Question

PLEASE ANSWER BOTH PARTS THANK YOU SO MUCH 1.Consider a CMO with Interest Only (IO) and Principal Only (PO) tranches that is backed by a

PLEASE ANSWER BOTH PARTS THANK YOU SO MUCH

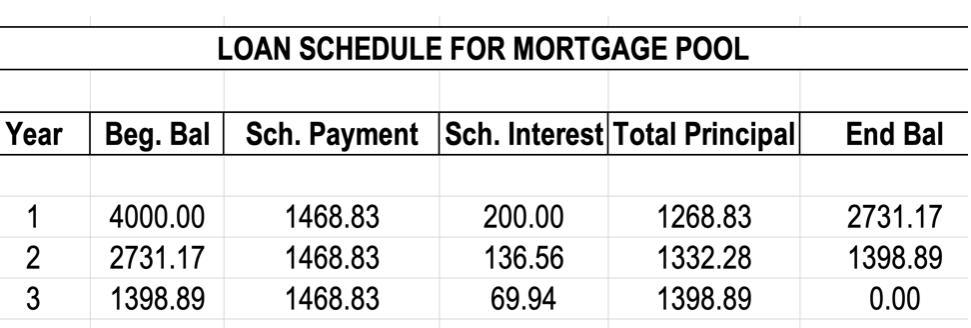

1.Consider a CMO with Interest Only (IO) and Principal Only (PO) tranches that is backed by a pool of $4 thousand fully amortizing mortgages. Mortgages are fixed rate at 5% with 3 year maturity and annual payments. Suppose that the market rate for comparable securities (investor discount rate) is 2.9%. Suppose that no prepayment is expected and there are no servicing fees.

How much should the investors value the IO security? Use the amortization table below and round your answer to two decimal points (e.g. if your answer is $1567.8901, write 1567.89).

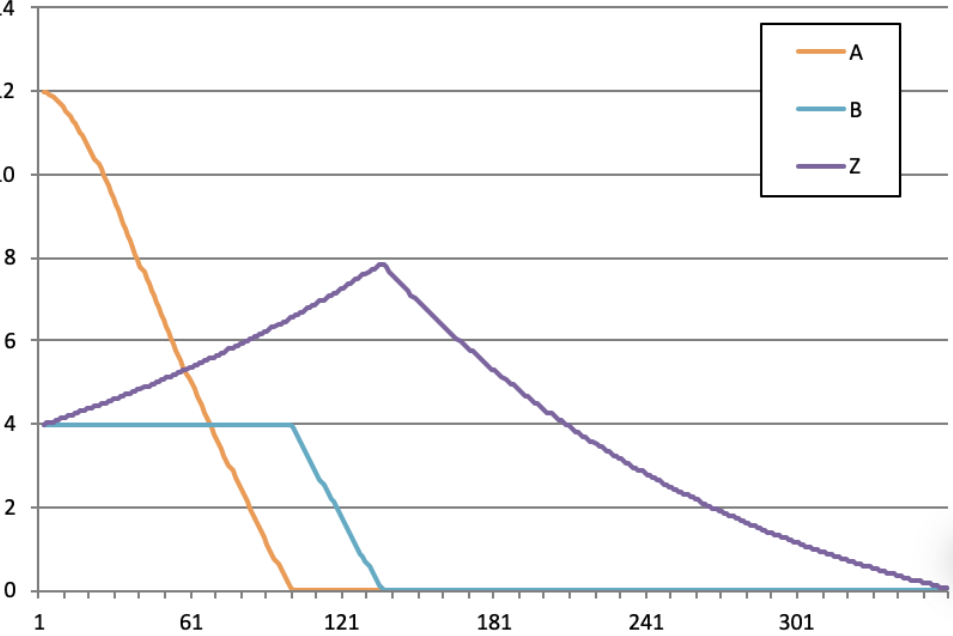

2.Consider the following CMO:

- Tranche A issued for $12 million with a coupon of 6.5%

- Tranche B issued for $4 million with a coupon of 6.5%

- Z-Tranche issued for $4 million with a coupon of 6.5%

The securities are backed by a pool of fully amortizing 30-year fixed rate mortgages with WAC equal to 6.5% and monthly payments. There is assumed to be a 5% CPR in this pool and no servicing fee.

What does the y-axis in the graph represent? Note that the x-axis is month.

A. Interest payment on each tranche

B. Remaining balance on each tranche

C. Principal payment on each tranche

D. Cash flow to each tranche

LOAN SCHEDULE FOR MORTGAGE POOL \begin{tabular}{l|c|c|c|c|c} \hline Year & Beg. Bal & Sch. Payment & Sch. Interest & Total Principal & End Bal \\ \hline & & & & & \\ \hline 1 & 4000.00 & 1468.83 & 200.00 & 1268.83 & 2731.17 \\ \hline 2 & 2731.17 & 1468.83 & 136.56 & 1332.28 & 1398.89 \\ \hline 3 & 1398.89 & 1468.83 & 69.94 & 1398.89 & 0.00 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started