Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both questions as soon as possible. thank you soo i really appreciate it George and Edith Jackson own 500 shares of publicly traded

please answer both questions as soon as possible. thank you soo i really appreciate it

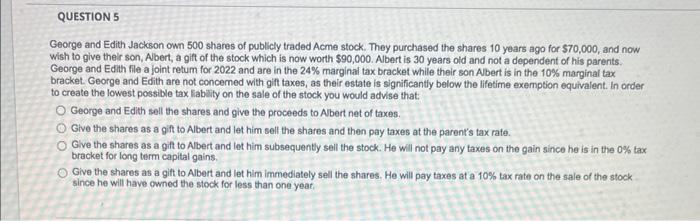

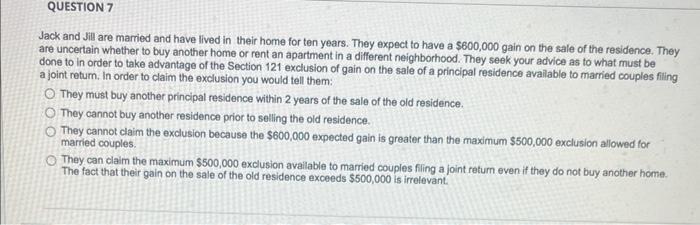

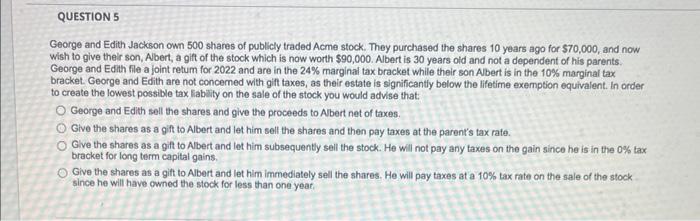

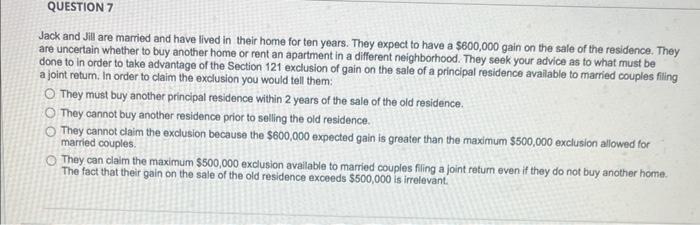

George and Edith Jackson own 500 shares of publicly traded Acme stock. They purchased the shares 10 years ago for $70,000, and now wish to give their son, Abert, a gift of the stock which is now worth $90,000. Albert is 30 years oid and not a dependent of his parents. George and Edith file a joint retum for 2022 and are in the 24% marginal tax bracket while their son Abert is in the 10% marginal tex bracket. George and Edith are not concemed with gift taxes, as their estate is significantly below the lifetime exemption equivalent. In order to create the lowest possible tax labWity on the sale of the stock you would advise that: George and Edith sell the shares and give the proceeds to Abert net of taxes. Give the shares as a gift to Albert and let him sell the shares and then pay taxes at the parent's tax rate. Give the shares as a gift to Albert and let him subsequently sell the stock. He will not pay any taxes on the gain since he is in the o\% tax bracket for long term capital gains. Give the shares as a gift to Abert and let him immediately sell the shares. He will pay taxes at a 10% tax rate on the sale of the stock since he will have owned the stock for less than one yeat, Jack and Jil are married and have lived in their home for ten years. They expect to have a $600,000 gain on the sale of the residence. They are uncertain whether to buy another home or rent an apartment in a different neighborhood. They seek your advice as to what must be done to in order to take advantage of the Section 121 exclusion of gain on the sale of a principal residence available to married couples filing a joint return, In order to claim the exclusion you would tell them: They must buy another principal residence within 2 years of the sale of the old residence. They cannot buy another residence prior to selling the old residence. They cannot claim the exclusion because the $600,000 expected gain is greater than the maximum $500,000 exclusion allowed for married couples. They can claim the maximum $500,000 exclusion avallable to married couples fling a joint retum even if they do not buy another home. The fact that their gain on the sale of the old residence exceeds $500,000 is irrelevant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started