Question: Please answer B & C! C. Eastwood, A. North, and M. West are manufacturers' representatives in the architecture business. Their capital accounts in the ENW

Please answer B & C!

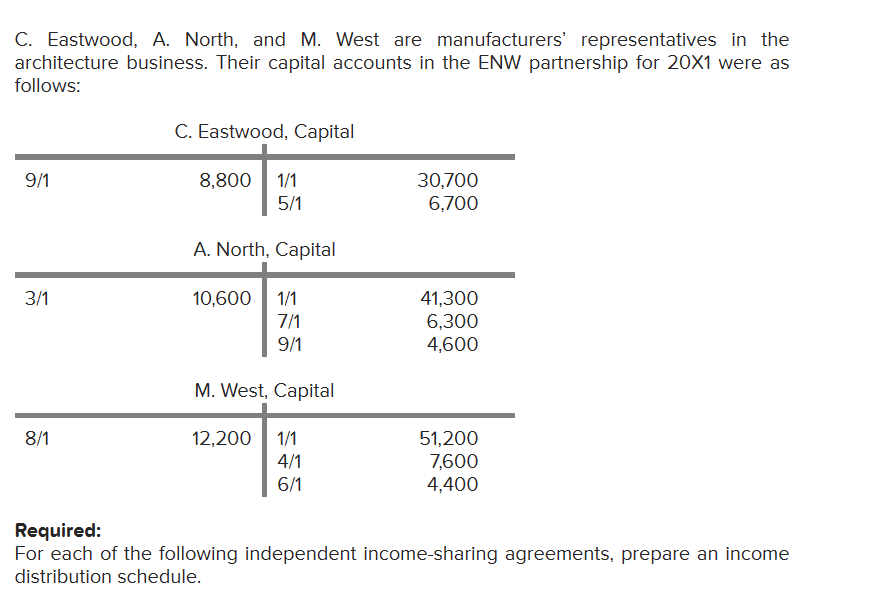

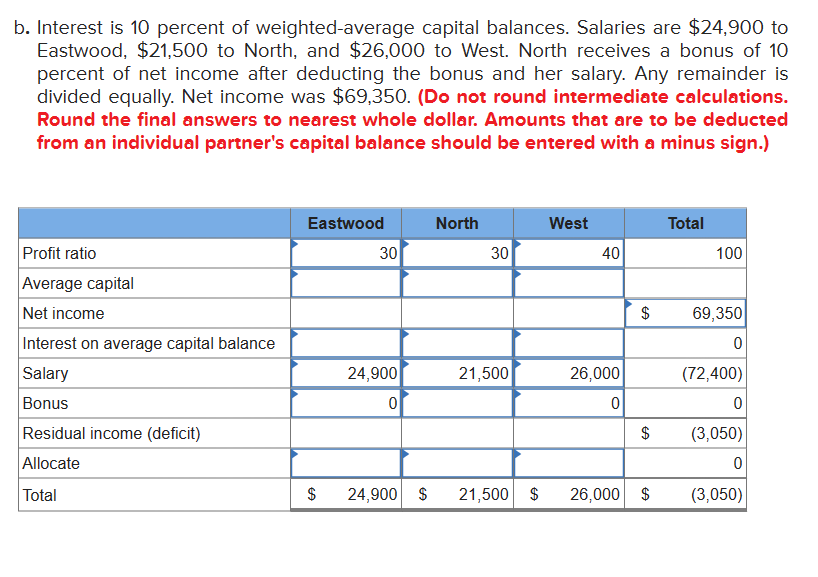

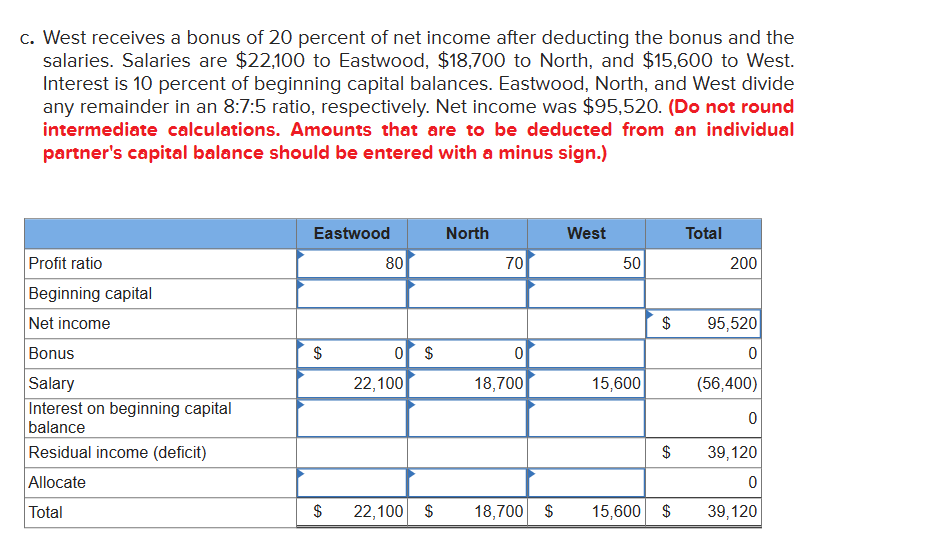

C. Eastwood, A. North, and M. West are manufacturers' representatives in the architecture business. Their capital accounts in the ENW partnership for 201 were as follows: Required: For each of the following independent income-sharing agreements, prepare an income distribution schedule. b. Interest is 10 percent of weighted-average capital balances. Salaries are $24,900 to Eastwood, $21,500 to North, and $26,000 to West. North receives a bonus of 10 percent of net income after deducting the bonus and her salary. Any remainder is divided equally. Net income was $69,350. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.) c. West receives a bonus of 20 percent of net income after deducting the bonus and the salaries. Salaries are $22,100 to Eastwood, $18,700 to North, and $15,600 to West. Interest is 10 percent of beginning capital balances. Eastwood, North, and West divide any remainder in an 8:7:5 ratio, respectively. Net income was \$95,520. (Do not round intermediate calculations. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts