Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both 9 and 10 9. (a) Iggy borrows X amount for 10 years at an effective annual rate of 6%. If he pays

please answer both 9 and 10

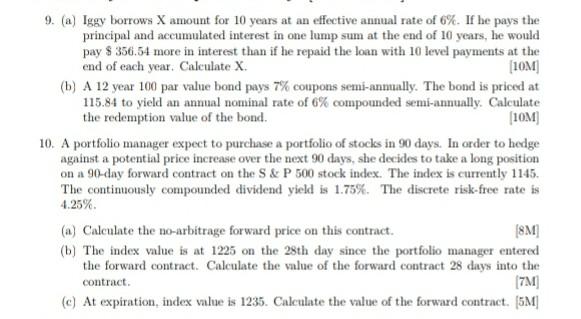

9. (a) Iggy borrows X amount for 10 years at an effective annual rate of 6%. If he pays the principal and accumulated interest in one lump sum at the end of 10 years, he would pay $ 356.54 more in interest than if he repaid the loan with 10 level payments at the end of each year. Calculate X [10M (b) A 12 year 100 par value bond pays 7% coupons semi-annually. The bond is priced at 115.84 to yield an annual nominal rate of 6% compounded semi-annually. Calculate the redemption value of the bond. (10M 10. A portfolio manager expect to purchase a portfolio of stocks in 90 days. In order to hedge against a potential price increase over the next 90 days, she decides to take a long position on a 90-day forward contract on the S&P 500 stock index. The index is currently 1145. The continuously compounded dividend yield is 1.75%. The discrete risk-free rate is 4.25% (a) Calculate the no-arbitrage forward price on this contract. [8M (b) The index value is at 1225 on the 28th day since the portfolio manager entered the forward contract. Calculate the value of the forward contract 28 days into the contract 7M) (c) At expiration, index value is 1235. Calculate the value of the forward contract. (SM)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started