PLEASE ANSWER ASAP!! No need for explanations just simple solutions

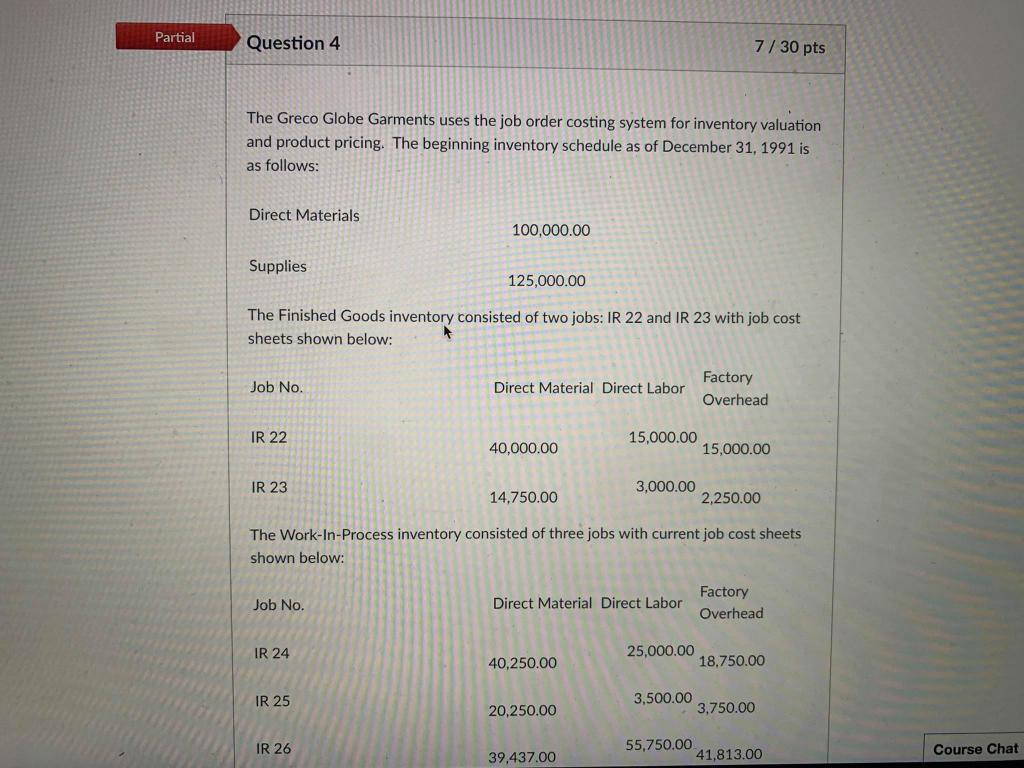

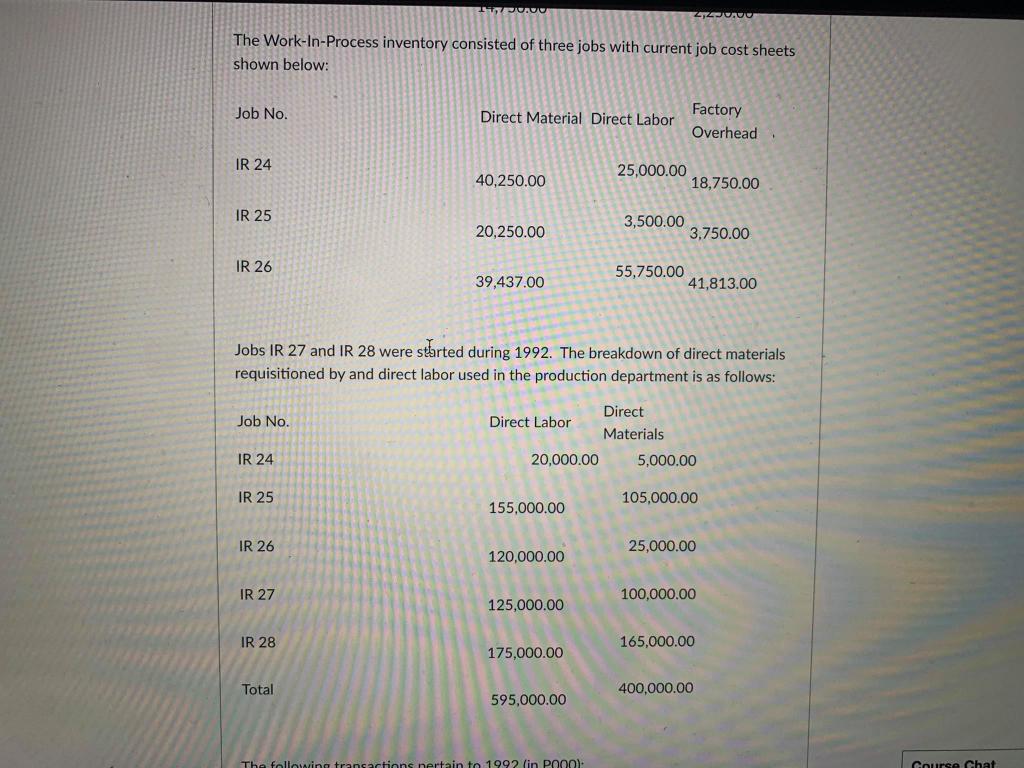

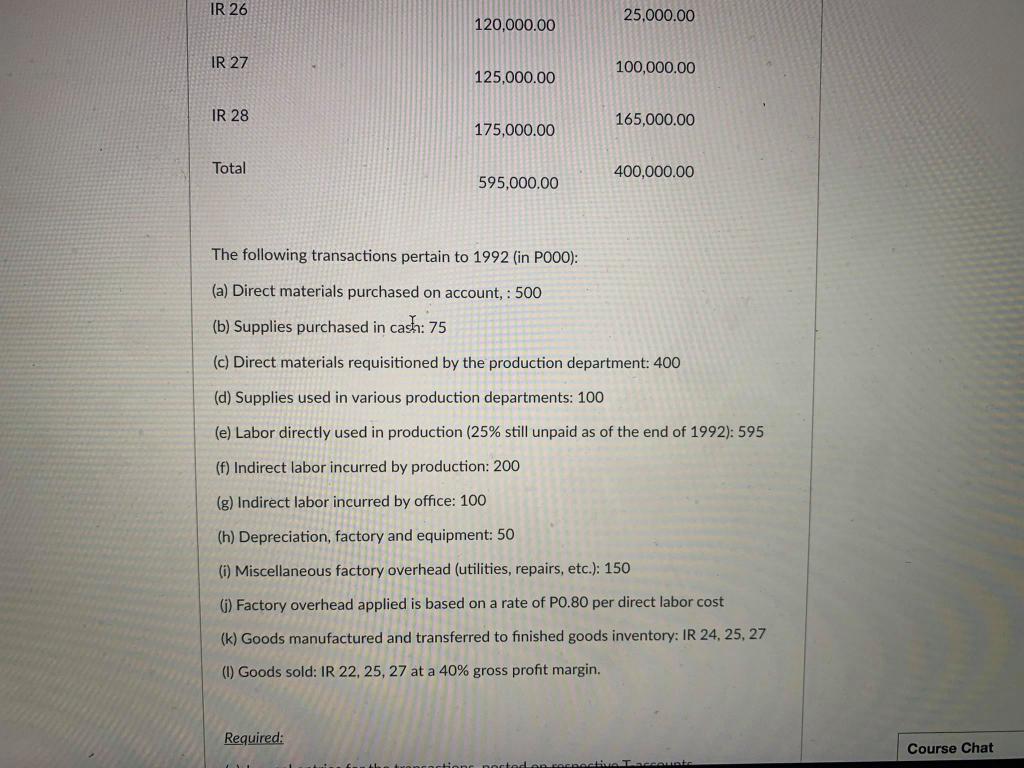

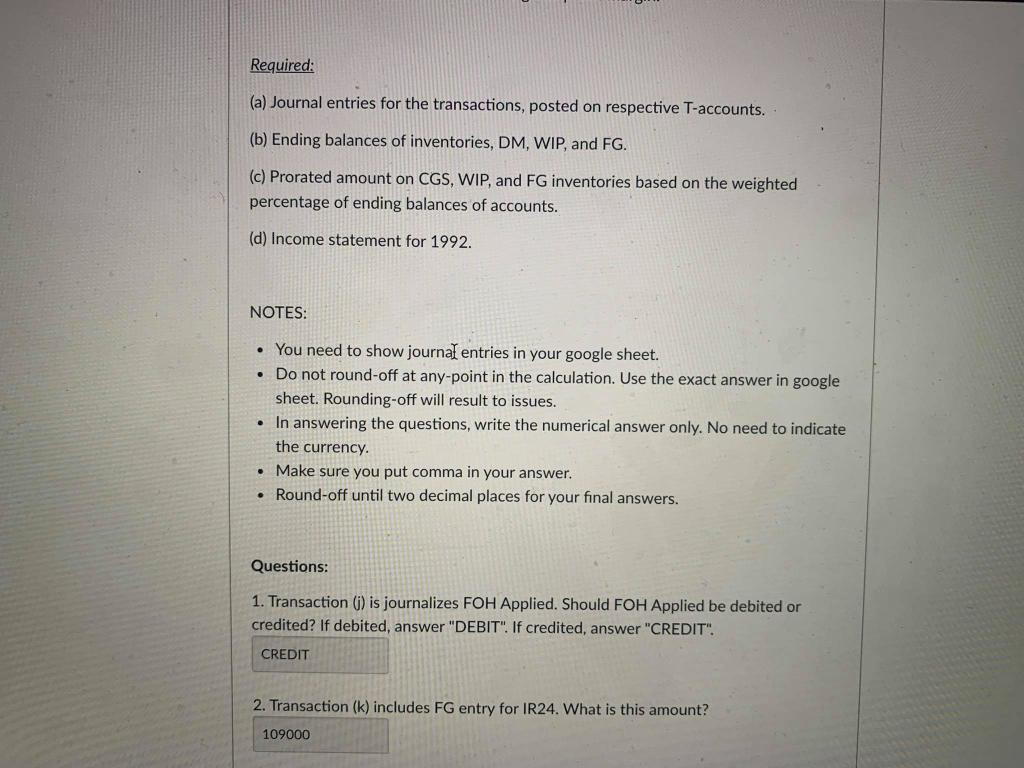

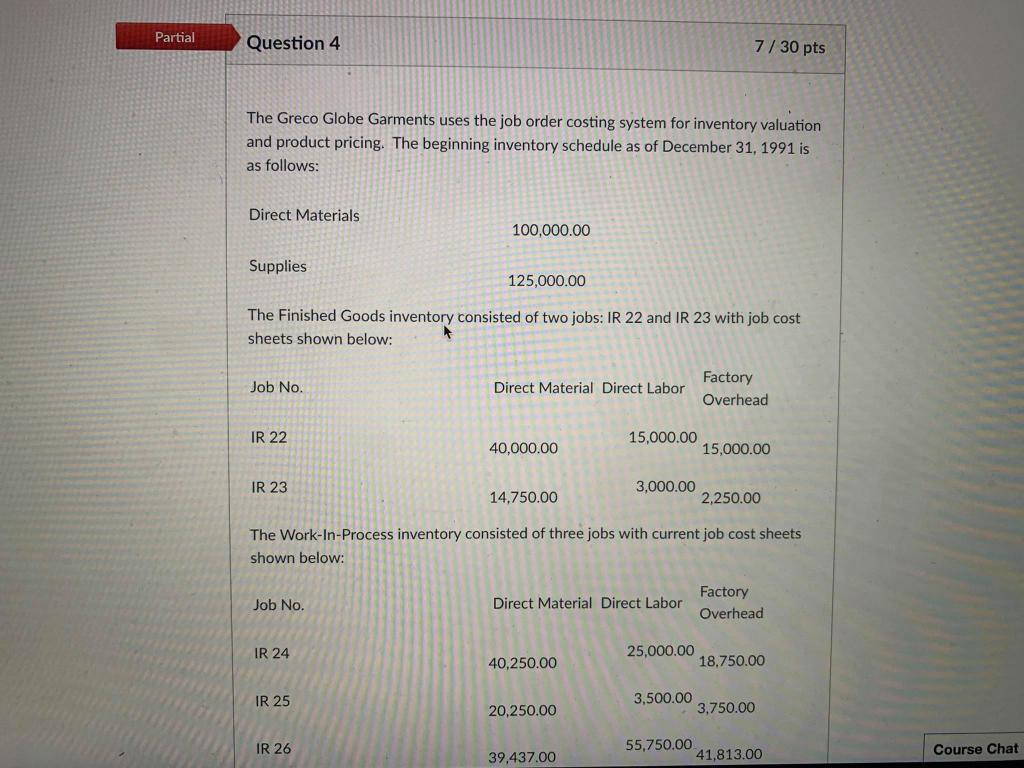

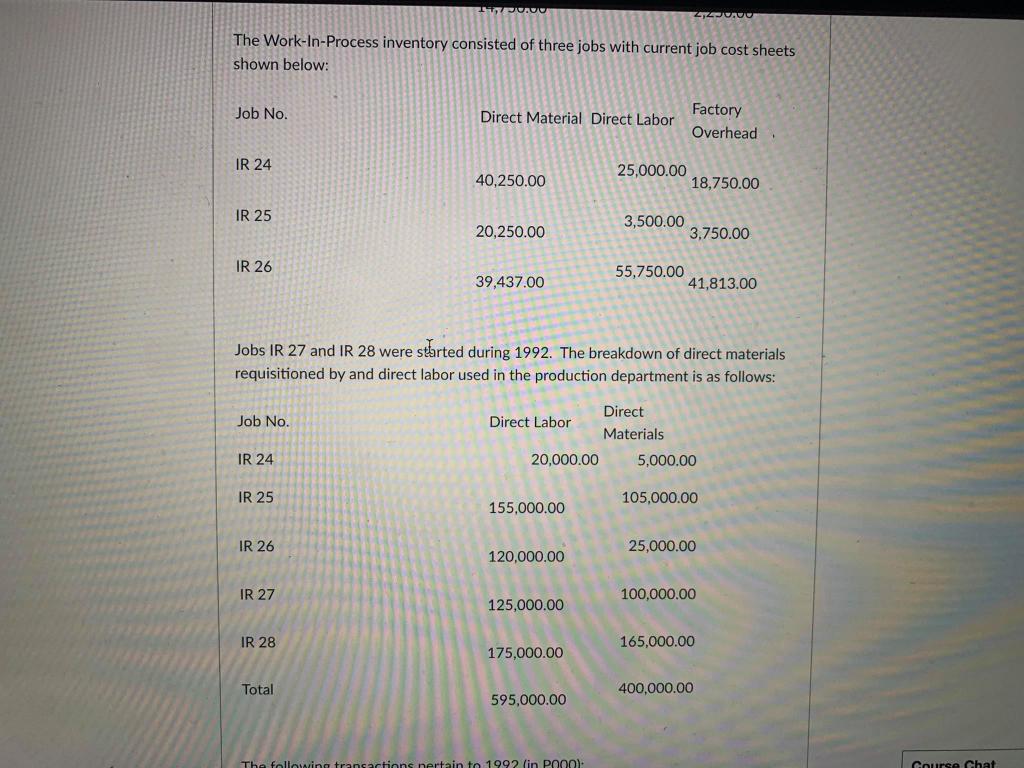

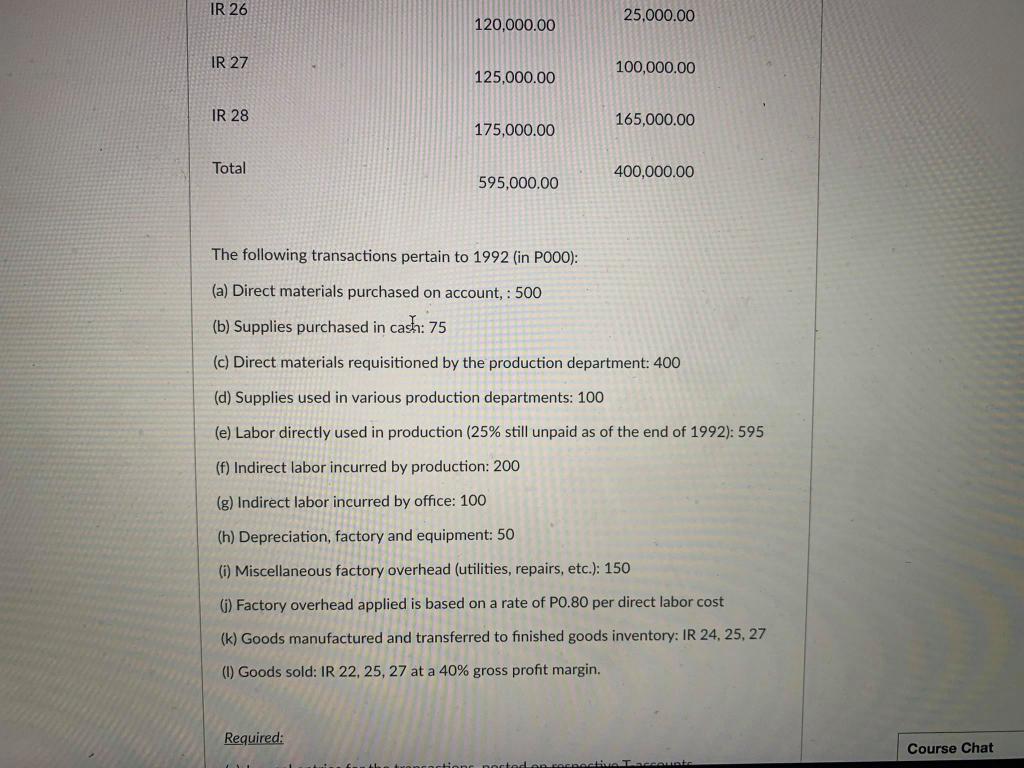

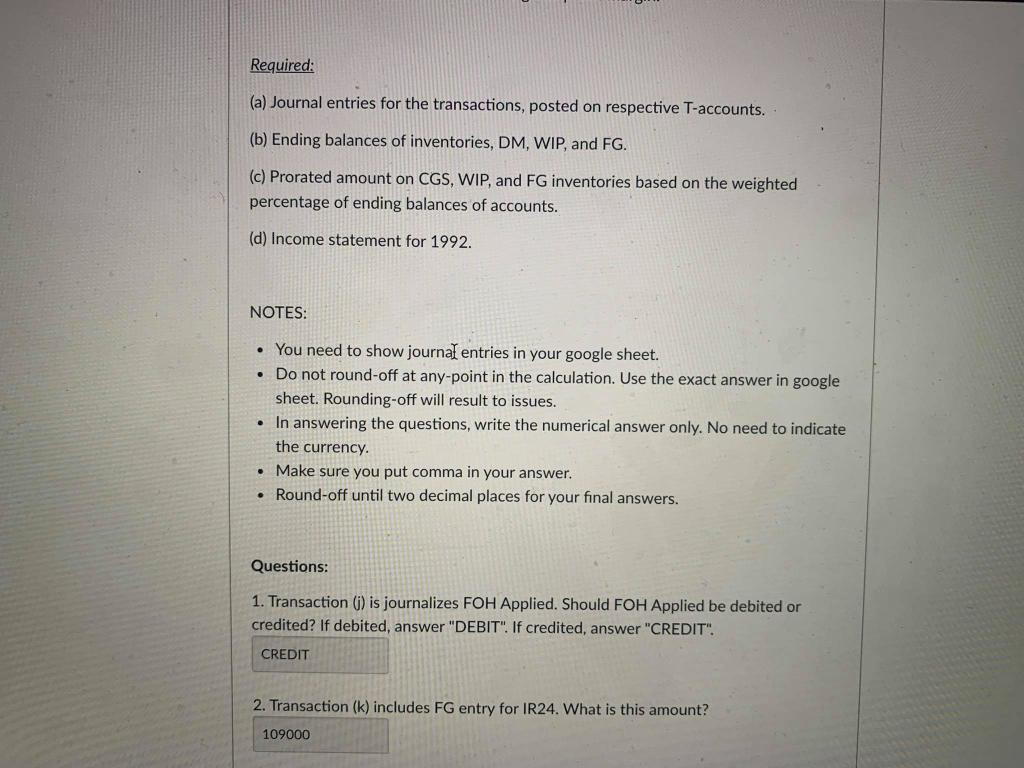

Partial Question 4 7/30 pts The Greco Globe Garments uses the job order costing system for inventory valuation and product pricing. The beginning inventory schedule as of December 31, 1991 is as follows: Direct Materials 100,000.00 Supplies 125,000.00 The Finished Goods inventory consisted of two jobs: IR 22 and IR 23 with job cost sheets shown below: Job No. Direct Material Direct Labor Factory Overhead IR 22 40,000.00 15,000.00 15,000.00 IR 23 14.750.00 3,000.00 2,250.00 The Work-In-Process inventory consisted of three jobs with current job cost sheets shown below: Factory Job No. Direct Material Direct Labor Overhead IR 24 40,250.00 25,000.00 18.750.00 IR 25 20,250.00 3,500.00 3.750.00 IR 26 55,750.00 41,813.00 39.437.00 Course Chat The Work-In-Process inventory consisted of three jobs with current job cost sheets shown below: Job No. Direct Material Direct Labor Factory Overhead IR 24 40,250.00 25,000.00 18,750.00 IR 25 20,250.00 3,500.00 3,750.00 IR 26 39,437.00 55,750.00 41,813.00 Jobs IR 27 and IR 28 were started during 1992. The breakdown of direct materials requisitioned by and direct labor used in the production department is as follows: Job No. Direct Direct Labor Materials 20,000.00 5,000.00 IR 24 IR 25 105,000.00 155,000.00 IR 26 25,000.00 120,000.00 IR 27 100,000.00 125,000.00 IR 28 165,000.00 175,000.00 Total 400,000.00 595,000.00 The following transactions pertain to 1992 (in POO0). Course Chat IR 26 120,000.00 25,000.00 IR 27 100,000.00 125,000.00 IR 28 165,000.00 175,000.00 Total 400,000.00 595,000.00 The following transactions pertain to 1992 (in POOO): (a) Direct materials purchased on account, : 500 (b) Supplies purchased in cash: 75 (c) Direct materials requisitioned by the production department: 400 (d) Supplies used in various production departments: 100 (e) Labor directly used in production (25% still unpaid as of the end of 1992): 595 (f) Indirect labor incurred by production: 200 (g) Indirect labor incurred by office: 100 (h) Depreciation, factory and equipment: 50 (i) Miscellaneous factory overhead (utilities, repairs, etc.): 150 (1) Factory overhead applied is based on a rate of PO.80 per direct labor cost (k) Goods manufactured and transferred to finished goods inventory: IR 24, 25, 27 (1) Goods sold: IR 22, 25, 27 at a 40% gross profit margin. Required: Course Chat Required: (a) Journal entries for the transactions, posted on respective T-accounts. (b) Ending balances of inventories, DM, WIP, and FG. (c) Prorated amount on CGS, WIP, and FG inventories based on the weighted percentage of ending balances of accounts. (d) Income statement for 1992. NOTES: You need to show journal entries in your google sheet. Do not round-off at any-point in the calculation. Use the exact answer in google sheet. Rounding-off will result to issues. In answering the questions, write the numerical answer only. No need to indicate the currency. Make sure you put comma in your answer. Round-off until two decimal places for your final answers. Questions: 1. Transaction () is journalizes FOH Applied. Should FOH Applied be debited or credited? If debited, answer "DEBIT". If credited, answer "CREDIT". CREDIT 2. Transaction (k) includes FG entry for IR24. What is this amount? 109000