Renegade, Inc. when using a FCFF valuation approach? The WACC is 9.3% and the terminal growth rate is 3%. Hint: You should be using a DCF model here.

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Liabilities and shareholders' equity \\ Liabilities \end{tabular}} \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline \begin{tabular}{l} Acoounts payable \\ Short-term debt \end{tabular} & \begin{tabular}{r} $,300,000.00 \\ 7,700,000.00 \\ \end{tabular} & \begin{tabular}{r} 5,735,340.00 \\ 7,602,660.00 \\ \end{tabular} \\ \hline Total current liabilities & $14,000,000.00 & $13,338,000.00 \\ \hline Long-term bonds & $18,572,800.00 & $16,302,000.00 \\ \hline Total liabilities & $32,572,800.00 & $29,640,000.00 \\ \hline \multicolumn{3}{|l|}{ Equity } \\ \hline Common stook & $8,255,520.00 & $10,062,000.00 \\ \hline Retained earnings & 15,331,680.00 & 12,298,000.00 \\ \hline Total shareholders' equity & $23,587,200.00 & $22,360,000.00 \\ \hline Total liabilities and shareholders' equit & 56,160,000.00 & $52,000,000.00 \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Liabilities and shareholders' equity \\ Liabilities \end{tabular}} \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline \begin{tabular}{l} Acoounts payable \\ Short-term debt \end{tabular} & \begin{tabular}{r} $,300,000.00 \\ 7,700,000.00 \\ \end{tabular} & \begin{tabular}{r} 5,735,340.00 \\ 7,602,660.00 \\ \end{tabular} \\ \hline Total current liabilities & $14,000,000.00 & $13,338,000.00 \\ \hline Long-term bonds & $18,572,800.00 & $16,302,000.00 \\ \hline Total liabilities & $32,572,800.00 & $29,640,000.00 \\ \hline \multicolumn{3}{|l|}{ Equity } \\ \hline Common stook & $8,255,520.00 & $10,062,000.00 \\ \hline Retained earnings & 15,331,680.00 & 12,298,000.00 \\ \hline Total shareholders' equity & $23,587,200.00 & $22,360,000.00 \\ \hline Total liabilities and shareholders' equit & 56,160,000.00 & $52,000,000.00 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started