Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer ASAP The income statement, also known as a profit and loss (P&L) statement, provides a snapshot of a company's financial performance during a

please answer ASAP

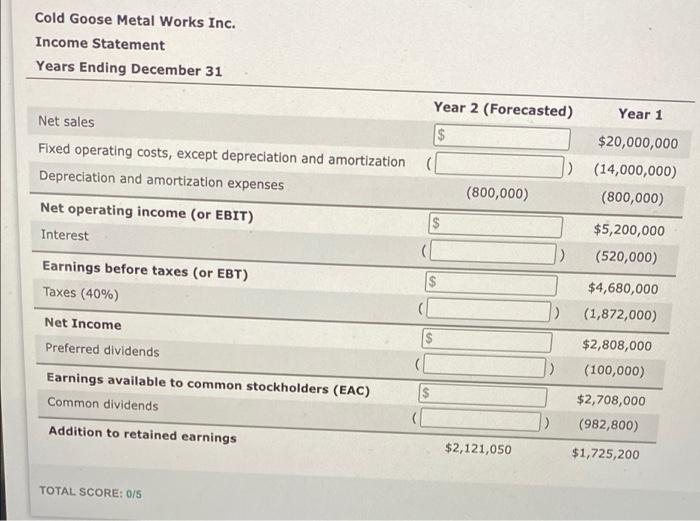

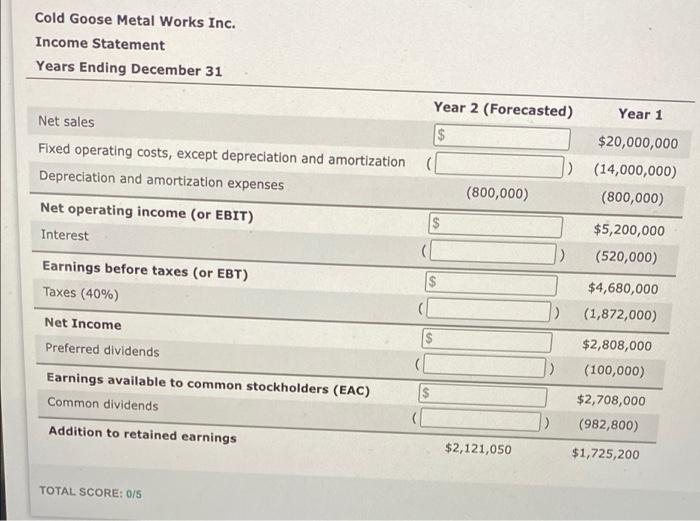

The income statement, also known as a profit and loss (P&L) statement, provides a snapshot of a company's financial performance during a specified period of time. It reports a firm's gross income, expenses, net income, and the income that is available for distribution to its preferred and common shareholders The Income statement is prepared using the generally accepted accounting principles (GAAP) that match the firm's revenues and expenses to the period in which they are incurred, not necessarily when cash is received or pald. Investors and analysts use the information presented in the Income statement, and the other financial statements and reports, to evaluate the company's financial performance and condition. Consider the following scenario: Cold Goose Metal Works Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year 1. Cold Goose is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before Interest and taxes (EBIT) 2. The company's operating costs (excluding depreciation and amortization) remain at 70.00% of net sales, and its depreciation and amortization expenses remain constant from year to year 3. The company's tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT) 4. In Year 2, Cold Goose expects to pay $100,000 and $1,195,950 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Round each dollar value to the nearest whole dollar Cold Goose Metal Works Inc. Income Statement Years Ending December 31 Net sales Fixed operating costs, except depreciation and amortization Depreciation and amortization expenses Net operating income (or EBIT) Interest Earnings before taxes (or EBT) Taxes (40%) Year 2 (Forecasted) Year 1 $ $ $20,000,000 ) (14,000,000) (800,000) (800,000) $ $5,200,000 (520,000) ( $4,680,000 (1,872,000) Net Income Preferred dividends $ $2,808,000 (100,000) D) Earnings available to common stockholders (EAC) Common dividends (1 $2,708,000 (982,800) Addition to retained earnings $2,121,050 $1,725,200 TOTAL SCORE: 0/5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started