Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ASAP!!! Please fill in the blanks with the options shown. For Part A, all options are provided. For Part B. the options are:

PLEASE ANSWER ASAP!!!

Please fill in the blanks with the options shown.

For Part A, all options are provided.

For Part B. the options are:

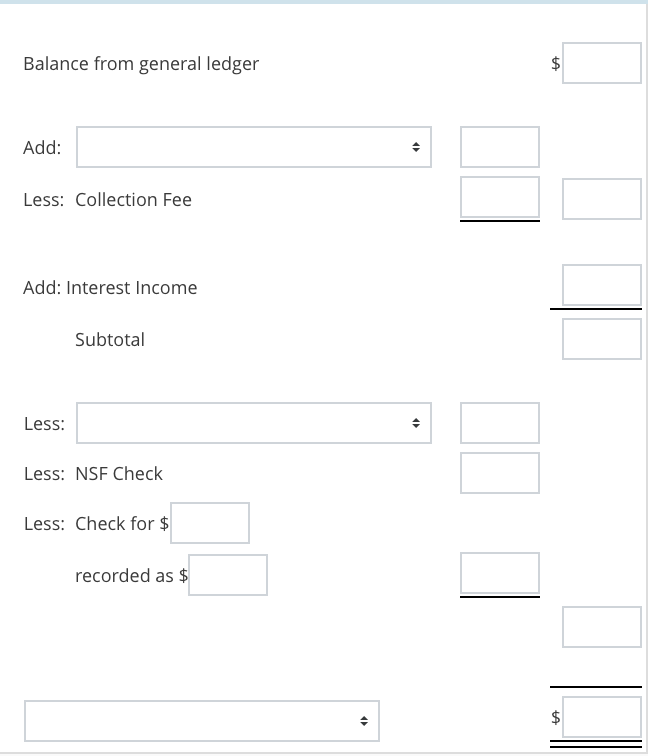

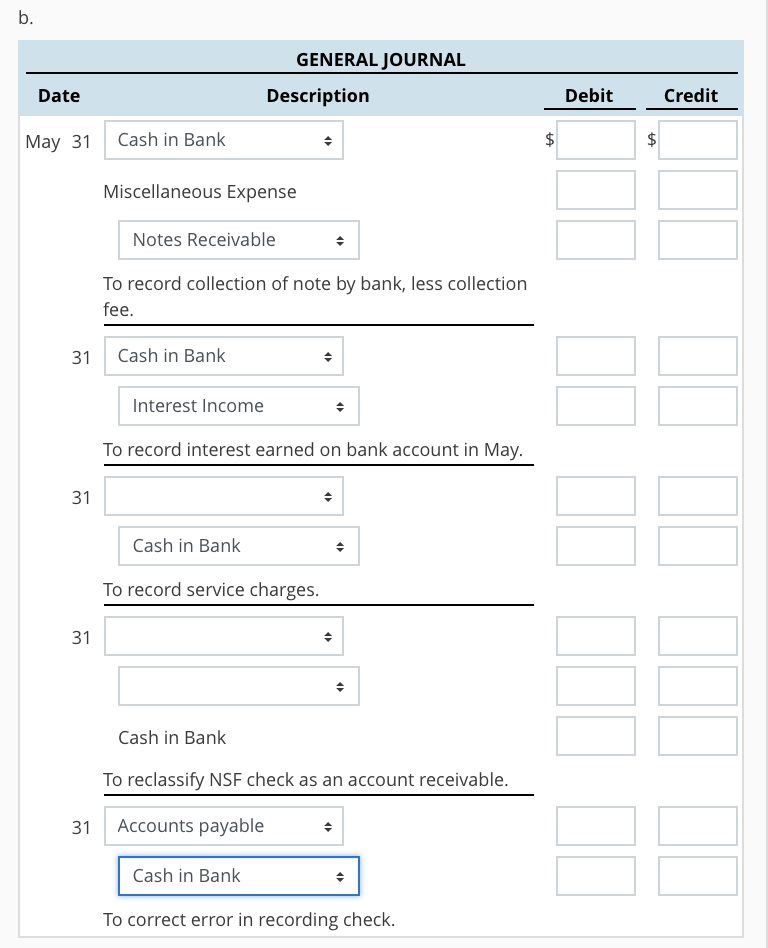

Accounts Payable, Accounts Receivable, Cash in Bank, Interest Income, Miscellaneous Expense, Notes Receivable, Repairs Expense, Sales Discounts

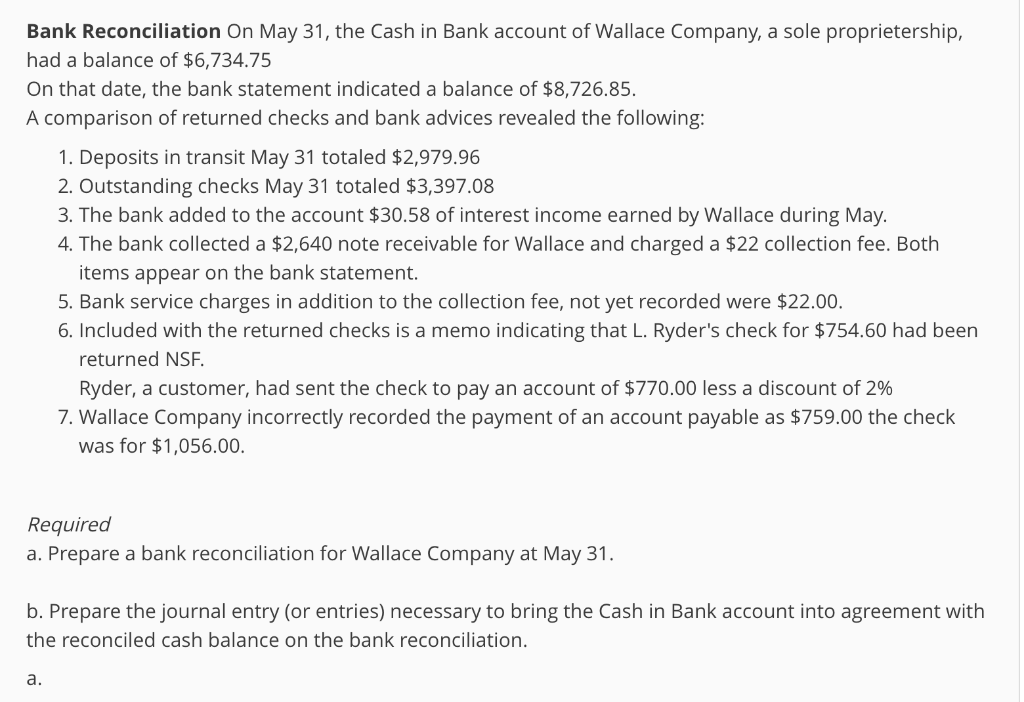

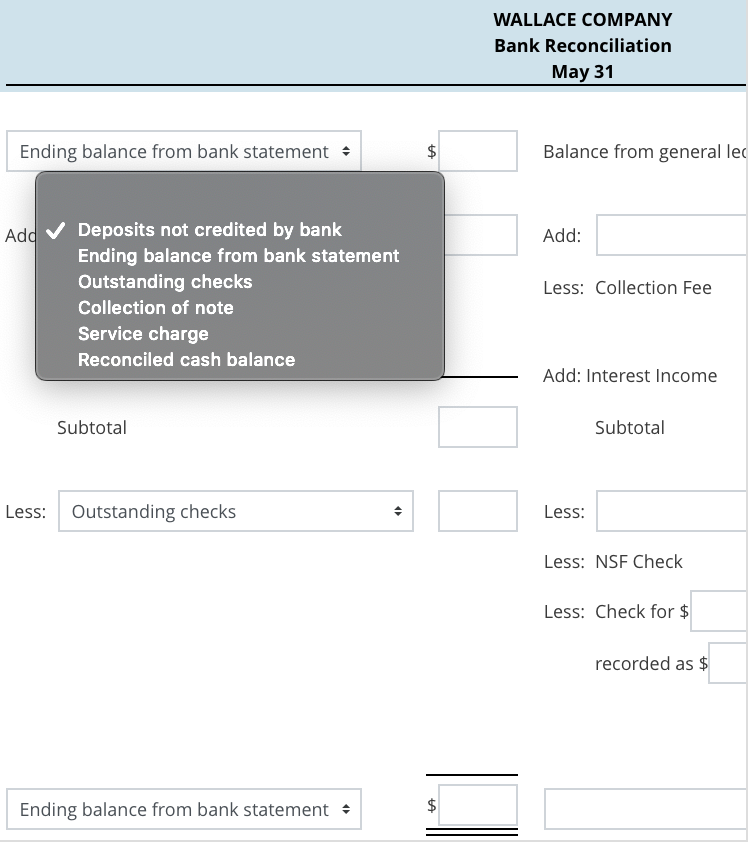

Bank Reconciliation On May 31, the Cash in Bank account of Wallace Company, a sole proprietership, had a balance of $6,734.75 On that date, the bank statement indicated a balance of $8,726.85. A comparison of returned checks and bank advices revealed the following: 1. Deposits in transit May 31 totaled $2,979.96 2. Outstanding checks May 31 totaled $3,397.08 3. The bank added to the account $30.58 of interest income earned by Wallace during May. 4. The bank collected a $2,640 note receivable for Wallace and charged a $22 collection fee. Both items appear on the bank statement. 5. Bank service charges in addition to the collection fee, not yet recorded were $22.00 6. Included with the returned checks is a memo indicating that L. Ryder's check for $754.60 had been returned NSF. Ryder, a customer, had sent the check to pay an account of $770.00 less a discount of 2% 7. Wallace Company incorrectly recorded the payment of an account payable as $759.00 the check was for $1,056.00. Required a. Prepare a bank reconciliation for Wallace Company at May 31. b. Prepare the journal entry (or entries) necessary to bring the Cash in Bank account into agreement with the reconciled cash balance on the bank reconciliation. a. WALLACE COMPANY Bank Reconciliation May 31 Ending balance from bank statement Balance from general le Ado VDeposits not credited by bank Add: Ending balance from bank statement Outstanding checks Collection of note Service charge Reconciled cash balance Less: Collection Fee Add: Interest Income Subtotal Subtotal Less: Outstanding checks Less: Less: NSF Check Less: Check for$ recorded as$ Ending balance from bank statement Balance from general ledger Add: Less: Collection Fee Add: Interest Income Subtotal Less: Less: NSF Check Less: Check for $ recorded as $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started