Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER BOTH QUESTIONS!! I REALLY NEED HELP!! Homework: HW-07 Profitability Measures (PW, FW, AW) Question 3, Problem 5-22 (algorithmic) Part 1 of 2 HW

PLEASE ANSWER BOTH QUESTIONS!! I REALLY NEED HELP!!

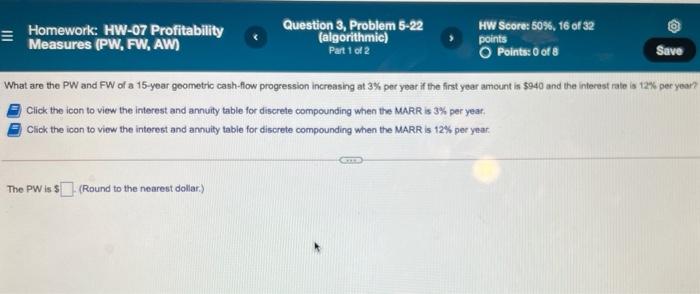

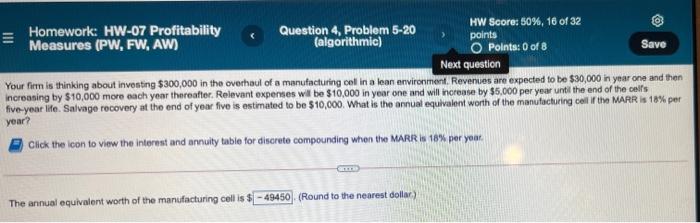

Homework: HW-07 Profitability Measures (PW, FW, AW) Question 3, Problem 5-22 (algorithmic) Part 1 of 2 HW Score: 50%, 16 of 32 points Points: 0 of 8 Save What are the PW and FW of a 15-year geometric cash-flow progression increasing at 3% per year if the first year amount is $940 and the interest rate is 12% per year? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 3% per year Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The PW is $(Round to the nearest dollar) HW Score: 50%, 16 of 32 Homework: HW-07 Profitability Question 4, Problem 5-20 points Measures (PW, FW, AW) (algorithmic) O Points: 0 of 8 Save Next question Your firm is thinking about investing $300,000 in the overhaul of a manufacturing coll in a loan environment. Revenues are expected to be $30,000 in year one and then increasing by $10,000 more each year thereafter. Relevant expenses will be $10,000 in year one and will increase by $5,000 per year until the end of the call's five-year life. Salvage recovery at the end of your five is estimated to be $10,000. What is the annual equivalent worth of the manufacturing call the MARR is 18% per year? Click the icon to view the interest and annuity table for discreto compounding when the MARR Is 10% per your The annual equivalent worth of the manufacturing cell is $ - 49450 (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started