Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both of the qustion a) Capital Reconstruction Dunstable Ltd has a statement of financial position with significant retained losses and no cash (it

Please answer both of the qustion

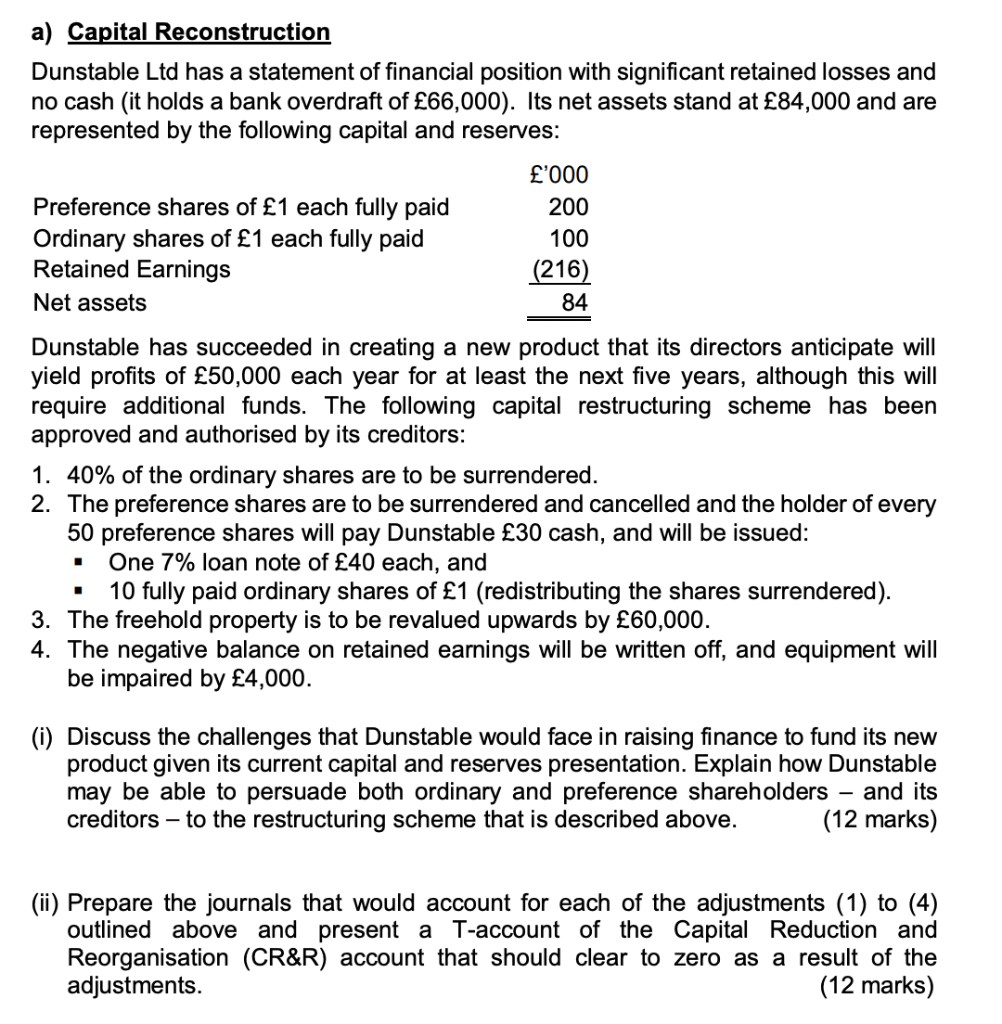

a) Capital Reconstruction Dunstable Ltd has a statement of financial position with significant retained losses and no cash (it holds a bank overdraft of 66,000). Its net assets stand at 84,000 and are represented by the following capital and reserves: '000 Preference shares of 1 each fully paid 200 100 Ordinary shares of 1 each fully paid Retained Earnings (216) 84 Net assets Dunstable has succeeded in creating a new product that its directors anticipate will yield profits of 50,000 each year for at least the next five years, although this will require additional funds. The following capital restructuring scheme has been approved and authorised by its creditors: 1. 40% of the ordinary shares are to be surrendered. 2. The preference shares are to be surrendered and cancelled and the holder of every 50 preference shares will pay Dunstable 30 cash, and will be issued: One 7% loan note of 40 each, and 10 fully paid ordinary shares of 1 (redistributing the shares surrendered). 3. The freehold property is to be revalued upwards by 60,000. 4. The negative balance on retained earnings will be written off, and equipment will be impaired by 4,000. (i) Discuss the challenges that Dunstable would face in raising finance to fund its new product given its current capital and reserves presentation. Explain how Dunstable may be able to persuade both ordinary and preference shareholders and its creditors to the restructuring scheme that is described above. (12 marks) (ii) Prepare the journals that would account for each of the adjustments (1) to (4) outlined above and present a T-account of the Capital Reduction and Reorganisation (CR&R) account that should clear to zero as a result of the adjustments. (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started