Answered step by step

Verified Expert Solution

Question

1 Approved Answer

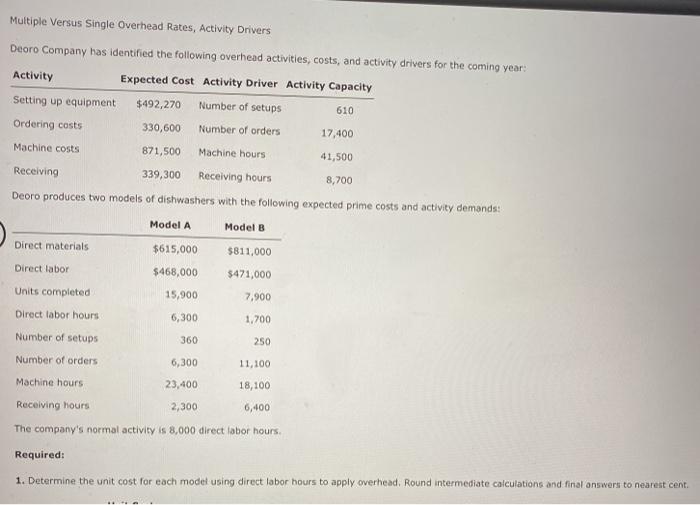

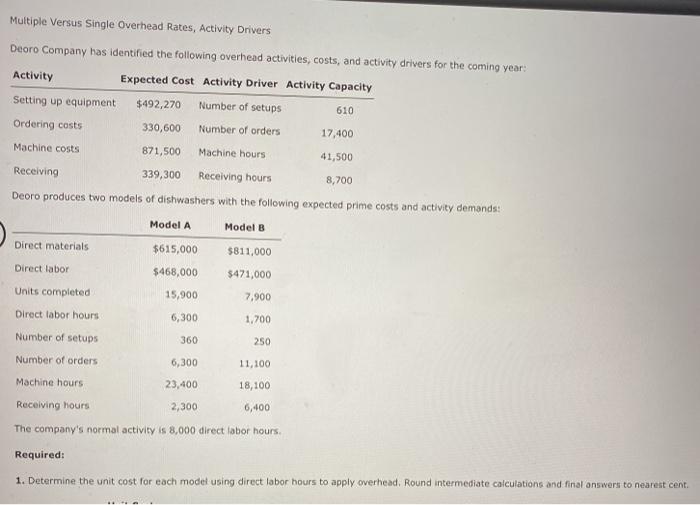

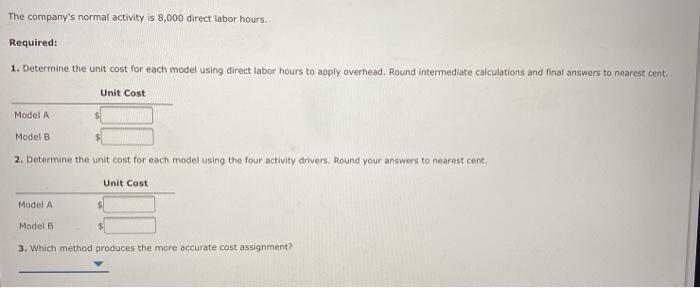

PLEASE ANSWER BOTH , PICTURE 1-2 ARE SAME QUESTION Multiple Versus Single Overhead Rates, Activity Drivers Deoro Company has identified the following overhead activities, costs,

PLEASE ANSWER BOTH , PICTURE 1-2 ARE SAME QUESTION

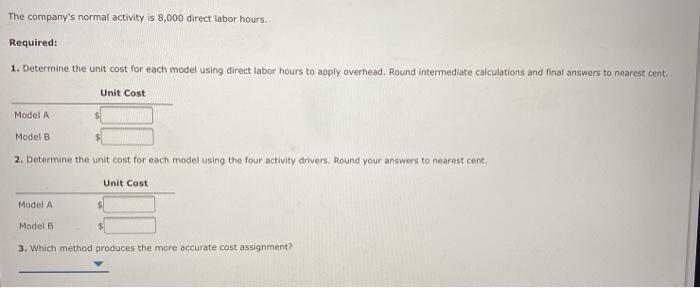

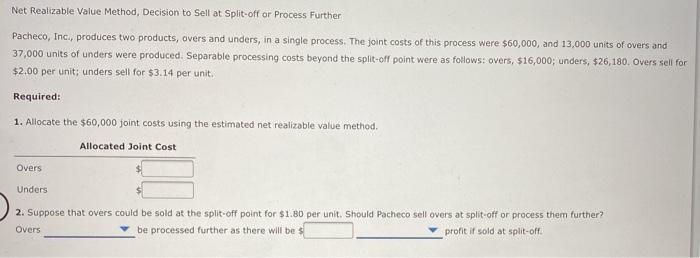

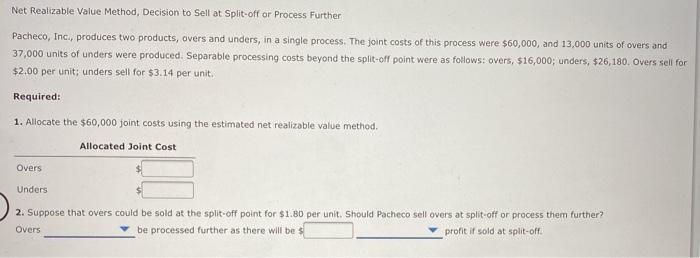

Multiple Versus Single Overhead Rates, Activity Drivers Deoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment $492,270 Number of setups 610 Ordering costs 330,600 Number of orders 17,400 Machine costs 871,500 Machine hours 41,500 Receiving 339,300 Receiving hours 8,700 Deoro produces two models of dishwashers with the following expected prime costs and activity demands: Model A Model B Direct materials $615,000 $811,000 Direct labor $468,000 $471,000 Units completed 7,900 15,900 6,300 Direct labor hours 1,700 Number of setups 360 250 Number of orders 6,300 11,100 Machine hours 23,400 18,100 Receiving hours 2,300 6,400 The company's normal activity is 8,000 direct labor hours. Required: 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent. The company's normal activity is 8,000 direct labor hours. Required: 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round Intermediate calculations and final answers to nearest cent Unit Cost Model A Model B 2. Determine the unit cost for each model using the four activity drivers. Round your answers to nearest cent. Unit Cost Model A Model B 3. Which method produces the more accurate cost assignment? Net Realizable Value Method, Decision to Sell at Split-off or Process Further Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were $60,000, and 13,000 units of overs and 37,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, 516,000; unders, $26,180. Overs sell for $2.00 per unit; unders sell for $3.14 per unit. Required: 1. Allocate the $60,000 joint costs using the estimated net realizable value method. Allocated Joint Cost Overs Unders 2. Suppose that overs could be sold at the split-off point for $1.80 per unit. Should Pacheco sell overs at split-off or process them further? Overs be processed further as there will be $ profit if sold at split-off

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started