Answered step by step

Verified Expert Solution

Question

1 Approved Answer

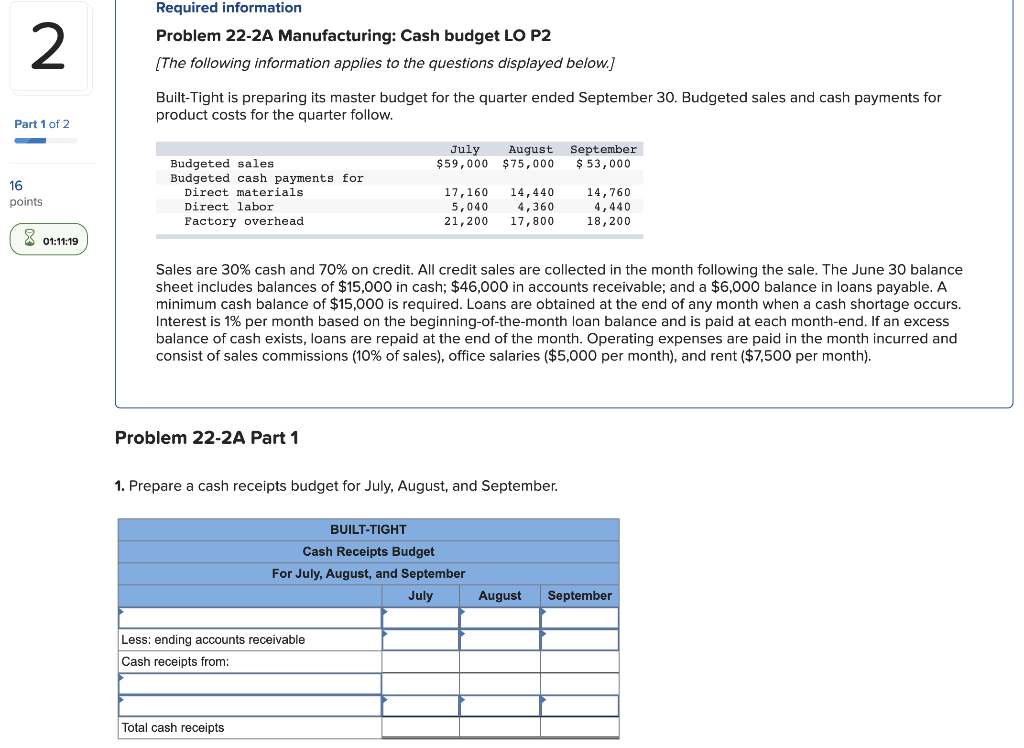

Please answer both parts of the question, as they are all apart of one question. 2 Required information Problem 22-2A Manufacturing: Cash budget LO P2

Please answer both parts of the question, as they are all apart of one question.

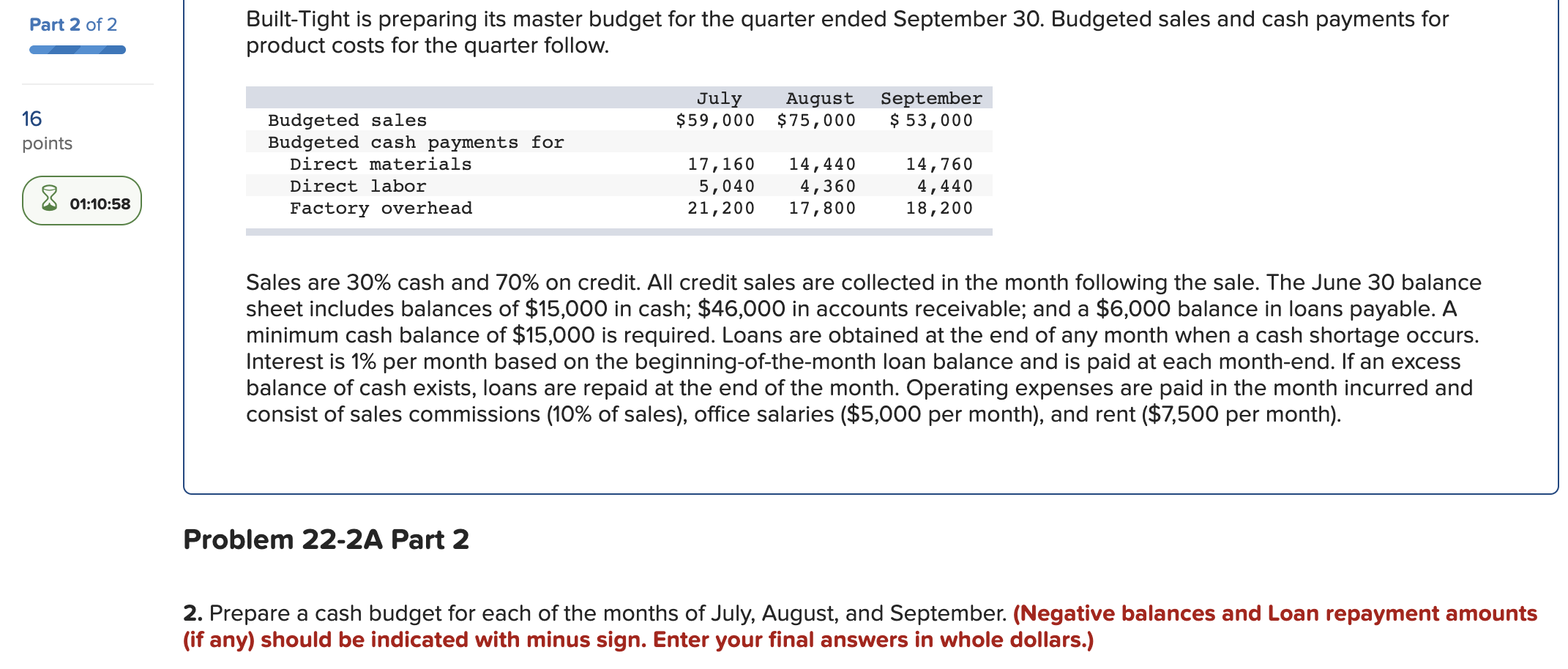

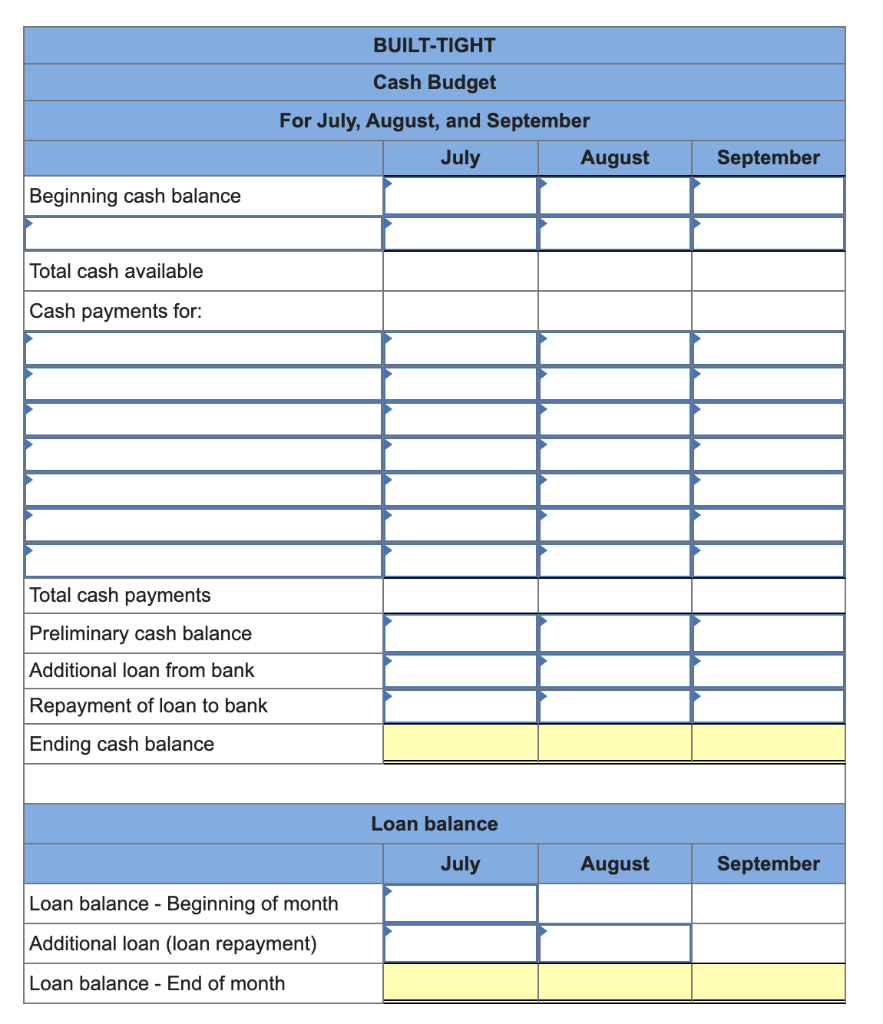

2 Required information Problem 22-2A Manufacturing: Cash budget LO P2 (The following information applies to the questions displayed below.) Built-Tight is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for product costs for the quarter follow. Part 1 of 2 July August $59,000 $75,000 September $ 53,000 16 points Budgeted sales Budgeted cash payments for Direct materials Direct labor Factory overhead 17,160 5,040 21,200 14,440 4,360 17,800 14,760 4,440 18, 200 8 01:11:19 Sales are 30% cash and 70% on credit. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $15,000 in cash; $46,000 in accounts receivable; and a $6,000 balance in loans payable. A minimum cash balance of $15,000 is required. Loans are obtained the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If an excess balance of cash exists, loans are repaid at the end of the month. Operating expenses are paid in the month incurred and consist of sales commissions (10% of sales), office salaries ($5,000 per month), and rent ($7,500 per month). Problem 22-2A Part 1 1. Prepare a cash receipts budget for July, August, and September. BUILT-TIGHT Cash Receipts Budget For July, August, and September July August September Less: ending accounts receivable Cash receipts from: Total cash receipts Part 2 of 2 Built-Tight is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for product costs for the quarter follow. July August $59,000 $75,000 16 points September $ 53,000 Budgeted sales Budgeted cash payments for Direct materials Direct labor Factory overhead 8 17,160 5,040 21,200 14,440 4,360 17,800 14,760 4,440 18, 200 01:10:58 Sales are 30% cash and 70% on credit. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $15,000 in cash; $46,000 in accounts receivable; and a $6,000 balance in loans payable. A minimum cash balance of $15,000 is required. Loans are obtained at the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If an excess balance of cash exists, loans are repaid at the end of the month. Operating expenses are paid in the month incurred and consist of sales commissions (10% of sales), office salaries ($5,000 per month), and rent ($7,500 per month). Problem 22-2A Part 2 2. Prepare a cash budget for each of the months of July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Enter your final answers in whole dollars.) BUILT-TIGHT Cash Budget For July, August, and September July August September Beginning cash balance Total cash available Cash payments for: Total cash payments Preliminary cash balance Additional loan from bank Repayment of loan to bank Ending cash balance Loan balance July August September Loan balance - Beginning of month Additional loan (loan repayment) Loan balance - End of monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started