Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both questions CORRECTLY. P.S. - under both of the select dropdowns, choose among the following: Neither, Project A, Project B, Both Projects A

Please answer both questions CORRECTLY.

P.S. - under both of the "select" dropdowns, choose among the following: "Neither", "Project A", "Project B", "Both Projects A and B".

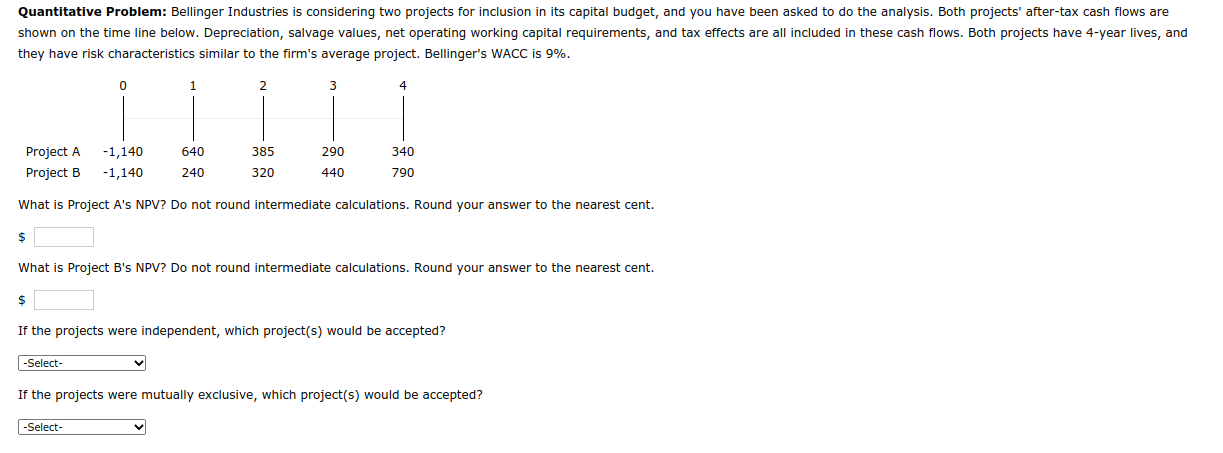

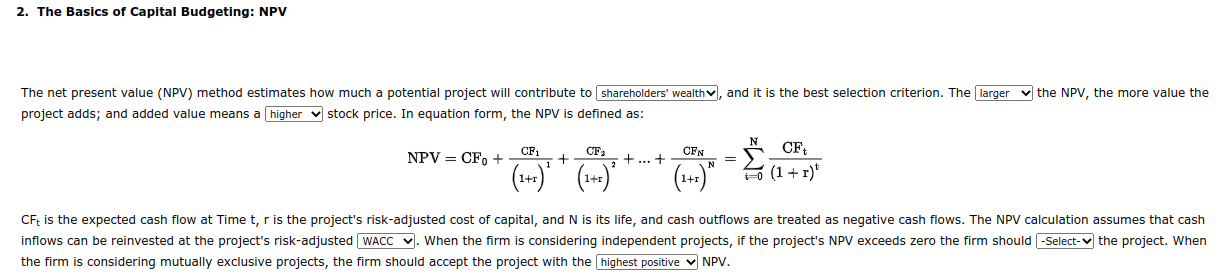

they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%. What is Project A's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is Project B's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $ If the projects were independent, which project(s) would be accepted? If the projects were mutually exclusive, which project(s) would be accepted? 2. The Basics of Capital Budgeting: NPV The net present value (NPV) method estimates how much a potential project will contribute to and it is the best selection criterion. The the NPV, the more value t project adds; and added value means a stock price. In equation form, the NPV is defined as: NPV=CF0+(1+r)1CF1+(1+r)2CF2++(1+r)NCFN=i=0N(1+r)tCFt the firm is considering mutually exclusive projects, the firm should accept the project with the NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started