Answered step by step

Verified Expert Solution

Question

1 Approved Answer

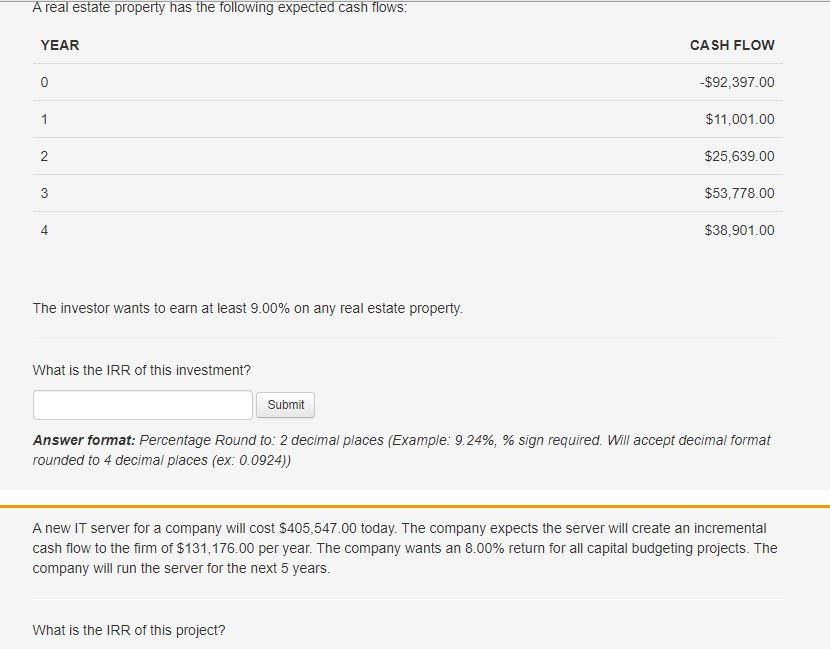

Please answer both questions. A real estate property has the following expected cash flows: YEAR CASH FLOW $92,397.00 $11.001.00 $25,639.00 $53,778.00 $38.901.00 The investor wants

Please answer both questions.

A real estate property has the following expected cash flows: YEAR CASH FLOW $92,397.00 $11.001.00 $25,639.00 $53,778.00 $38.901.00 The investor wants to earn at least 9.00% on any real estate property. What is the IRR of this investment? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) A new IT server for a company will cost $405,547.00 today. The company expects the server will create an incremental cash flow to the firm of $131,176.00 per year. The company wants an 8.00% return for all capital budgeting projects. The company will run the server for the next 5 years. What is the IRR of this projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started