Answered step by step

Verified Expert Solution

Question

1 Approved Answer

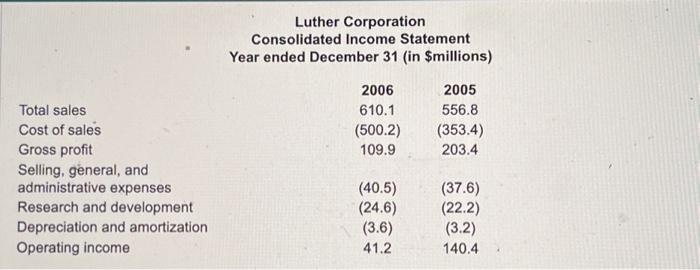

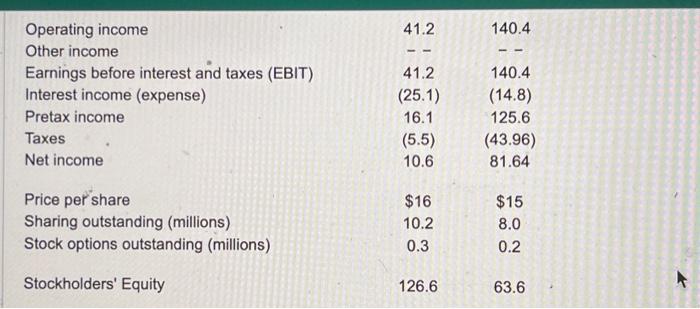

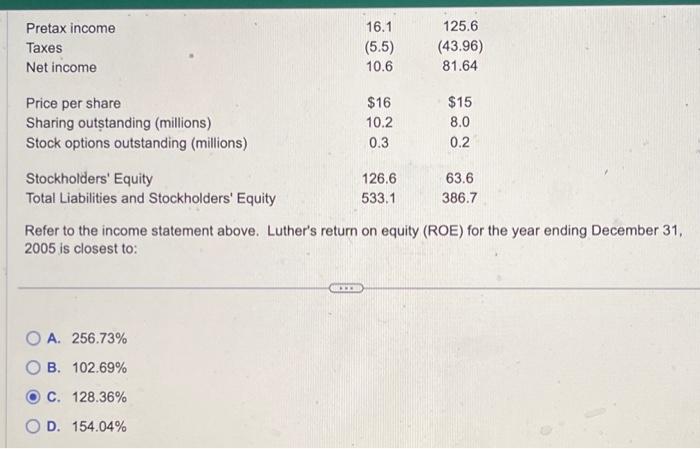

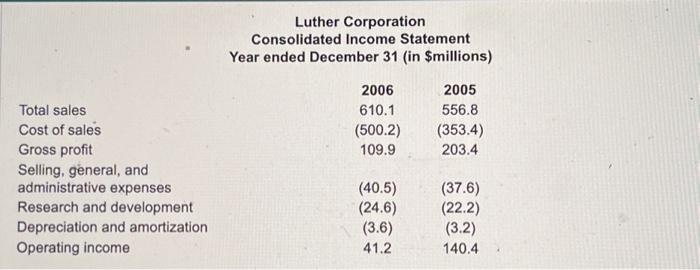

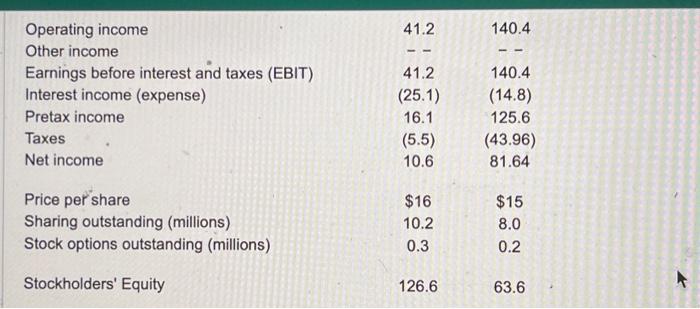

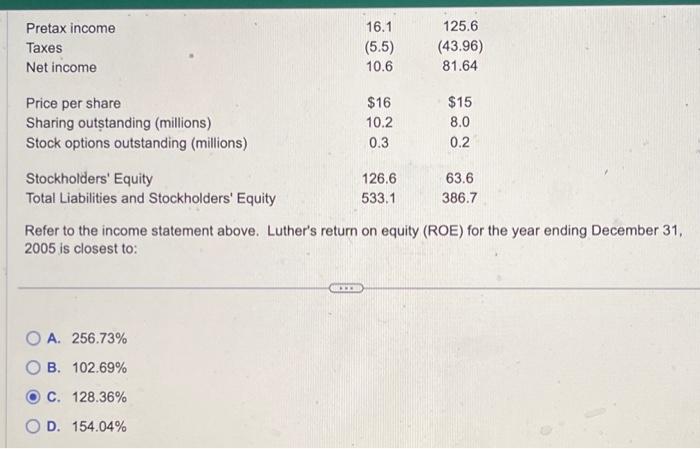

please answer asap!! Luther Corporation Consolidated Income Statement Year ended December 31 (in $millions) OperatingincomeOtherincomeEarningsbeforeinterestandtaxes(EBIT)Interestincome(expense)PretaxincomeTaxesNetincomePricepershareSharingoutstanding(millions)Stockoptionsoutstanding(millions)41.241.2(25.1)16.1(5.5)10.6$1610.20.3126.6140.4140.4(14.8)125.6(43.96)81.64$158.00.263.6 Refer to the income statement above. Luther's return on equity

please answer asap!!

Luther Corporation Consolidated Income Statement Year ended December 31 (in \$millions) OperatingincomeOtherincomeEarningsbeforeinterestandtaxes(EBIT)Interestincome(expense)PretaxincomeTaxesNetincomePricepershareSharingoutstanding(millions)Stockoptionsoutstanding(millions)41.241.2(25.1)16.1(5.5)10.6$1610.20.3126.6140.4140.4(14.8)125.6(43.96)81.64$158.00.263.6 Refer to the income statement above. Luther's return on equity (ROE) for the year ending December 31 , 2005 is closest to: A. 256.73% B. 102.69% C. 128.36% D. 154.04%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started