Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both part, i.e. a and b b)What happens to the replicating portfolio as the stock price changes? A stock is currently trading for

Please answer both part, i.e. a and b

b)What happens to the replicating portfolio as the stock price changes?

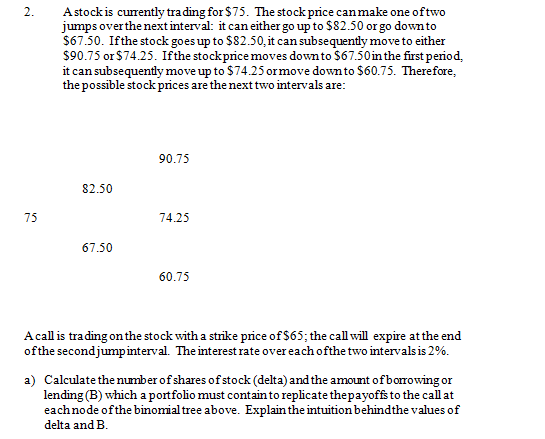

A stock is currently trading for $75. The stock price can make one of two jumps over the next interval: it can either go up to $82.50 or go down to $67.50. If the stock goes up to $82.50, it can subsequently move to either $90.75 or $74.25. If the stock price moves down to $67.50 in the first period, it can subsequently move up to $74.25 or move down to $60.75. Therefore, the possible stock prices are the next two intervals are: A call is trading on the stock with a strike price of $65: the call will expire at the end of the second jump interval. The interest rate over each of the two intervals is 2%. a) Calculate the number of shares of stock (delta) and the amount of borrowing or lending (B) which a portfolio must contain to replicate the payoffs to the call at each node of the binomial tree above. Explain the intuition behind the values of delta and EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started