Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ASAP WILL RATE!!! ALL 3 QS ARE RELATED Question 12 1 pts The following information applies to the next three questions (12- 14)

PLEASE ANSWER ASAP WILL RATE!!! ALL 3 QS ARE RELATED

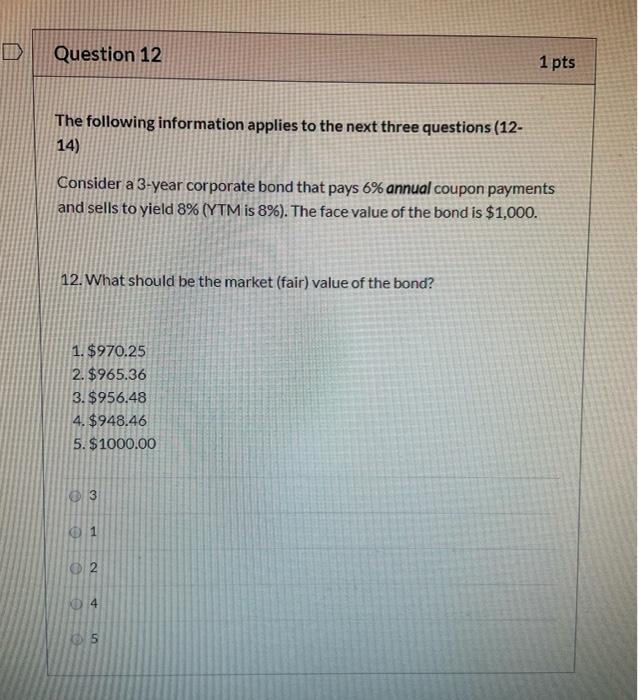

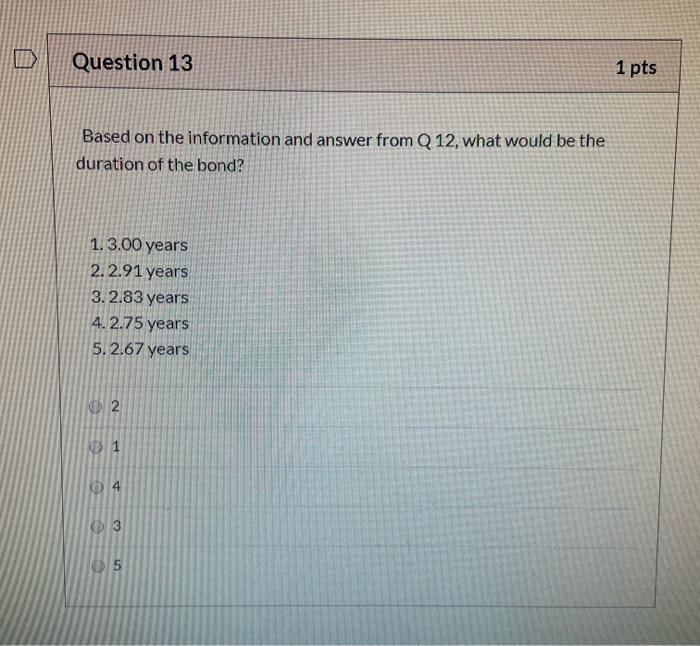

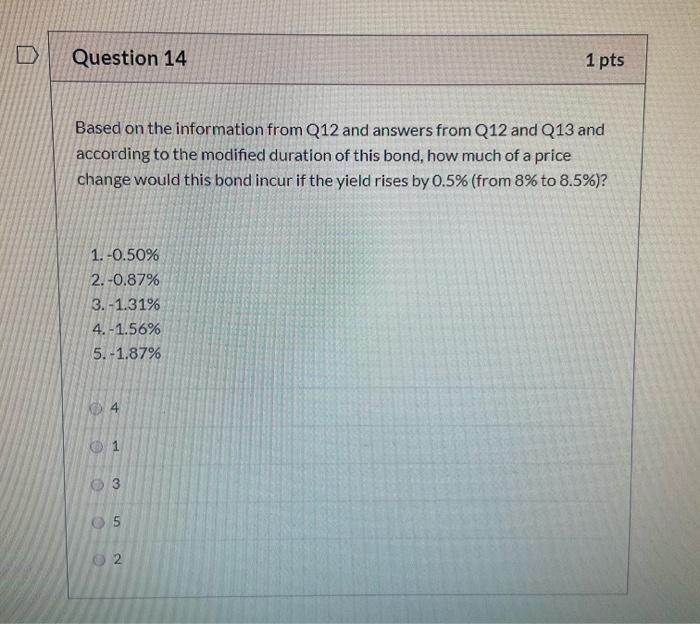

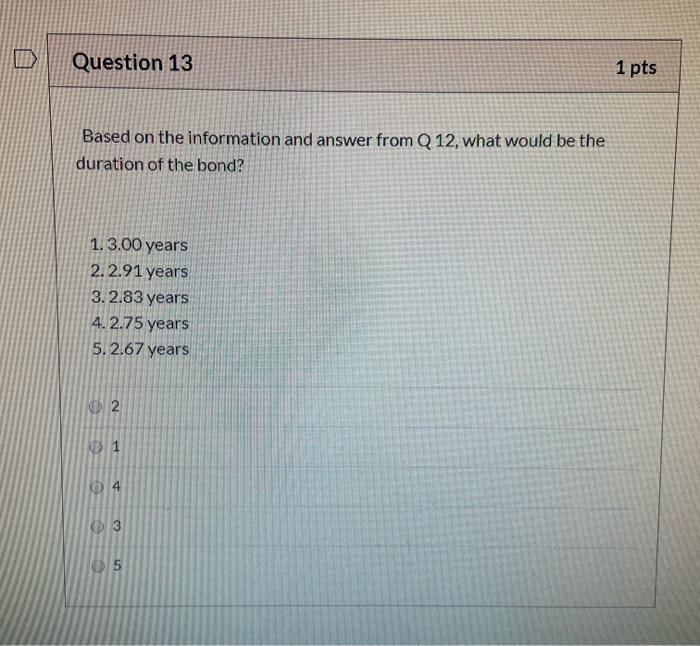

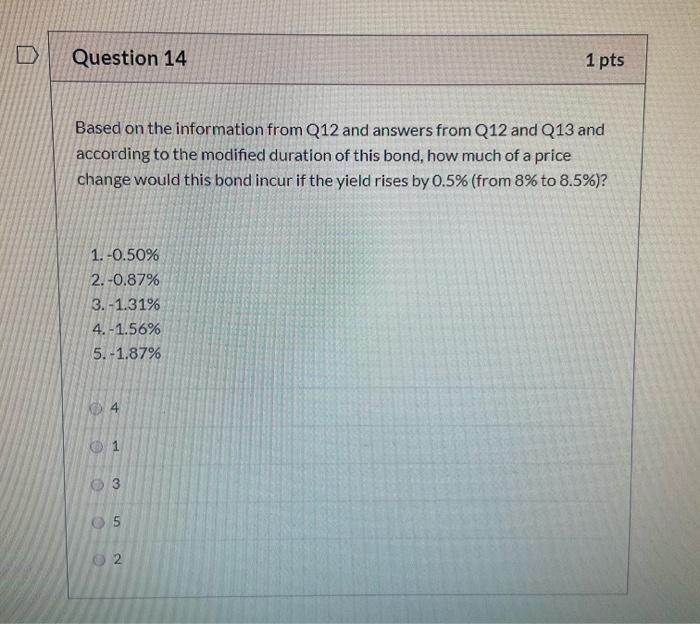

Question 12 1 pts The following information applies to the next three questions (12- 14) Consider a 3-year corporate bond that pays 6% annual coupon payments and sells to yield 8% (YTM is 8%). The face value of the bond is $1,000. 12. What should be the market (fair) value of the bond? 1. $970.25 2. $965.36 3. $956.48 4. $948.46 5.$1000.00 3 1 2 4 5 Question 13 1 pts Based on the information and answer from Q 12, what would be the duration of the bond? 1.3.00 years 2.2.91 years 3.2.83 years 4.2.75 years 5.2.67 years 2 0 1 4 5 Question 14 1 pts Based on the information from Q12 and answers from Q12 and Q13 and according to the modified duration of this bond, how much of a price change would this bond incur if the yield rises by 0.5% (from 8% to 8.5%)? 1.-0.50% 2.-0.87% 3. -1.31% 4.-1.56% 5.-1.87% 1 5 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started