Answered step by step

Verified Expert Solution

Question

1 Approved Answer

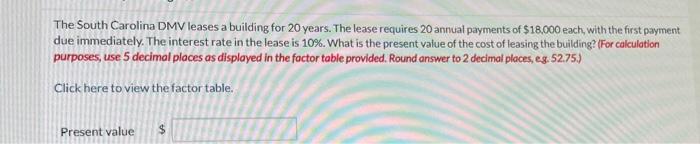

please answer asap! The South Carolina DMV leases a building for 20 years. The lease requires 20 annual payments of $18,000 each, with the first

please answer asap!

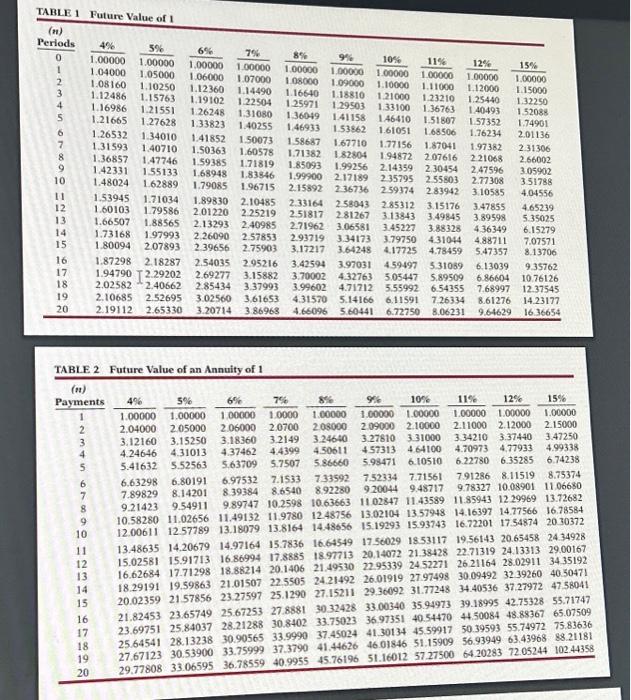

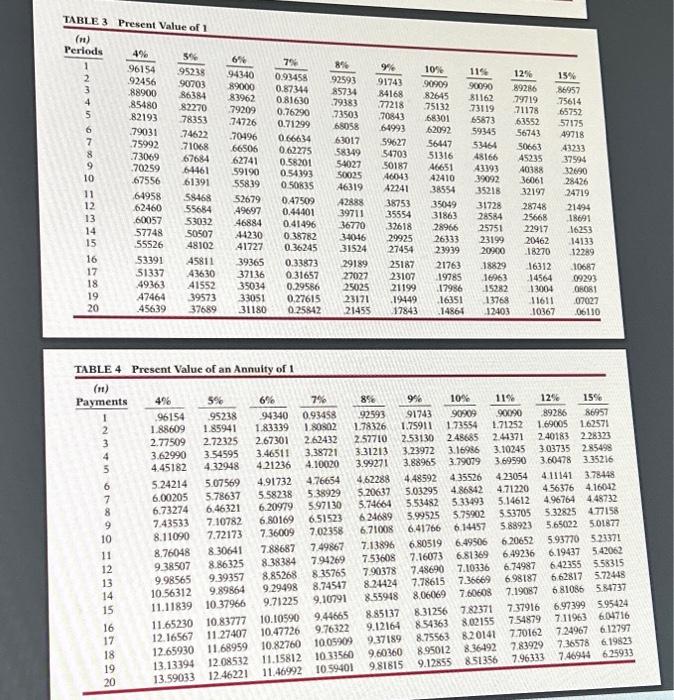

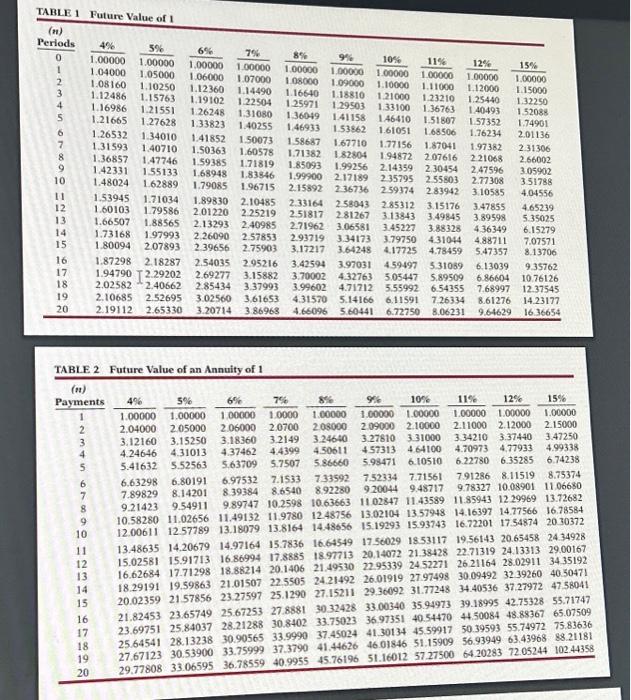

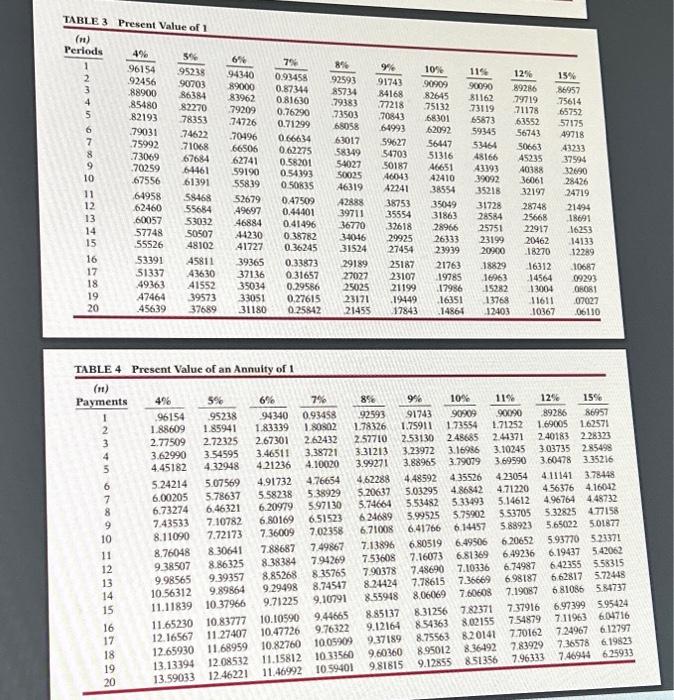

The South Carolina DMV leases a building for 20 years. The lease requires 20 annual payments of $18,000 each, with the first payment due immediately. The interest rate in the lease is 10%. What is the present value of the cost of leasing the building? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, eg. 52.75.) Click here to view the factor table. TABLE 1 Future Value of 1 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{c} (ni) \\ Periods \\ \end{tabular} & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 15% \\ \hline 0 & 1.00000 & 1.00000 & 1,00000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 \\ \hline 1 & 1.04000 & 1.05000 & 1.06000 & 1.07000 & 1.08000 & 1.09000 & 1.10000 & 1.11000 & 1.12000 & L. 15000 \\ \hline 2 & 1.08160 & 1.10250 & 1.12360 & 1.14490 & 1.16640 & 1.18810 & 1.21000 & 1.23210 & 1.25440 & 1.32250 \\ \hline 3 & 1.12486 & 1.15763 & 1.19102 & 1.22504 & 125971 & 1.29503 & 133100 & 1.36763 & 1.40493 & 1.52088 \\ \hline 4 & 1.16986 & 1.21551 & 1.26248 & 1.31080 & 1,36049 & 1.41158 & 1.46410 & 1.51807 & 1.57352 & 1.74901 \\ \hline 5 & 1.21665 & 1.27628 & 1.33823 & 1.40255 & 1.46933 & 1.53862 & 1.61051 & 1.68506 & 1.76234 & 2.01136 \\ \hline 6 & 1.26532 & 1.34010 & 1.41852 & 1.50073 & 1.58687 & 1.67710 & 1.77156 & 1.87041 & 1.97382 & 231306 \\ \hline 7 & 1.31593 & 1.40710 & 1.50363 & 1.60578 & 1.71382 & 1.82804 & 1.94872 & 207616 & 2.21068 & 2,66002 \\ \hline 8 & 1.36857 & 1.47746 & 1.59385 & 1.71819 & 1.85093 & 1.99256 & 2.14359 & 2,30454 & 2,47596 & 3.05902 \\ \hline 9 & 1.42331 & 155133 & 1,68948 & 1.83846 & 1.99900 & 2.17189 & 235795 & 255803 & 277308 & 351788 \\ \hline 10 & 1.48024 & 1.62889 & 1.79085 & 1.96715 & 2.15392 & 236736 & 259374 & 2.83942 & 3.10585 & 4.04556 \\ \hline 11 & 1.53945 & 1.71034 & 1.89830 & 2.10485 & 2.33164 & 2.58043 & 2.85312 & 3.15176 & 3.47855 & 4.65239 \\ \hline 12 & 1.60103 & 1.79586 & 2.01220 & 2.25219 & 2.51817 & 281267 & 3.13843 & 3.49845 & 3.89598 & 5.35025 \\ \hline 13 & 1.66507 & 1.88565 & 2.13293 & 2,40985 & 2.71962 & 3.06581 & 3.45227 & 3.88328 & 436349 & 6.15279 \\ \hline 14 & 1.73168 & 1.97993 & 2,26090 & 2.57853 & 2.93719 & 3.34173 & 3.79750 & 431044 & 4.88711 & 7.07571 \\ \hline 15 & 1.80094 & 2.07893 & 239656 & 2.75903 & 3,17217 & 3.64248 & 4.17725 & 4.78459 & 5.47357 & 8.13706 \\ \hline 16 & 1.87298 & 2,18287 & 2.54035 & 2.95216 & 3.42594 & 3.97031 & 4.59497 & 5.31089 & 6.13039 & 935762 \\ \hline 17 & 1.94790 & 2.29202 & 2.69277 & 3.15882 & 3.70002 & 4.32763 & 5.05447 & 5,89509 & 6.86604 & 10.76126 \\ \hline 18 & 2.02582 & 2,40662 & 2.85434 & 3.37993 & 3.99602 & 4.71712 & 5.55992 & 6.54355 & 7.68997 & 12.37545 \\ \hline 19 & 2.10685 & 2.52695 & 3.02560 & 3.61653 & 4.31570 & 5.14166 & 6.11591 & 7.26334 & 8.61276 & 14.23177 \\ \hline 20 & 2.19112 & 2.65330 & 3.20714 & 386968 & 4.66096 & 5.60441 & 6.72750 & 8.06231 & 9.64629 & 16.36654 \\ \hline \end{tabular} TABLE 2 Future Value of an Annuity of 1 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{c} (n) \\ Payments \\ \end{tabular} & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 15% \\ \hline 1 & 1.00000 & 1.00000 & 1.00000 & 1.0000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 & 1.00000 \\ \hline 2 & 2.04000 & 2.05000 & 2.06000 & 2.0700 & 208000 & 2.09000 & 2.10000 & 2.11000 & 2.12000 & 2.15000 \\ \hline 3 & 3,12160 & 3.15250 & 3,18360 & 3.2149 & 3.24640 & 3.27810 & 3.31000 & 3.34210 & 3.37440 & 3.47250 \\ \hline 4 & 4.24646 & 4.31013 & 4.37462 & 4.4399 & 4.50611 & 457313 & 4.64100 & 4.70973 & 4,77933 & 4.99338 \\ \hline 5 & 5.41632 & 5.52563 & 5.63709 & 5,7507 & 5.86660 & 5.98471 & 6.10510 & 6.22780 & 6.35285 & 6.74238 \\ \hline 6 & 6.63298 & 6.80191 & 6.97532 & \begin{tabular}{l} 7.1533 \\ 8.6540 \end{tabular} & 733592 & 7.52334 & \begin{tabular}{l} 7.71561 \\ 9.48717 \end{tabular} & \begin{tabular}{l} 7.91286 \\ 9.78327 \end{tabular} & 8.11519 & 8.75374 \\ \hline 7 & 7.89829 & 8.14201 & 8.39384 & 8.6540 & 8.92280 & 920044 & \begin{tabular}{r} 9.48717 \\ 11.43589 \end{tabular} & \begin{tabular}{r} 9.78327 \\ 11.85943 \end{tabular} & 10.08901 & 11.06680 \\ \hline 8 & 9.21423 & 9.54911 & 9.89747 & 10.2598 & 10.63663 & 11.02847 & 11.43589 & 11.85943 & 1229969 & 13.72682 \\ \hline 9 & 10.58280 & 11.02656 & 11.49132 & 11.9780 & 12.48756 & 13.02104 & 13.57948 & 14.16397 & \begin{tabular}{l} 14.77566 \\ 1754874 \end{tabular} & \begin{tabular}{l} 16.78584 \\ 2030372 \end{tabular} \\ \hline 10 & 12.00611 & 12.57789 & 13.18079 & 13.8164 & 14.48656 & 15.19293 & 15.93743 & 16.72201 & 17.54874 & 2030372 \\ \hline 11 & 13.48635 & 14.20679 & 14.97164 & 15.7836 & 16.64549 & 17.56029 & 18.53117 & 19.56143 & 20.65458 & 24.34928 \\ \hline 12 & 15.02581 & 15.91713 & 16.86994 & 17,8885 & 18.97713 & 20.14072 & 21.38428 & 22.71319 & \begin{tabular}{l} 24.13313 \\ 28.02911 \end{tabular} & \begin{tabular}{l} 29.00167 \\ 34.35192 \end{tabular} \\ \hline 13 & 16.62684 & 17.71298 & 18.88214 & 20.1406 & 21.49530 & 22.95339 & 24.52271 & 26.21164 & \begin{tabular}{l} 28.02911 \\ 32.39260 \end{tabular} & \begin{tabular}{l} 34.35192 \\ 40.50471 \end{tabular} \\ \hline 14 & 18.29191 & 19.59863 & 21.01507 & 22.5505 & 24.21492 & 26.01919 & \begin{tabular}{l} 27.97498 \\ 31.77248 \end{tabular} & \begin{tabular}{l} 30.09492 \\ 34.40536 \end{tabular} & & \begin{tabular}{l} 40.50471 \\ 47.58041 \end{tabular} \\ \hline 15 & 20.02359 & 2157856 & 23.27597 & 25.1290 & 27.15211 & 29,36092 & \begin{tabular}{l} 31.77248 \\ 35.94973 \end{tabular} & \begin{tabular}{l} 34.40536 \\ 39.18995 \end{tabular} & 42.75328 & 55.71747 \\ \hline 16 & 21.82453 & 23.65749 & \begin{tabular}{l} 25.67253 \\ 2871288 \end{tabular} & \begin{tabular}{l} 27.8881 \\ 30.8402 \end{tabular} & \begin{tabular}{l} 30.32428 \\ 33.75023 \end{tabular} & \begin{tabular}{l} 33.00340 \\ 36.97351 \end{tabular} & \begin{tabular}{l} 35.94973 \\ 40.54470 \end{tabular} & \begin{tabular}{l} 39.18495 \\ 44.50084 \end{tabular} & 48.88367 & 65.07509 \\ \hline 17 & 23.69751 & 25.84037 & \begin{tabular}{l} 28.21288 \\ 30.90565 \end{tabular} & \begin{tabular}{l} 30.8402 \\ 33.9990 \end{tabular} & \begin{tabular}{l} 33.75023 \\ 37.45024 \end{tabular} & 41.30134 & 45.59917 & 50.39593 & 55,74972 & 75.83636 \\ \hline 18 & 25.64541 & 28.13238 & \begin{tabular}{l} 30.90565 \\ 33.75999 \end{tabular} & 37.3790 & 41.44626 & 46.01846 & 51,15909 & 56.93949 & 63,43968 & 88.21181 \\ \hline \begin{tabular}{l} 19 \\ 20 \end{tabular} & \begin{tabular}{l} 27.67123 \\ 29,77808 \end{tabular} & \begin{tabular}{l} 30.53900 \\ 33.06595 \end{tabular} & \begin{tabular}{l} 33.75999 \\ 36.78559 \end{tabular} & 40.9955 & 45.76196 & 51.16012 & 57.27500 & 64.20283 & 72.05244 & 102.44358 \\ \hline \end{tabular} TABLE 3 Present Value of 1 TABLE 4 Present Value of an Annuity of 1 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{c} (n) \\ Payments \\ \end{tabular} & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 15% \\ \hline 1 & .96154 & 95238 & 94340 & 0.93458 & .92593 & 91743 & 90909 & 90090 & 89286 & 86957 \\ \hline 2 & 1.88609 & 1.85941 & 1.83339 & 1. 80502 & 1.78326 & 1.75911 & 1,73554 & 1.71252 & 1.69005 & 1.62571 \\ \hline 3 & 2.77509 & 2.72325 & 2,67301 & 2.62432 & 2.57710 & 253130 & 2.48685 & 244371 & 2.40183 & 228323 \\ \hline 4 & 3.62990 & 3.54595 & 3.46511 & 3,38721 & 3.31213 & 3.23972 & 3.16936 & 3.10245 & 3.03735 & 285498 \\ \hline 5 & 4.45182 & 4.32948 & 421236 & 4.10020 & 3.99271 & 3.88965 & 3.79079 & 3.69590 & 3.60478 & 3.35216 \\ \hline 6 & 5.24214 & 5.07569 & 4.91732 & 4.76654 & 4.62288 & 4.48592 & 435526 & 4.23054 & 4.11141 & 3.78448 \\ \hline 7 & 6.00205 & 5.78637 & 5.58238 & 538929 & 5.20637 & 5.03295 & 4.86842 & 4.71220 & 456376 & 4.16012 \\ \hline 8 & 6.73274 & 6.46321 & 6.20979 & 597130 & 5.74664 & 5,53482 & 533493 & 5.14612 & 4.96764 & 4.48732 \\ \hline 9 & 7.43533 & 7.10782 & 6.80169 & 6.51523 & 624689 & 5.99525 & 5.75902 & 5.53705 & 5.32825 & 4.77158 \\ \hline 10 & 8.11090 & 7.72173 & 7.36009 & 7,02358 & 6.71008 & 6.41766 & 6.14457 & 588923 & 5.65022 & 5.01877 \\ \hline 11 & 8,76048 & 830641 & 7.88687 & 7,49867 & 7.13896 & 6.80519 & & 6.20652 & \begin{tabular}{l} 5.93770 \\ 6.19437 \end{tabular} & \begin{tabular}{l} 523371 \\ 542062 \end{tabular} \\ \hline 12 & 9.38507 & 8.86325 & 8.38384 & 7.94269 & 7.53608 & \begin{tabular}{l} 7.16073 \\ 7.48690 \end{tabular} & \begin{tabular}{l} 6.81369 \\ 7.10336 \end{tabular} & \begin{tabular}{l} 6.49236 \\ 6.74987 \end{tabular} & 6.42355 & \begin{tabular}{l} 542062 \\ 5.53315 \end{tabular} \\ \hline 13 & 9.98565 & 9.39357 & 8.85268 & 835765 & \begin{tabular}{l} 7.90378 \\ 82+424 \end{tabular} & \begin{tabular}{l} 7.48690 \\ 7,78615 \end{tabular} & 7.36669 & 6.98187 & 662817 & 5.72448 \\ \hline 14 & 10.56312 & \begin{tabular}{r} 9.89864 \\ 1037966 \end{tabular} & \begin{tabular}{l} 9.29498 \\ 9.71225 \end{tabular} & \begin{tabular}{l} 8.74547 \\ 9.10791 \end{tabular} & \begin{tabular}{l} 8.2+424 \\ 8.55948 \end{tabular} & 8.06069 & 7.60608 & 7.19087 & 681086 & 5.84737 \\ \hline 15 & 11.11839 & \begin{tabular}{l} 1037966 \\ 10.83777 \end{tabular} & \begin{tabular}{r} 9.71225 \\ 10.10590 \end{tabular} & 9,44665 & 8.85137 & 8.31256 & 7.82371 & 737916 & 6.97399 & 5.95424 \\ \hline 16 & 11.65230 & \begin{tabular}{l} 10.83777 \\ 11.27407 \end{tabular} & \begin{tabular}{l} 10.10590 \\ 10.47726 \end{tabular} & 9.76322 & 9.12164 & 854363 & 8.02155 & 754879 & 7.11963 & 604716 \\ \hline 17 & \begin{tabular}{l} 12.16567 \\ 12.65930 \end{tabular} & \begin{tabular}{l} 11.27407 \\ 11.68959 \end{tabular} & 10.82760 & 10.05909 & 9.37189 & 8.75563 & 8.20141 & 7.70162 & 7.24967 & 6.12797 \\ \hline 18 & \begin{tabular}{l} 12.65930 \\ 13.13394 \end{tabular} & \begin{tabular}{l} 11.65959 \\ 12.08532 \end{tabular} & 11.15812 & 1033560 & 9.60360 & 8.95012 & 8.36492 & 7.83929 & 7,36578 & 6.19823 \\ \hline 19 & \begin{tabular}{l} 13.13394 \\ 13.59033 \end{tabular} & \begin{tabular}{l} 12.08532 \\ 12.46221 \end{tabular} & 11.46992 & 1059401 & 9.81815 & 9.12855 & 851356 & 7,96333 & 7.46944 & 625933 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started