Question: Please answer below with elaborative justification from the attached cases below: What is similar and different about the two case companies? How important is the

Please answer below with elaborative justification from the attached cases below:

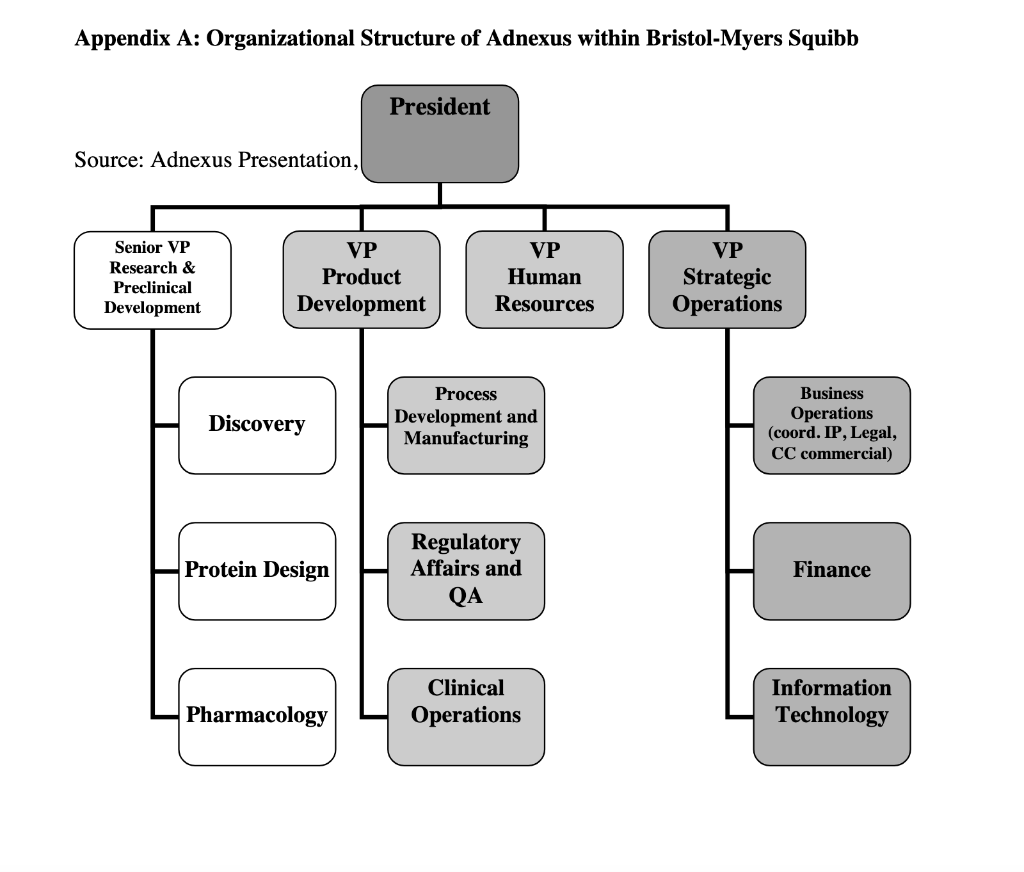

What is similar and different about the two case companies?

How important is the ProFusion platform to Adnexus?

Should Agiltron add a customer facing element to their process?

Would both of these firms benefit from an agile process such as Scrum?

Adnexus: Strategic and Resource Considerations When

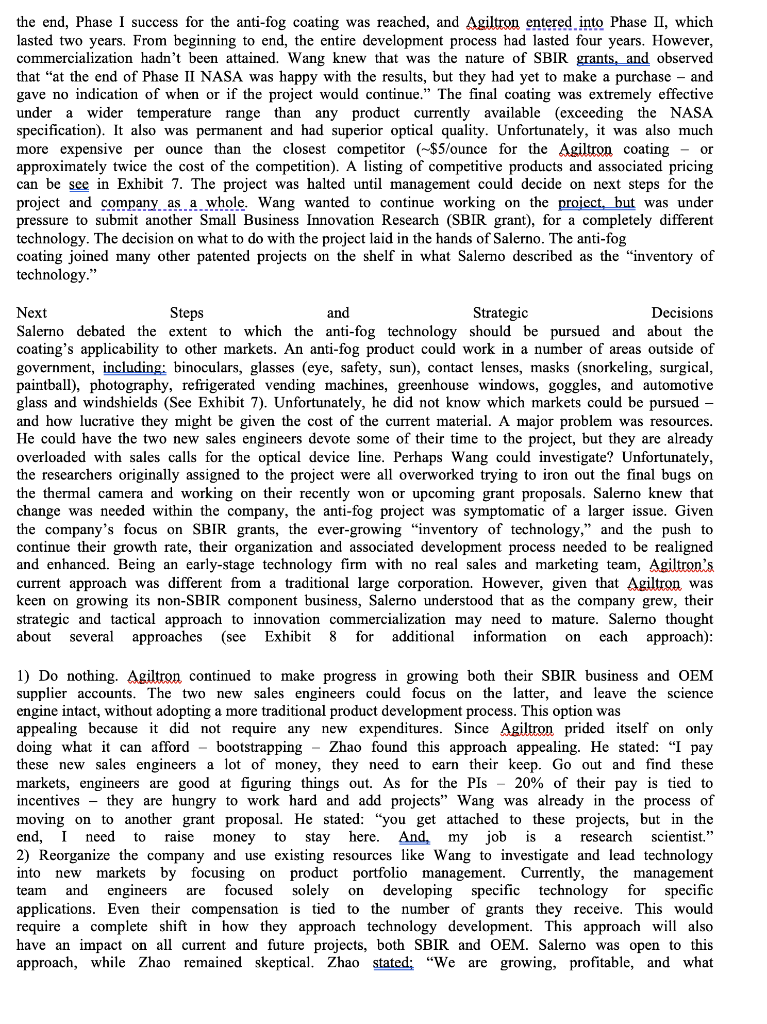

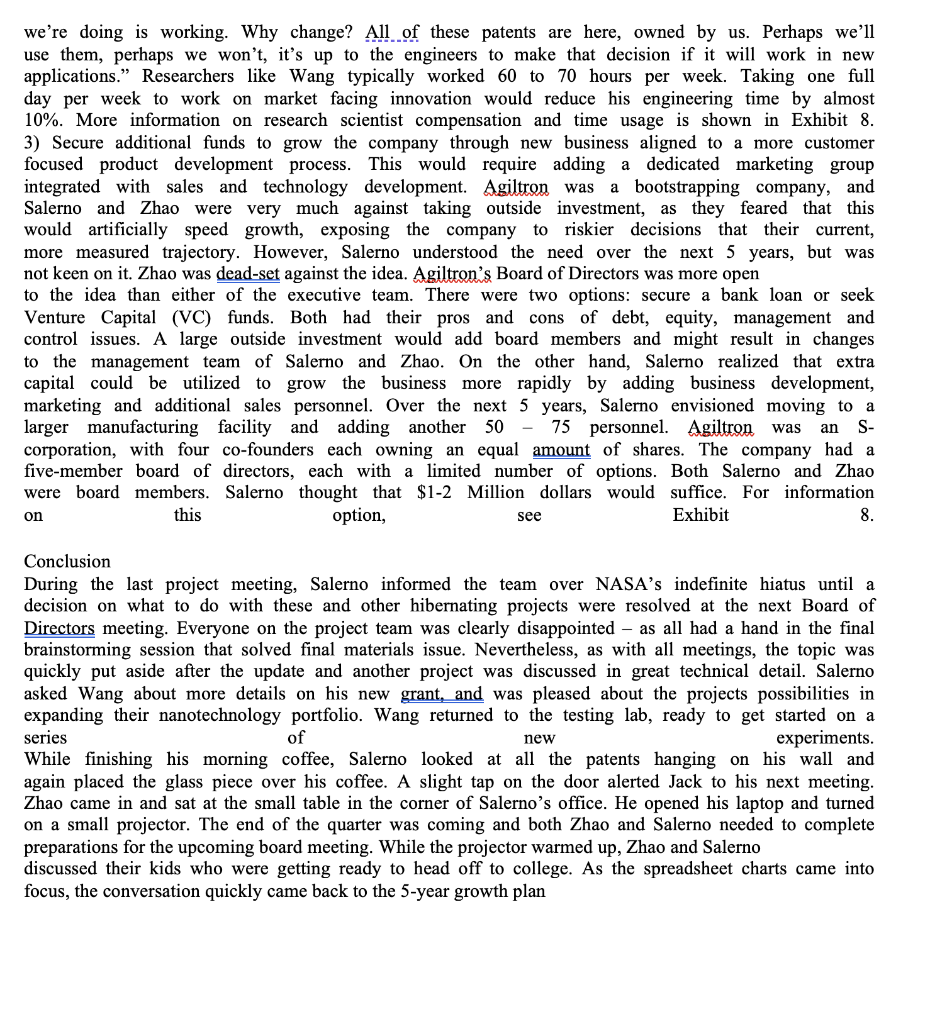

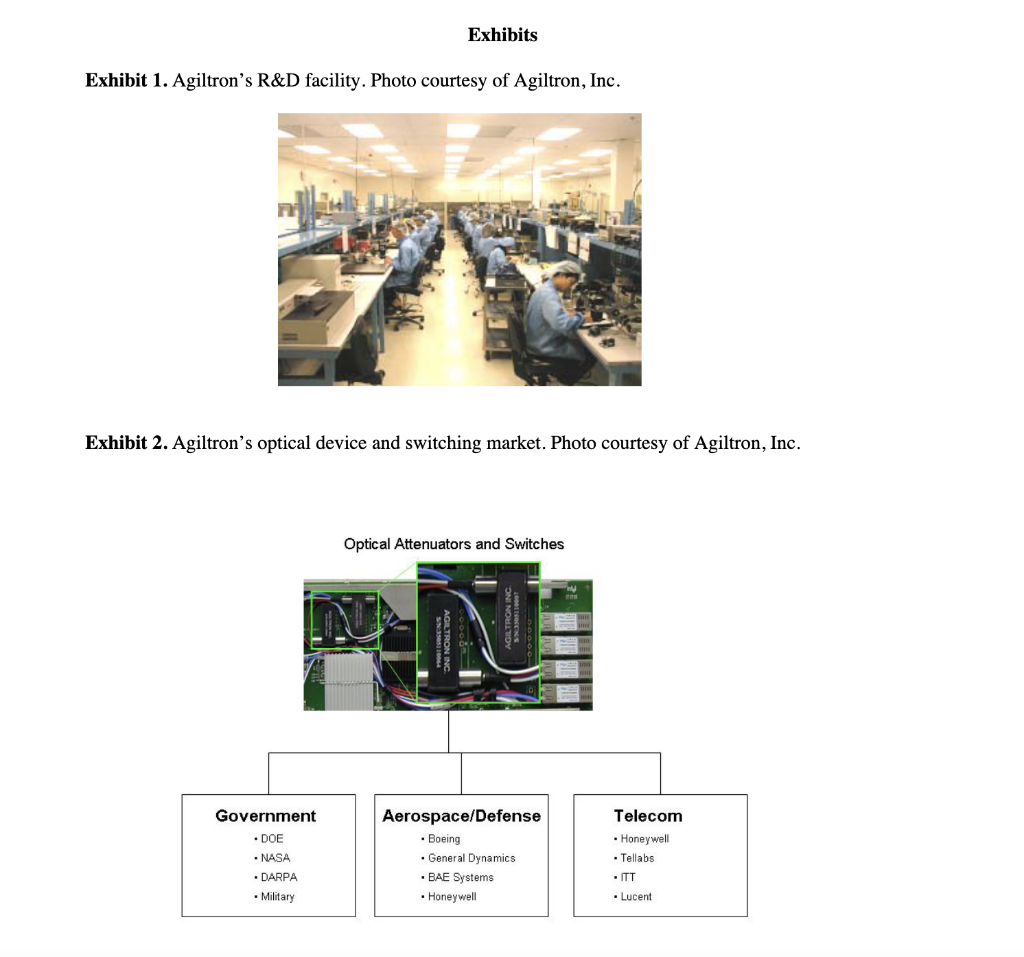

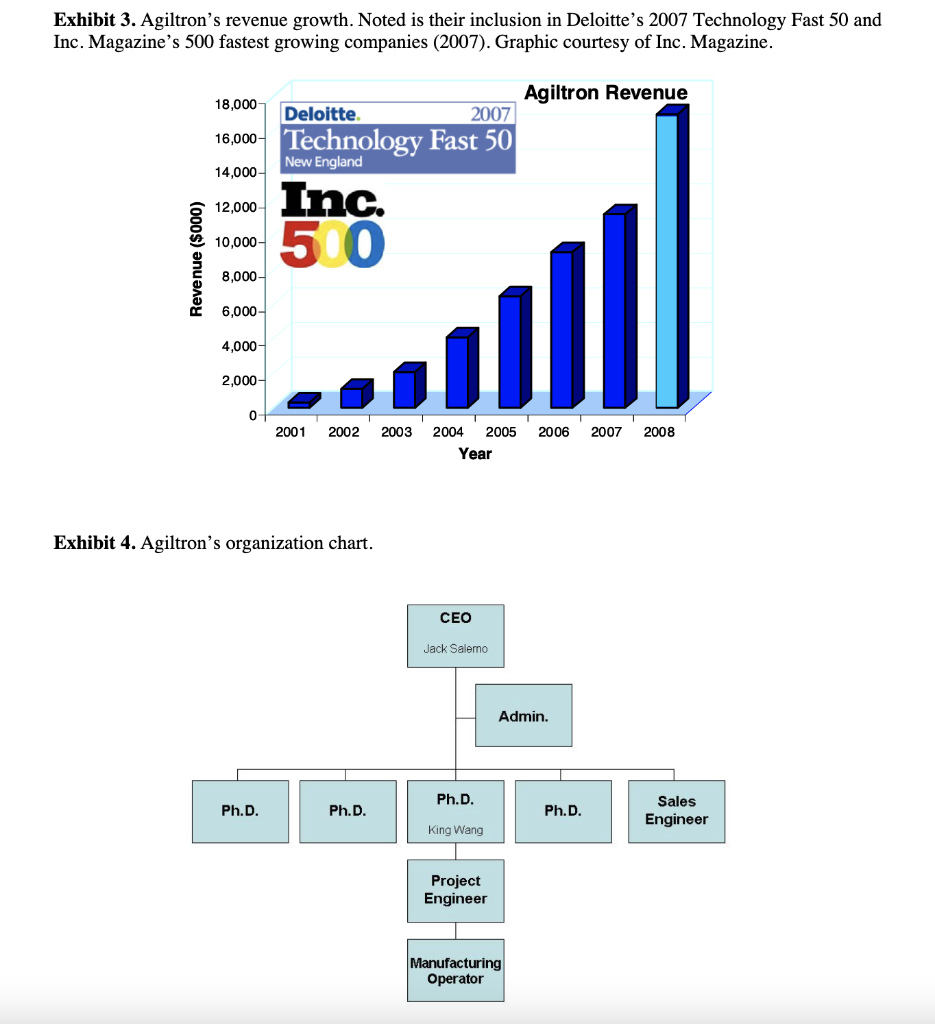

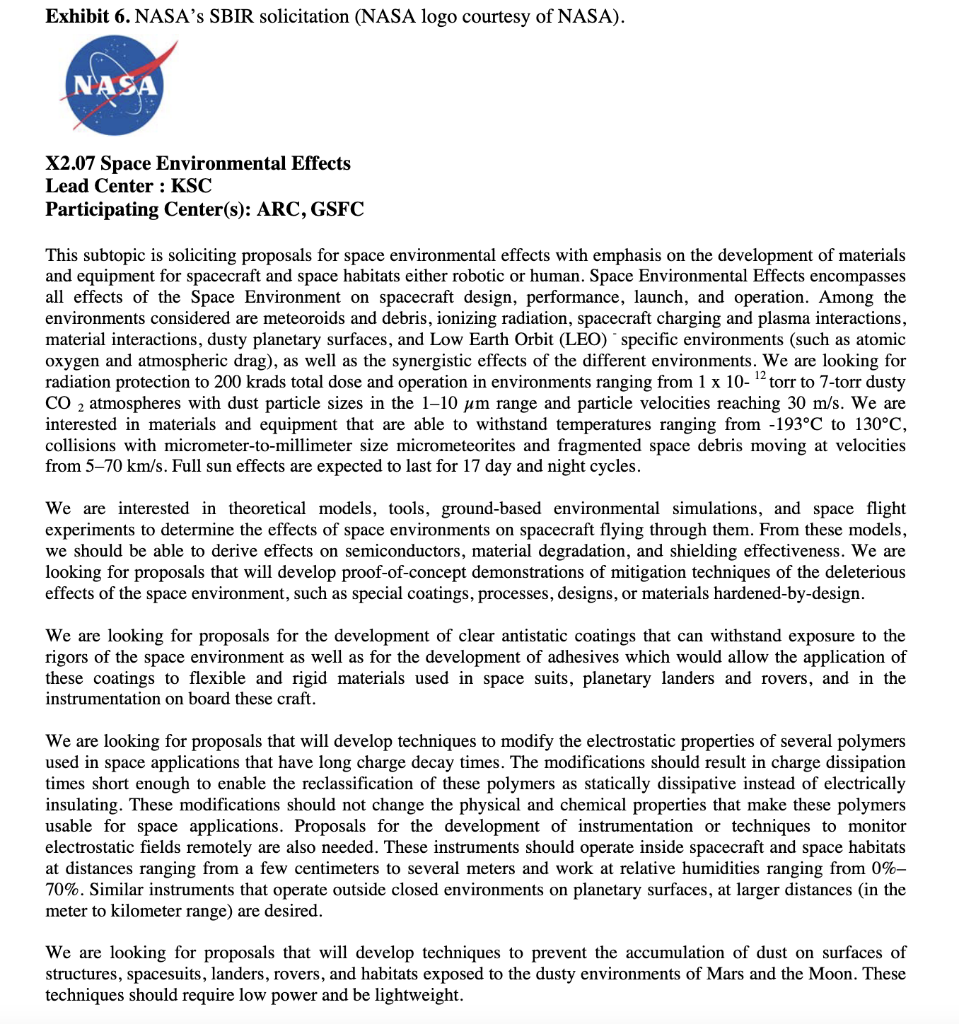

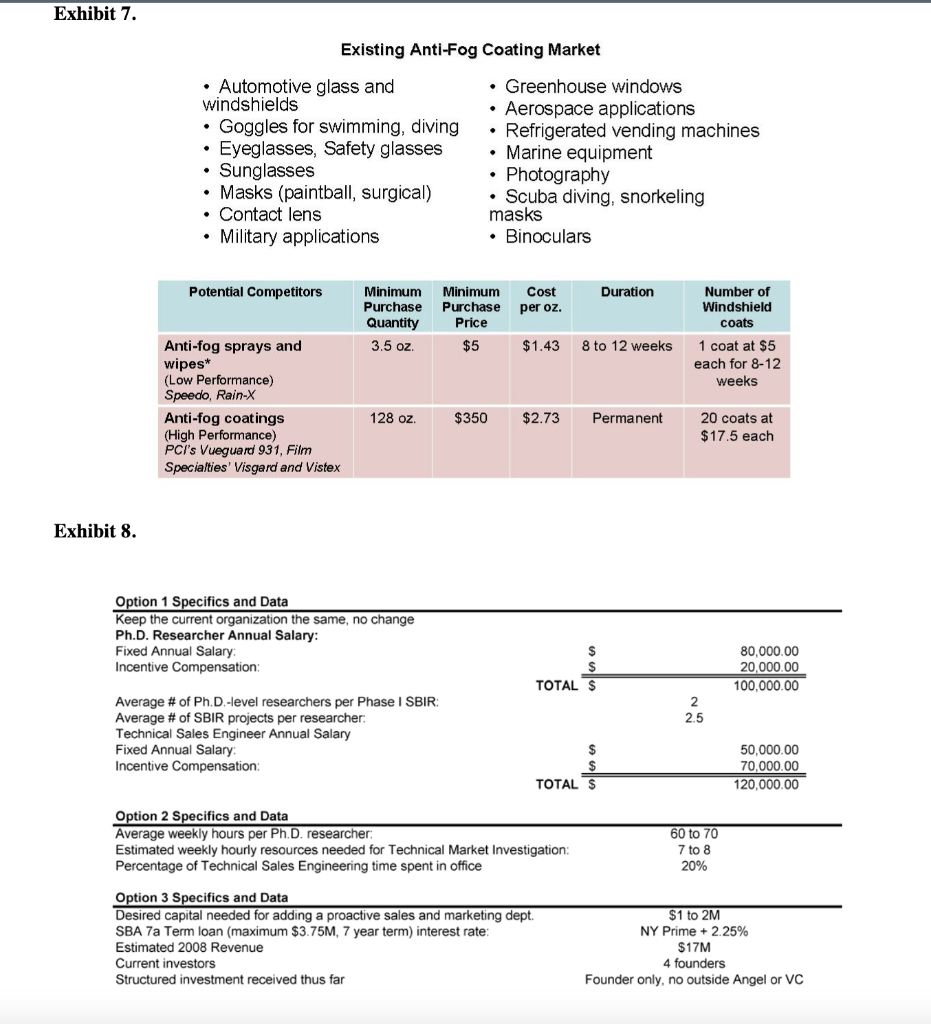

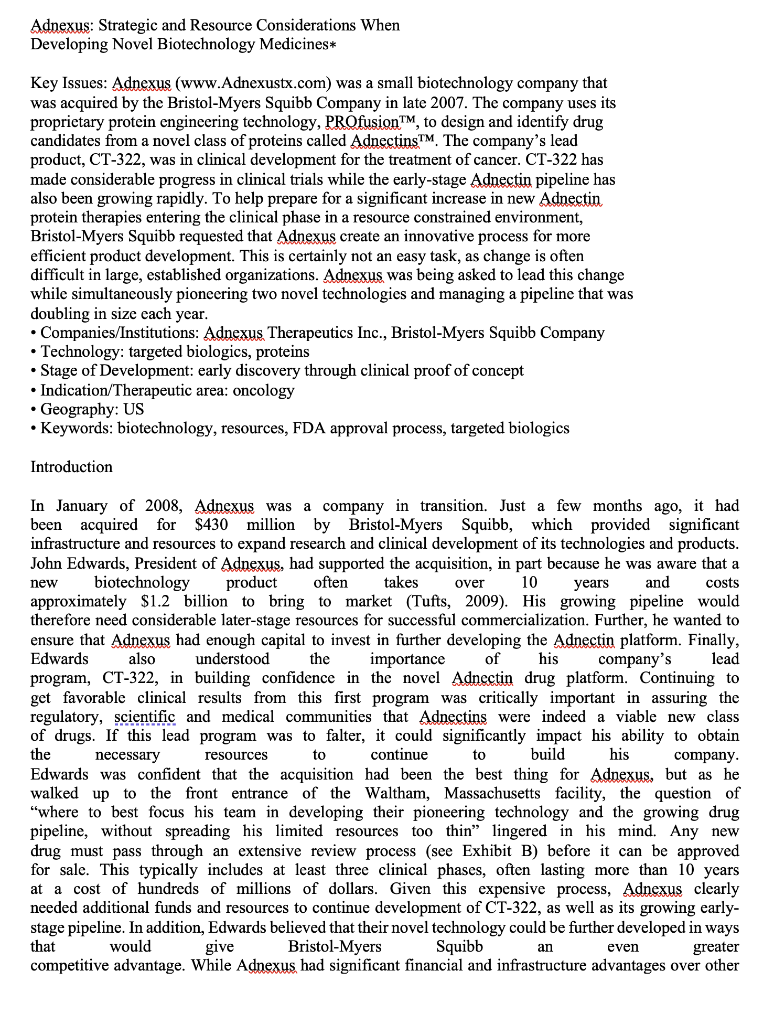

Agiltron Incorporated: Company Growth and Challenges in New Product Development Abstract Agiltron Incorporated is an early-stage company focused on innovation in optics and nano materials. The company is a self-described 'internal university' comprised of Ph.D-level scientists. While rapidly growing, approximately half of Agiltron's revenue is tied to government SBIR grants, which result in specific technological applications that may not have immediate market viability. Development of one of these technologies is described. The case illustrates: 1) the distinct challenges of new product development and commercialization within technology-driven early-stage firms, and 2) how firms must modify and enhance their process and organization as they mature and shift from pure technology-push to market-driven innovation. Introduction Dr. Jack Salerno, Agiltron Inc. co-founder and President had arrived early in the morning to start preparing for an important quarterly meeting with Agiltron's board of directors. Salerno stared at a small piece nano-material coated glass that sat on his desk. He placed the glass over his steaming coffee. The glass remained completely clear - no condensation appeared. This patented anti-fog technology was developed for NASA, who decided to stop further work on the project after two successful funding phases. Just as he entered into deep thought about the company's future, lead research scientist on the coating project, Dr. King Wang, entered his office and notified Salerno that they just secured another Small Business Innovation Research (SBIR) Phase I grant, unrelated to any of their existing nano-coating technology. Salerno looked up and said to Wang, "congrats Wang, looks like you're going to have a good bonus this year." A percentage of Wang's annual salary was tied to winning grant money. Agiltron Inc., one of Inc Magazines 500 fastest growing companies for 2007, sought to grow revenue by increasing sales of products and systems. Further complicating the issue for Agiltron was the economic and political uncertainty of one of their major sources of revenue, government grants, specifically SBIR grants, which accounted for approximately half of Agiltron's revenue. Salerno, a former research scientist, was tasked with operations management of the organization, which had grown to over 50 employees. He had to decide whether to commit resources to the anti-fog coating project or put it 'on-the-shelf' with dozens of other projects and technologies that had yet to find a commercial application. Agittron lacked a sales and marketing department, and were hesitant to add one. Under the leadership of CEO and co-founder Dr. Jing Zhao, Agiltron profitably grew steadily, and organically. Zhao was a firm believer in bootstrapping, and operating in a very lean fashion. Zhao began the company with SBIR grant funding which led to contracts with telecommunications firms. Agiltron had eschewed venture capital financing and prided themselves on their ability to self-fund growth. Adding human resources like sales personnel ran counter to this ethos. Yet Salerno knew something had to change, the anti-fog coating was but one of several technologies that were inactive after successfully completing SBIR grant phases. Salerno had three choices: 1) do nothing and allow the project to go dormant and commit Wang to another, new SBIR project, 2) reorganize the company to allow Wang to continue on the project and perform some non-core competency business development tasks in addition to engineering, or 3) raise capital and add marketing and sales personnel to explore opportunities for this technology and others in their patent portfolio. Company Overview Agiltron, founded in 2001, was a Woburn, Massachusetts-based private company specializing in three areas: telecommunications components, thermal imaging, and functional materialsano-coatings. Although some of the company's 50 employees worked in sales offices located in California, China, Japan, and Europe, and some subcontracting took place overseas, the maiority of the employees were located at its Woburn facilities, which included a 16,000 square foot R\&D and manufacturing facility and a 10,000 square foot engineering center (Exhibit 1). The R\&D facility was a state-of-the-art US photonic design and manufacturing center, and allowed the company to volume-produce photonic components for industries that included data communications, telecommunications, aerospace, instrumentation, and R\&D. The company's business model was summarized by Salerno, Agiltron's president, as an "internal university." Salerno stated that the company's 30 PhDs "are hired and are required to support themselves. They go after SBIR funds and hope to translate that research into a viable technology on the market." The SBIR program is a government sponsored grant initiative to foster the development and commercialization of new technologies, often leading-edge technologies that are spin-offs of basic research and have military or other high-technology applications. Salerno stated Agiltron's mission: "We are adept at developing and transitioning technology to manufacture and sell products. As such, we are vertically integrated, continually invest in ourselves, and believe that manufacturing processes are core to who we are." In addition to their U.S. facility, Agiltron operated a Chinese facility for more standard components. Their corporate mission was: MARKET Agiltron develops and manufactures optical devices that expand human and machine communications and sensing capabilities. DEVELOP. Through continued optical technology innovations, Agiltron maintains differentiated advantages against price erosion as market volumes increase. MANUFACTURE Through extensive manufacturing technology development, Agiltron implements better ways to make products and increase its market share. Agiltron's 2007 revenue reached $13 million, with approximately half coming from grants, and the other half coming from the sale of telecommunications related products and services. Customers for their products and services included large Tier 1 suppliers and original equipment manufacturer (OEM) firms in military, computer, and the telecom industry. The company's reliance on grant-based funding attracted experienced and accomplished outside scientists, including Wang, whose background involved materials science and engineering. As Wang noted: "I wanted to have a direct impact on seeing my research turned into real-world application. I wanted to focus on research, not publications like you do in academia. I love being in the lab." The scientists worked within Agiltron's three areas of specialization: Telecommunications Components Agiltron's first area of specialization involved selling a range of fiberoptic components. These components provided the benefits of faster speed, lower loss, higher reliability, wider spectrum, and higher power handlings in data communication. The company produced fiber optic switches, which were necessary in managing incoming and outgoing signals within an optical system. These devices drove current sales, and were broken-out into three groups including the U.S. Government, aerospace and defense contractors, and telecommunication suppliers and OEMs (see Exhibit 2). This area was the most mature of Agiltron's core, with the greatest portion of internal research reaching the point of commercialization. Thermal Agiltron's second area of specialization involved the production of a new class of ambient operation thermal cameras, which, using its patented LightLever TM sensor, passively converted infrared radiation into visible images that could be viewed by a mobile phone's camera. The camera was a lowpower, low-cost, high-speed, and high-sensitivity device, with potential applications ranging from the military, to first responders and firefighters, to energy auditing. Salerno believed this "could be a disruptive technology. We believe bould big." Nano-Coatings Agilitron's third, and least mature specialty was in producing nanotechnology material coatings. Nanotechnology is the development of materials and engineered applications that have feature sizes measured in nanometers, or one billionth of a meter. Current applications include materials like powders and coatings, and biotechnology applications. Agiltron's patent-pending NanoPaint TM technology was a coating that could be applied to a range of materials, including plastic and glass, of all shapes and sizes. The technology was based on the proposition of superior optical clarity, adhesion, and scratch resistance, and could withstand very high operating temperatures. There was broad potential applicability, ranging from electrostatic discharge (ESD) coating to radiation shielding. Salerno described the company's entry into nano-coatings: "Management had the initial idea to go after nano coatings. Wang was brought on to focus in that area. He started investigating open grant proposals and decided to go after a NASA anti-fog request." Wang came on board as with all of the Agiltron scientists, with a clear direction to self-fund in core areas of research but also have the ability to pivot and take on other, interesting projects. Wang was excited to work on a proposal for NASA. As a Ph.D. student, Wang's advisors had worked on a number.of projects for NASA and the Johnson Propulsion Lab. As a result, Wang considered himself "very plugged into NASA," and that led to him applying for an SBIR grant to develop an anti-fog nano-coating. Agriltron grew rapidly, with projected revenue of over \$17 Million in CY2008 (see Exhibit 3). While growth was important to the management team, the company remained very conscious of its bootstrapping nature. Founded by four individuals, they had never taken a large, structured equity investment and shied away from Venture Capital (VC) involvement. According to Salerno, "we like to incrementally add value to the company - we are very adept at bootstapping," Bootstrapping can be defined as a situation in which an entrepreneur starts a company with little capital. An individual is said to be bootstrapping when he or she attempts to found and build a company from personal finances or from the operating revenues of the new company. In the case of Agiltron, they only expand when they can afford, through income of government grants. As evidence of their bootstrapping mentality, Salerno noted: "we are experts at scavenging equipment through liquidation sales and on eBay. We pick up equipment at 20 cents on the dollar. It's in our blood here, and we only do what we can afford." At the time of the case, Agiltron was quickly moving from being a small (typically those firms with fewer than 100 employees), early-stage technology firm to a successful medium-sized company. But Salerno recognized a potential issue in the coming years: "At some point, we may have the need to have access to funds other than what is in the bank or line of credit. But Zhao doesn't like debt." Zhao added: "We do just fine. The last thing I want to do is answer to investors and new board members. If we can't afford it, we don't do it." The Private University: Agiltron's Focus on Small Business Innovation Research (SBIR) Grants A core of Agiltron's revenue was winning federal grant proposals. There were several programs that fit well within Agiltron's skill set. One of these was the Small Business Innovation Research (SBIR) grants that are administered by the US Small Business Administration (SBA) Office of Technology. With a sister program, the Small Business Technology Transfer (STTR) Program, a combined $2 billion in awards had been distributed to small high-tech businesses since the inception of the program in the early 1980's. SBIR's are grants that "ensure that the nation's small, high-tech, innovative businesses are a significant part of the federal government's research and development efforts." From 2002 to 2006 , approximately 25\% of R\&D Magazine's top 100 annual innovations came from companies that received SBIR grants. Moreover, from 1992 to 2005 , nearly 15,000 different firms received at least one Phase II SBIR award (National Academies, SBIR Archive). Three phases were involved in SBIR grants: - Phase I: Up to $100,000 was awarded to a small business to establish the feasibility of an idea that showed potential commercial applicability. The timetable for Phase I completion was six months. - Phase II: Upon successful Phase I completion, a contract may be awarded for up to $500,000, allowing research and development work to continue. The timetable for Phase II completion was two years. - Phase III: No SBIR funding was offered in this phase, although reaching it means the point of commercialization has been achieved. Private sector or non-SBIR federal funding was relied upon. Agiltron became very proficient at obtaining SBIR grants. King noted: "we have a success percentage of 5060% on Phase I proposals, substantially higher than the average." Salerno stated that "we have all the benefits of a university - good research talent, a knowledge base on how to win grants, a very comprehensive portfolio of intellectual property, and a better entrepreneurial culture than any university. And we don't have the administration and overhead." While Agiltron viewed their SBIR focus as a core competency, there was growing concern at Agiltron of an over reliance on SBIR grants, particularly as the company strategically planned for the next five years. Salerno stated: "SBIR is a good program, it would be a real problem for us if it changed dramatically - but it is changing, leaning more towards fewer, bigger programs." For Agiltron, skilled at winning Phase I and II grants, it meant that this recurring revenue stream might be at risk in the future. Agiltron counted on these grants to pay the bills, and the salaries of their employees. Engineering Driven: Agiltron's Corporate Structure and Processes Agiltron continued to focus on being extremely productive from a technical research perspective - generating new technologies and their associated patents. Though there was inherent risk for basing half of the companies business on government funds, Agiltron continued with aggressive pursuit of SBIR funds. According to Wang, "Agiltron's 30 Ph.D.'s act in many ways similar to professors at large research universities, collaborating with outside faculty members, identifying award solicitations, and putting together proposals that fit within our mission and innate expertise." As such, Agiltron was a very flat organization. Salerno noted "this type of organization structure really suited our needs. We are a task-driven matrix organization, with little hierarchy." An organization chart can be seen in Exhibit 4. Agiltron's number of employees grew steadily since 2001. However, Salerno was quick to point out that each Ph.D. is "required to support themselves through grants. They are free to pursue opportunities, and we give them a bureaucracy-free environment to do that. People are given incentives to be innovative." He added: "We are very conscious to limit hiring. It seems to me that as soon as you hire someone your cost structure goes up. For example, if I hire an on-staff financial officer, the next thing I'll hear about is having to purchase the latest accounting software, and the need for a new bookkeeper... this list goes on and on. It's taken a long time to hire sales people - and good sales people. We tried commission only - it didn't work. Recently we added two salaried sales engineers. Hopefully they will be able to pay for themselves with new, incremental sales revenue." Agiltron had no dedicated product portfolio managers or marketing personnel. Zhao added: "I only hire people that can support themselves. Everyone else is a cost." If an Agiltron Ph.D. identified a government grant solicitation, and submited a proposal and won Phase I, the project was initiated. The grant writer then became the project leader (Principal Investigator, or PI) and identified other resources in the organization to assist with the project. For Phase I projects, there was a PI-level staff meeting run by Salerno to review issues every two weeks. Wang added: "In Phase I, if there was no solution by month 4 , the team tried harder. We worked longer hours. Managing to the critical issues made us more successful, we're very goal orientated and focused. We just worked harder. If there was still no solution by month 5, we brought in management for other opinions and brainstorming sessions. During months 14, we concentrated on science and the experiments. There is lots trial and error." A schematic of their Phase I development process is shown in Exhibit 5. In terms of the product development process, Salerno stated: "we develop very specific technology and expertise. A good product may emerge or it may not. We try to go as far as we can with the technology, some projects like our optics find a market, like telecommunications. We don't follow a formal development process, we follow the SBIR process, which is 6 months for Phase I and 2 years for Phase II. Projects ran on a company basis, driven by issues. We have 6 months to develop a solution, so we talk, meet, and review problems on the project. We don't use tools like Microsoft Project. We run the company to the science and the issues." They viewed their NPD process as lean, flexible, and issues driven. Salerno commented: "we rarely proactively link market application to technology development. We complete the science first." Market Driven: Traditional New Product Deyelopemnt Processes Agiltron's approach was somewhat different from the conventional new product development (NPD) process. Conventional NPD was typically characterized by a process that places heavy emphasis on understanding market and consumer needs up-front. This research was typically completed at the beginning of the development project and once fully vetted, the idea moved into a sequential development process that proceeds with decision points or stage-gates. A generic process is shown below: Figure. 1. Ulrich and Eppinger (2004) NPD process. In established corporations, Cooper (2001, 2005) denoted that companies should focus on two main fundamentals: 1) doing the project right, based on common success factors among successful NPD companies including cross-functional teams, up-front market planning, and early product concept definition; and 2) doing the right projects. Cooper argued that product selection and product planning methodology are essential to a successful product launch and lifecycle. Common wisdom in NPD research and practice is that voice-of-the-customer and market-facing development is a key first step, and technology development begins during system-level design. This is much different than Agiltron's approach, which is driven to specifications outlined in grant proposals. Additionally, Agiltron was most keen on technologies they can manufacture in-house, rather than seeking external input from not only customers but potential vendors. Salerno stated: "we look to commercialize what we are going to make." In the next section, we review an Agiltron SBIR project and the resulting technology application. NASA's Anti-Fog Nano-Coating and Agiltron's Response Wang was excited when he read the NASA solicitation, which called for developing a new coating for spacecraft (see Exhibit 6). Of interest to Wang was this line: We are looking for proposals for the development of clear antistatic coatings that can withstand exposure to the rigors of the space environment as well as for the development of adhesives which would allow the application of these coatings to flexible and rigid materials used in space suits, planetary landers and rovers, and in the instrumentation on board these craft. According to Wang, he knew he could get the funding: "NASA wanted an anti-static, anti-fog coating for the new lunar module. Lunar dust is a problem on the windows of a lunar excursion module (LEM)...I knew I could win the SBIR Phase I. I read the proposal, did some research, and looked for professors at universities to collaborate with. On this project I was co-Principal Investigator (PI) with Professor Michael Rubner, from MIT. We wrote the proposal and submitted it. We heard back from NASA 3-4 months later and received the Phase I grant for $100,000." The Phase I grant provided Wang and his colleagues with a six month timeframe to demonstrate feasibility. Wang said: "We worked hard - on experiments. A lot of exploration of materials. Much of this research would prove useful in the practical world. For the project, the material was new, and the process was new." Despite the hard work, Wang's team faced early challenges and setbacks: "In the beginning the team suffered a lot. The nano material did not work initially. We tried myriads of different processing agents to solve the problem. This was basically trial and error. We went through test results and parameters for six months." Wang recalled: "We essentially were getting nowhere. In the end, we had a brainstorming session with management that helped solve the problem. This occurred at month five of the six month Phase I phase. We achieved it, but for a long time it didn't look promising, no matter how hard we tried." The longer Wang's team spent on the project, the more concerned Zhao became. Zhao stated: "while the nano coating team was funded, there was still the opportunity cost. Four of my employees worked day and night, seven days a week and did not make progress. What other opportunities wissing?" Wang reflected on the past four years. He had joined the company excited about its unique business model that provided him with the opportunity to "make real things" through research grants. In the end, Phase I success for the anti-fog coating was reached, and Agiltron entered into Phase II, which lasted two years. From beginning to end, the entire development process had lasted four years. However, commercialization hadn't been attained. Wang knew that was the nature of SBIR grants, and observed that "at the end of Phase II NASA was happy with the results, but they had yet to make a purchase - and gave no indication of when or if the project would continue." The final coating was extremely effective under a wider temperature range than any product currently available (exceeding the NASA specification). It also was permanent and had superior optical quality. Unfortunately, it was also much more expensive per ounce than the closest competitor ( $5/ ounce for the Agiltron coating or approximately twice the cost of the competition). A listing of competitive products and associated pricing can be see in Exhibit 7. The project was halted until management could decide on next steps for the project and company as a whole. Wang wanted to continue working on the project, but was under pressure to submit another Small Business Innovation Research (SBIR grant), for a completely different technology. The decision on what to do with the project laid in the hands of Salerno. The anti-fog coating joined many other patented projects on the shelf in what Salemo described as the "inventory of technology." Next Steps and Strategic Decisions Salerno debated the extent to which the anti-fog technology should be pursued and about the coating's applicability to other markets. An anti-fog product could work in a number of areas outside of government, including: binoculars, glasses (eye, safety, sun), contact lenses, masks (snorkeling, surgical, paintball), photography, refrigerated vending machines, greenhouse windows, goggles, and automotive glass and windshields (See Exhibit 7). Unfortunately, he did not know which markets could be pursued and how lucrative they might be given the cost of the current material. A major problem was resources. He could have the two new sales engineers devote some of their time to the project, but they are already overloaded with sales calls for the optical device line. Perhaps Wang could investigate? Unfortunately, the researchers originally assigned to the project were all overworked trying to iron out the final bugs on the thermal camera and working on their recently won or upcoming grant proposals. Salerno knew that change was needed within the company, the anti-fog project was symptomatic of a larger issue. Given the company's focus on SBIR grants, the ever-growing "inventory of technology," and the push to continue their growth rate, their organization and associated development process needed to be realigned and enhanced. Being an early-stage technology firm with no real sales and marketing team, Agiltron's current approach was different from a traditional large corporation. However, given that Agiltron was keen on growing its non-SBIR component business, Salerno understood that as the company grew, their strategic and tactical approach to innovation commercialization may need to mature. Salerno thought about several approaches (see Exhibit 8 for additional information on each approach): 1) Do nothing. Agiltron continued to make progress in growing both their SBIR business and OEM supplier accounts. The two new sales engineers could focus on the latter, and leave the science we're doing is working. Why change? All of these patents are here, owned by us. Perhaps we'll use them, perhaps we won't, it's up to the engineers to make that decision if it will work in new applications." Researchers like Wang typically worked 60 to 70 hours per week. Taking one full day per week to work on market facing innovation would reduce his engineering time by almost 10%. More information on research scientist compensation and time usage is shown in Exhibit 8. 3) Secure additional funds to grow the company through new business aligned to a more customer focused product development process. This would require adding a dedicated marketing group integrated with sales and technology development. Agiltron was a bootstrapping company, and Salerno and Zhao were very much against taking outside investment, as they feared that this would artificially speed growth, exposing the company to riskier decisions that their current, more measured trajectory. However, Salerno understood the need over the next 5 years, but was not keen on it. Zhao was dead-set against the idea. Agiltron's Board of Directors was more open to the idea than either of the executive team. There were two options: secure a bank loan or seek Venture Capital (VC) funds. Both had their pros and cons of debt, equity, management and control issues. A large outside investment would add board members and might result in changes to the management team of Salerno and Zhao. On the other hand, Salerno realized that extra capital could be utilized to grow the business more rapidly by adding business development, marketing and additional sales personnel. Over the next 5 years, Salerno envisioned moving to a larger manufacturing facility and adding another 50 - 75 personnel. Agiltron was an Scorporation, with four co-founders each owning an equal amount of shares. The company had a five-member board of directors, each with a limited number of options. Both Salerno and Zhao were board members. Salerno thought that \$1-2 Million dollars would suffice. For information on this option, see Exhibit 8. Exhibit 1. Agiltron's R\&D facility. Photo courtesy of Agiltron, Inc. Exhibit 2. Agiltron's optical device and switching market. Photo courtesy of Agiltron, Inc. Exhibit 3. Agiltron's revenue growth. Noted is their inclusion in Deloitte's 2007 Technology Fast 50 and Inc. Magazine's 500 fastest growing companies (2007). Graphic courtesy of Inc. Magazine. Exhibit 4. Agiltron's organization chart. Exhibit 6. NASA's SBIR solicitation (NASA logo courtesy of NASA). X2.07 Space Environmental Effects Lead Center : KSC Participating Center(s): ARC, GSFC This subtopic is soliciting proposals for space environmental effects with emphasis on the development of materials and equipment for spacecraft and space habitats either robotic or human. Space Environmental Effects encompasses all effects of the Space Environment on spacecraft design, performance, launch, and operation. Among the environments considered are meteoroids and debris, ionizing radiation, spacecraft charging and plasma interactions, material interactions, dusty planetary surfaces, and Low Earth Orbit (LEO) " specific environments (such as atomic oxygen and atmospheric drag), as well as the synergistic effects of the different environments. We are looking for radiation protection to 200krads total dose and operation in environments ranging from 11012 torr to 7 -torr dusty CO2 atmospheres with dust particle sizes in the 110m range and particle velocities reaching 30m/s. We are interested in materials and equipment that are able to withstand temperatures ranging from 193C to 130C, collisions with micrometer-to-millimeter size micrometeorites and fragmented space debris moving at velocities from 5-70 km/s. Full sun effects are expected to last for 17 day and night cycles. We are interested in theoretical models, tools, ground-based environmental simulations, and space flight experiments to determine the effects of space environments on spacecraft flying through them. From these models, we should be able to derive effects on semiconductors, material degradation, and shielding effectiveness. We are looking for proposals that will develop proof-of-concept demonstrations of mitigation techniques of the deleterious effects of the space environment, such as special coatings, processes, designs, or materials hardened-by-design. We are looking for proposals for the development of clear antistatic coatings that can withstand exposure to the rigors of the space environment as well as for the development of adhesives which would allow the application of these coatings to flexible and rigid materials used in space suits, planetary landers and rovers, and in the instrumentation on board these craft. We are looking for proposals that will develop techniques to modify the electrostatic properties of several polymers used in space applications that have long charge decay times. The modifications should result in charge dissipation times short enough to enable the reclassification of these polymers as statically dissipative instead of electrically insulating. These modifications should not change the physical and chemical properties that make these polymers usable for space applications. Proposals for the development of instrumentation or techniques to monitor electrostatic fields remotely are also needed. These instruments should operate inside spacecraft and space habitats at distances ranging from a few centimeters to several meters and work at relative humidities ranging from 0% 70%. Similar instruments that operate outside closed environments on planetary surfaces, at larger distances (in the meter to kilometer range) are desired. We are looking for proposals that will develop techniques to prevent the accumulation of dust on surfaces of structures, spacesuits, landers, rovers, and habitats exposed to the dusty environments of Mars and the Moon. These techniques should require low power and be lightweight. Existing Anti-Fog Coating Market - Automotive glass and - Greenhouse windows windshields - Aerospace applications - Goggles for swimming, diving - Refrigerated vending machines - Eyeglasses, Safety glasses - Marine equipment - Sunglasses - Photography - Masks (paintball, surgical) - Scuba diving, snorkeling - Contact lens masks - Military applications - Binoculars Exhibit 8. Adnexus: Strategic and Resource Considerations When Developing Novel Biotechnology Medicines* Key Issues: Adnexus (www.Adnexustx.com) was a small biotechnology company that was acquired by the Bristol-Myers Squibb Company in late 2007. The company uses its proprietary protein engineering technology, PROfusion TM, to design and identify drug candidates from a novel class of proteins called Adnectins TM. The company's lead product, CT-322, was in clinical development for the treatment of cancer. CT-322 has made considerable progress in clinical trials while the early-stage Adnectin pipeline has also been growing rapidly. To help prepare for a significant increase in new Adnectin protein therapies entering the clinical phase in a resource constrained environment, Bristol-Myers Squibb requested that Adnexus create an innovative process for more efficient product development. This is certainly not an easy task, as change is often difficult in large, established organizations. Adnexus was being asked to lead this change while simultaneously pioneering two novel technologies and managing a pipeline that was doubling in size each year. - Companies/Institutions: Adnexus Therapeutics Inc., Bristol-Myers Squibb Company - Technology: targeted biologics, proteins - Stage of Development: early discovery through clinical proof of concept - Indication/Therapeutic area: oncology - Geography: US - Keywords: biotechnology, resources, FDA approval process, targeted biologics Introduction In January of 2008, Adnexus was a company in transition. Just a few months ago, it had been acquired for $430 million by Bristol-Myers Squibb, which provided significant infrastructure and resources to expand research and clinical development of its technologies and products. John Edwards, President of Adnexus, had supported the acquisition, in part because he was aware that a new biotechnology product often takes over 10 years and costs approximately $1.2 billion to bring to market (Tufts, 2009). His growing pipeline would therefore need considerable later-stage resources for successful commercialization. Further, he wanted to ensure that Adnexus had enough capital to invest in further developing the Adnectin platform. Finally, Edwards also understood the importance of his company's lead program, CT-322, in building confidence in the novel Adnectin drug platform. Continuing to get favorable clinical results from this first program was critically important in assuring the regulatory, scientific and medical communities that Adnectins were indeed a viable new class of drugs. If this lead program was to falter, it could significantly impact his ability to obtain the necessary resources to continue to build his company. Edwards was confident that the acquisition had been the best thing for Adnexus, but as he walked up to the front entrance of the Waltham, Massachusetts facility, the question of "where to best focus his team in developing their pioneering technology and the growing drug pipeline, without spreading his limited resources too thin" lingered in his mind. Any new drug must pass through an extensive review process (see Exhibit B) before it can be approved for sale. This typically includes at least three clinical phases, often lasting more than 10 years at a cost of hundreds of millions of dollars. Given this expensive process, Adnexus clearly needed additional funds and resources to continue development of CT-322, as well as its growing earlystage pipeline. In addition, Edwards believed that their novel technology could be further developed in ways that would give Bristol-Myers Squibb an even greater competitive advantage. While Adnexus had significant financial and infrastructure advantages over other independent biotechnology firms, Edwards knew that continued funding from Bristol-Myers Squibb was contingent on results. As he entered into his office, he was weighed down with several questions: How could he and his colleagues consistently hit their drug discovery and development milestones? What organizational structure was optimal to ensure this would happen? What additional investment in the technology was required, and how could he convince Bristol-Myers Squibb to make that investment? Market Background Adnexus was in the business of making protein-based drugs. In 2009, the global targeted protein therapeutics market was approximately \$42B (Adneuxs internal research), with an expected CAGR of 12\% from 2010 - 2010 (RNCOS, Global Protein Therapeutics Market Analysis Report, August 2009). The fastest growing segment of this market was targeted protein therapeutics. These were protein drugs that were designed to specifically block, stimulate, or otherwise modulate a protein "target" in the body that was the cause of an underlying disease process. There were only two drug classes in this market segment: monoclonal antibodies and soluble receptors. Monoclonal antibodies had the largest share, and had enjoyed tremendous commercial success and growth. However, there remained unmet needs from traditional biologics such as antibodies "in terms of efficacy, tolerability, safety, convenience and cost" (Adnexus website, (www.adnexustx.com) 2009). The Adnexus team continued to believe, as they did when company wascouldformed,potentiallythatbetheseaddressedunmetwithneedsAdnectins. Company Background At Adnexus, we are opening new therapeutic horizons by unleashing the power of our science and our people to improve life (Adnexus, 2009). Adnexus Therapeutics, Inc. was founded in 2002 as Compound Therapeutics, Inc. and focused on developing a novel class of next-generation targeted biologics 1 called Adnectins. Adnectins are a novel, proprietary class of targeted biologics derived from human fibronectin, an abundant extracellular protein that naturally binds to other proteins1. Adnectins offer numerous potential advantages compared to traditional targeted biologics including: speed of discovery, ease of manufacturing, as well as the ability to create multidomain molecules that bind and can modulate a broad range of therapeutic disease processes (targets). Adnexus uses Adnectins to design drugs that specifically attacked a disease target while minimizing interactions with unrelated targets. Adnectins are engineered to have many of the desired properties needed for a successful drug: "high potency, specificity, stability, favorable half life, and high yield E. coli production" (FierceBiotech, 2009). Adnexus's lead drug, CT322 was being developed to treat cancer Not only was CT-322 being used to demonstrate the clinical potential of the Adnectin drug class, its mechanism of action offered important potential differentiation from related FDA approved drugs. 1 A biologic is defined as any substance derived from a biological source, for instance the human body, and can be used to or treat prevent disease. Adnectins are designed and identified using PROfusion, a proprietary protein engineering system, which allowed Adnexus to create and then sort through over a trillion unique Adnectins that target a specific disease of interest. Utilizing PROfusion allowed Adnexus to speed drug discovery and development, as well as design novel drugs with desired pharmaceutical properties. Adnexus is headquartered in Waltham, Massachusetts, with approximately 100 employees. The management team has considerable life sciences experience, which includes involvement in the development or commercialization of over 50 biotech products. Adnexus was initially funded by well-known venture capital firms such as Atlas Venture, Flagship Ventures, Polaris Venture Partners, Venrock and HBM BioVentures. Edwards talked about the approach that Adnexus took as a company in its early-stage development: Given that we were developing a novel therapeutic technologyessentially, a new class of drug - it was critical that we work as efficiently as possible to prove our technology in the eyes of existing and future investors. One way to do this was to focus on a-number of programs to showcase different ways that the technology could be used, for instance, in different therapeutic areas, in different formats, with different delivery mechanisms etc. This strategy would allow us to diversify our risk by putting our eggs in multiple baskets. But, given the resource constraints of a venture funded small biotech company, we also knew that this strategy would not allow us to take any one program very far in development. Another way to prove value was to largely focus on a single program and take it through to clinical development. The risk was that if the program failed, it could kill the company. But. we were willing to take this calculated risk because it would enable us to address the key questions that the scientific, medical and regulatory community would ask about any new class of drug: does this new class of drug really work in humans? This is the strategy we successfully followed-as we took our lead drug, CT-322, into Phase I clinical development. The strategy paid off - we caught the industry's attention with our early favorable clinical data, including that of Bristol-Myers Squibb, leading to the success we have experienced to this very day. The approach Adnexus took is not inexpensive. For the five year period of 2002 to 2006, Adnexus spent $33.9 million on research and development, and for the first six months of 2007, an additional \$10.4 million was spent, most of it related to early clinical trials with its lead program, CT-322. Bristol-Myers Squibb Acquisition In February 2007, Bristol-Myers Squibb and Adnexus announced a major strategic alliance "to discover, develop and commercialize Adnectin-based therapeutics for important oncology-related targets." (Businesswire, 2009) The alliance provided Adnexus with approximately \$30 million in committed research funds over three years. It also meant Adnexus could receive development milestone payments of up to $210 million per product, along with sales-related royalties. John Mendlein. Ph.D., J.D., the CEO of Adnexus at the time, stated: Bristol-Myers Squibb has world-class expertise in oncology, and we look forward to working together using our PRQfusion and Adnectin combination to discover potential therapies for people with cancer. (Businesswire, 2009) The strategic alliance was so successful it lead to Bristol-Myers Squibb's decision to acquire Adnexus for $430 million just eight months later in October 2007. At the time, Bristol-Myers Squibb CEO Jim Cornelius stated: Bringing Adnexus into the Bristol-Myers Squibb family builds upon a successful and productive collaboration between the two companies in oncology and is an important step in accelerating the strategic transformation Adnexus' management viewed this acquisition as a confirmation that the company had a very promising biologics technology and drug platform. Mendlein remarked: This is an exciting milestone for our scientists, investors, and company and is a unique opportunity to further accelerate advancement of Adnectin-based medicines...We are proud to bring the strength of our science, team, and intellectual property to Bristol-Myers Squibb. We have enjoyed a highly productive and collaborative relationship to date, and look forward to helping Bristol-Myers Squibb advance its innovative pipeline. (Adnexus Therapeutics, Inc and Bristol-Myers Squibb joint press release, September, 2007) Adnexus' management also knew that this would provide a level of financial stability that had not previously existed. In 2006, the company burned through approximately \$14 million in cash, and that amount would only increase as the company's clinical pipeline evolved. From both a business and scientific perspective, Adnexus' management knew that as a subsidiary of Bristol-Myers Squibb it would be better positioned to reach its goal to generate "a unique pipeline of best-in-class targeted biologics across multiple therapeutic areas" (Adnexus website: www.adnexustx.com). Edwards added: Bristol-Myers Squibb not only offered Adnexus greater financial security, but the incredible opportunity to tap into a broad range of expertise and infrastructure to enable our technology and programs to be successful. This included extensive therapeutic area experience to help speed products to the clinic and through clinical trials, as well as support to increasing the efficiency of our PROfusion and Adnectin technologies. As a recent acquisition for Bristol-Myers Squibb, Adnexus could have been fully absorbed into the larger pharmaceutical company. Bristol-Myers Squibb took a very different approach. According to Edwards: The full integration approach works well when there is a single asset or technology of interest to the pharma company, but when the value also lies in the scientists, professionals, and company culture, full integration often fails as the top talent walks out the door. (Edwards, 2008) Small biotech startups tended to be entrepreneurial and risk tolerant, often leading to greater innovation in discovery and higher R \& D productivity. For example, of 103 FDA approvals from January 2006 to December 2007, 65\% originated from the biotech industry (Czerepak and Ryser, 2008). Larger pharmaceutical companies offer the advantage of greater knowledge in specific therapeutic areas that can guide the discovery process and help identify successful drug candidates. In addition, larger firms often have more experience and a wellestablished infrastructure in later-stage drug development, as well as a 25% higher success rate in later stage clinical development. Edwards noted: [in the last 10 years], the success rate of a Phase 3 trial for the average Adnexus has maintained its name, location, and people post-merger [see Exhibit A for organizational chart], allowing it to continue to function as a successful biotech company without the need to adapt another organization's processes and procedures. The intent has been to focus Adnexus on the early drug development process, so that it could successfully deliver new candidates into Bristol-Myers Squibb's drug-development pipeline. As drug candidates move through the approval process, more of the BMS process and procedural aspects will be leveraged. Edwards noted: drug products, our ability to move programs rapidly through clinical proof of concept, as well as for our lead compound, CT-322, which was nearing Phase 2 clinical trials. The Drug Discovery and Development Process: The discovery of a new drug proceeds in three major steps. The first step requires understanding of a disease process and identifying an appropriate biological target, that when modulated reduces the disease severity. The second step involves identifying a drug that stimulates or blocks the target of interest and has desired disease-altering activity in laboratory settings, such as in vitro (in "test tubes") or animal models. The third step involves demonstrating the safety and efficacy of the drug in human studies and developing methods to manufacture the drug. To begin the process, researchers study the science behind the disease to better understand the genes or proteins involved with the cause or progression of the disease. In the area of cancer research, cellular pathways that are not properly controlled can lead to rapid and unchecked growth. Using a variety of laboratory and animal models, researchers will study alternative approaches to regulating the expressed gene product or other means to impact the disease symptoms. Once these biological targets are identified, the second step in the discovery and development pathway begins. Typically, large compilations of chemicals, sometimes more than a million, are screened for those chemicals that can best modulate the biological target. This activity often yields a lead candidate that requires chemical optimization to create the final drug candidate. Chemical libraries can come from natural products or designed compounds. Sometimes smaller libraries of compounds are screened when much is known about the class of biological target. With targeted biologics, often known as protein therapeutics, much larger diversity can be screened. For example, in the case of monoclonal antibodies, animals are immunized and vast antibody biological diversity is screened to identify the best antibodies with activity that modulates the target of interest. With Adnectins, such screening can be done without the need for animals. After a biologically active lead molecule is identified (i.e., the drug candidate), the discovery process next requires the use of animal models before human testing can begin. The aims of these studies include the demonstration of safety, efficacy, and appropriate pharmacokinetics (how long the drug will last in the body). With an appropriate demonstration of safety and efficacy in animal models, researchers then develop processes to manufacture the substance in larger quantities for human clinical testing and if clinical studies are successful, ultimately for commercial production. The Regulatory Development and Review Process The US and EU have a highly regulated process for oversight of products seeking approval for marketing. The process typically consists of three phases of development that typically take six to eight years for most products and consists of three major disciplines: (1) non-clinical which encompasses all the in-vitro (cell-based) and in-vivo (animal toxicology, pharmacokinetics, etc.) studies, (2) drug product manufacturing and testing, and (3) conducting human clinical studies to demonstrate safety and efficacy of the drug. Development in each of these areas is intentionally staged to support the clinical development phase of the product. A typical pharmaceutical company will invest in multiple parallel activities that increase costs, but lowers the overall development risk. The drug product manufacturing and testing activities are seldom developed to a commercial level while the product is in early clinical studies. As the development program progresses, manufacturing process/scale changes are implemented and the final product is optimized to support commercial production and distribution upon approval. For Adnexus, investments in manufacturing and comprehensive testing/characterization studies are strategically implemented using a "phase-appropriate" strategy. Prior to initiating human clinical trials, toxicology, pharmacokinetics, and other applicable animal studies are required. If a drug shows signs of promise in clinical trials, the completion of more comprehensive animal studies must be carefully planned to meet the requirements for a marketing application. Human clinical studies represent the largest investment as well as the largest uncertainty of any drug development program. They are sequentially staged to first establish safety and tolerability of the drug, then to determine a therapeutic dose level and schedule, and lastly to demonstrate efficacy. Once safety and tolerability are established, decisions regarding clinical study designs, target patient populations, and product registration strategies are made. The Science Behind Adnexus' Pead Program CT-322 was Adnexus' first drug candidate. Specific to oncology, CT-322 inhibits tumor growth by blocking a process called angiogenesis or new blood vessel growth. 2 Tumors are dependent on angiogenesis because the tumor's rapid growth rate creates a higher requirement for oxygen and nutrients provided by the blood. CT-322 targets the blocking of vascular endothelial growth factor receptor-2 (VEGFR-2), a specific signaling mechanism that stimulates angiogenesis. Another method of blocking this VEGFR-2 pathway is to block the vascular endothelial growth factor (VEGF), a small protein produced by tumors that stimulates VEGFR-2 and thus endothelial cell proliferation and the resultant angiogenesis. Genentech, a biotechnology firm in business for over 30 years and now fully owned by F. Hoffmann-La Roche Ltd., was the first to prove that inhibiting VEGF and thus inhibiting angiogenesis could inhibit tumor growth. Genentech created a monoclonal antibody called bevacizumab that specifically bound and blocked VEGF. Bevacizumab is approved for the treatment of numerous cancers, including colorectal cancer, NSCLC, and breast cancer. According to the company: In 1989, Napoleone Ferrara, M.D., and a team of scientists at Genentech first isolated human vascular endothelial growth factor (VEGF), a protein now believed to be one of the most potent sources of angiogenesis. The need for oxygen and nutrients triggers tumor cells to produce and release the VEGF protein, which leads to the formation of new blood vessels to feed the tumor. In addition to supporting tumor growth, these new vessels provide a "highway" along which tumor cells can travel through the bloodstream to other parts of the body. This may lead to the formation of new tumors and spread of cancer (metastasis). Sustained angiogenesis is a hallmark of most, if not all cancers. Without angiogenesis, a tumor would not likely grow beyond a few millimeters, the size of an average pencil eraser. (Gene.com, 2009) 2 Angiogenesis refers to the formation of new blood vessels, and is critical for the growth of tumors. Subsequent to the demonstration that bevacizumab had anti-tumor activity in humans, two small molecule drugs, sorafenib and sunitinib, that in part block VEGFR-2, showed efficacy in renal cell carcinoma. Combined these products validated the VEGF signaling pathway generally in oncology. Developing a new technology such as Adnectins, has a high degree of risk. By applying a new technology to validated or proven targets, helps to limit the overall investment risk. Therefore, the VEGF/VEGFR-2 pathway was an attractive target for the first Adnectin product due to the biological validation of the pathway3. (See Exhibit C below that illustrates the role of VEGF in forming new blood vessels that support tumor growth) (Gene.com, 2009). Adnexus had filed its IND on CT-322 in early 2006, with the Phase I clinical trial being initiated in August 2006. This initial trial was completed in February 2009. Edwards described the importance of this initial clinical study: This study provided important data related to validating the potential of the Adnectin platform. There is still work to be done, but this study played a crucial role in significantly increasing the confidence related to the potential for the novel Adnectin class. The trial was conducted on 40 oncology patients in the United States, patients with advanced solid tumors or non-Hodgkin's lymphoma. The rationale behind the Phase I clinical trial had been that "CT-322 may stop the growth of solid tumors or non-Hodgkin's lymphoma by stopping blood flow to the cancer." (Clinicaltrials.gov, 2009) Although final study results 3 VEGFR-2 Pathway refers to the Vascular Endothelial Growth Factor Receptor Pathway. The pathway has receptor and multiple activator proteins, which are in the VEGF family. According to the National Center for Biotechnology Information (NCBI), this protein is a glycosylated mitogen that specifically acts on endothelial cells (the cells that form the interior surface of blood vessels) and has various effects, including mediating increased vascular permeability, inducing angiogenesis, yasculogenesis and endothelial cell growth, promoting cell migration, and inhibiting apoptosis. had yet to be posted, preliminary results were consistent with the company's strategic Phase II trials were the initiated in the area of recurrent glioblastoma multiforme (GBM), the most common and aggressive primary brain tumor, colorectal cancer and lung cancer. The trials were in the process of recruiting patients, and the first study was due to be completed in September 2010, with subsequent studies finishing in mid-2011 (Clinicaltrials.gov, 2009). Competitors Due to the tremendous growth in the therapeutic application of targeted biologics, a handful of small biotech companies set out to create next-generation protein therapeutics. However, due to the speed of discovery and development of the platform, Adnexus was one of the first to advance a next generation drug into the clinic. The company believed there were a number of advantages it had vis--vis other competitors. First and foremost, it believed it had selected the optimal starting material for Adnectin drugs - that is, human fibronectin. This created a number..of advantages, namely, that the particular domain of human fibronectin used by Adnexus was: (1) inherently stable; (2) had low immunogenic potential due to its human extracellular origin; and (3) was cysteine-free, which made it suitable for expression in E. coli. These features made Adnectins more readily 4 Immunogenicity relates to a substance's ability to cause or produce an immune response. 5 Pharmacokinetics relates to a drug's process of absorption, distribution, metabolization, and elimination within the body. discoverable, easy to work with, and straightforward to manufacture. On top of that, Adnexus' PRQfusion discovery engine capitalized on the inherent advantages of Adnectiass through the rapid and efficient engineering, evaluation, and optimization of Adnectin product candidates. This had the potential to give Adnexus a competitive advantage by reducing the time and cost of identifying high quality drug candidates. Three competitor companies, Avidia Ablynx and Domantis, stood out in terms of advancing next-generation protein therapeutics. The first used a polymeric protein construct called avimers and the second two developed their drugs by making further alterations to the traditional antibody scaffold. In late 2006, an avimer entered the clinical trials. By 2009, both antibody-based companies had their respective drugs in the clinical trials. During this time, a number of pharmaceutical companies were also exploring next-generation protein therapeutics via partnerships and the acquisition of fundamental intellectual property. For example, in late 2006, Amgen acquired Avidia and in 2007, GlaxoSmithKline acquired Domantis. Edwards knew that as time marched on, the success of Adnexus, and a handful of other companies, would invite more competition. He firmly believed continued investment in the technology, to exploit unique ways that Adnectins could be applied to the treatment of diseases was critically important. Looking Ahead Risk is inherent in the drug development process. Bringing a novel technology forward in a highly competitive and regulated industry with limited resources requires taking considerable risk. As Adnexus evolved from a small biotech company with an innovative technology, its strategy changed from a high-risk single target platform to one that was capable of broadening into new areas as the expertise and resources expanded following the acquisition by Bristol-Myers Squibb. Overall, Edwards was pleased with the company's progress: The evolution of Adnexus didn't stop with the acquisition. In fact, the company has emerged stronger and more successful than ever. This has been made possible due the strategic decision to approach the acquisition of Adnexus with the idea of leveraging the best of biotech and the best of pharma, rather than focus on integrating the entire company or leaving it completely independent. This novel approach has resulted in one of the industry's most successful biotech acquisitions. However, as he reached his office, he thought about the challenges that remained, knowing it would take considerably more funding to realize the full potential of the Adnectin platform as the growing discovery pipeline enters the clinic. Annendiv A. Oroanizational Structure of Adnexus within Rrictol-Mverc Smuihh Appendix B : The Drug Discovery, Development, and Approval Process Appendix C: Role of VEGF in Forming New Blood Vessels that Support Tumor Growth (photo courtesy of Adnexus Theraputics, Inc.)

Step by Step Solution

There are 3 Steps involved in it

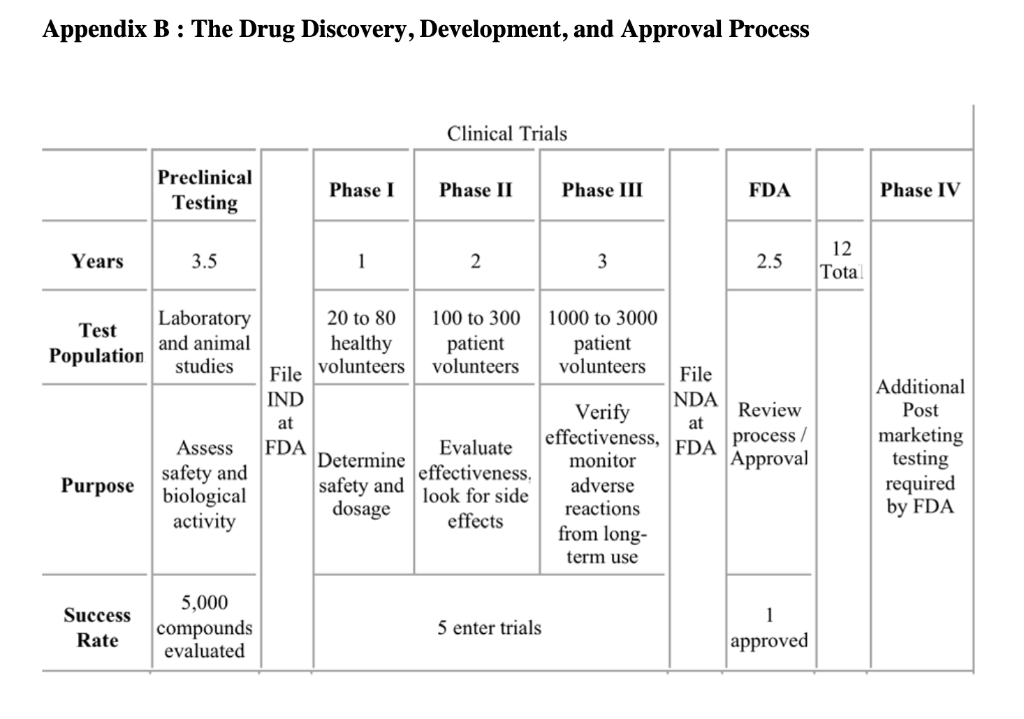

Get step-by-step solutions from verified subject matter experts