Answered step by step

Verified Expert Solution

Question

1 Approved Answer

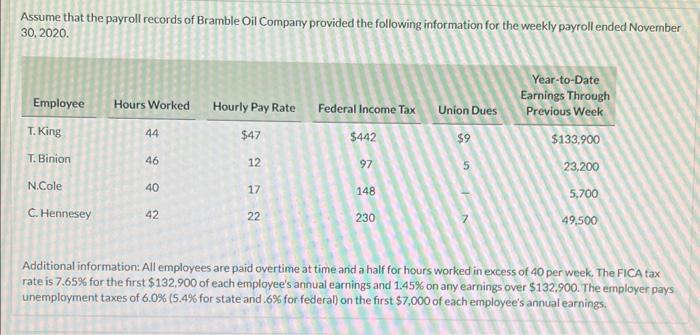

please answer. Assume that the payroll records of Bramble Oil Company provided the following information for the weekly payroll ended November 30, 2020. Employee T.

please answer.

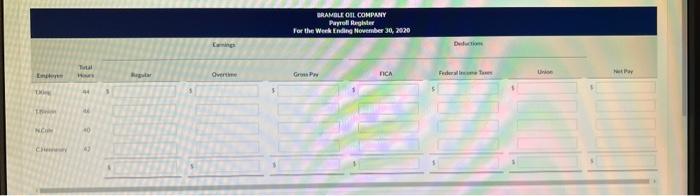

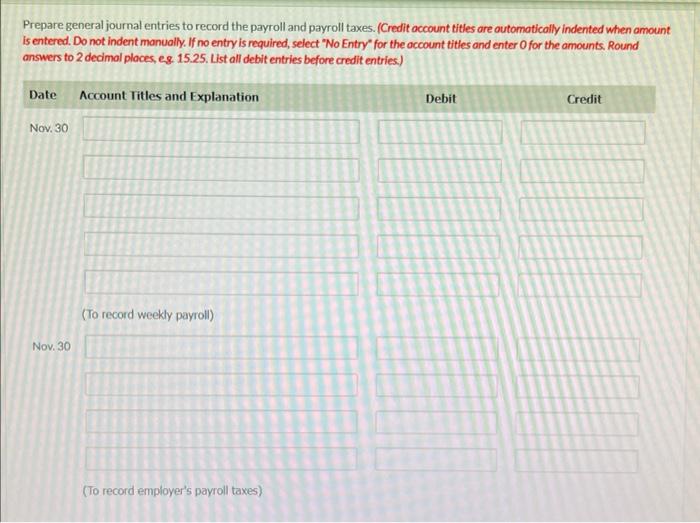

Assume that the payroll records of Bramble Oil Company provided the following information for the weekly payroll ended November 30, 2020. Employee T. King T. Binion N.Cole C. Hennesey Hours Worked 44 46 40 42 Hourly Pay Rate $47 12 17 22 Federal Income Tax $442 97 148 230 Union Dues $9 5 Year-to-Date Earnings Through Previous Week $133.900 23,200 5,700 49,500 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $132,900 of each employee's annual earnings and 1.45% on any earnings over $132.900. The employer pays unemployment taxes of 6.0 % (5.4% for state and .6% for federal) on the first $7,000 of each employee's annual earnings. Englene DON NOM Chane Tual Har 44 44 40 42 Regular Lenings BRAMBLE OIL COMPANY Payroll Register For the Week Ending November 30, 2020 Gro P FICA NENEN Deduction Federal Tax Union NetPay Prepare general journal entries to record the payroll and payroll taxes. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts. Round answers to 2 decimal places, eg 15.25. List all debit entries before credit entries.) Date Account Titles and Explanation Nov. 30 Nov. 30 (To record weekly payroll) (To record employer's payroll taxes) Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started