Answered step by step

Verified Expert Solution

Question

1 Approved Answer

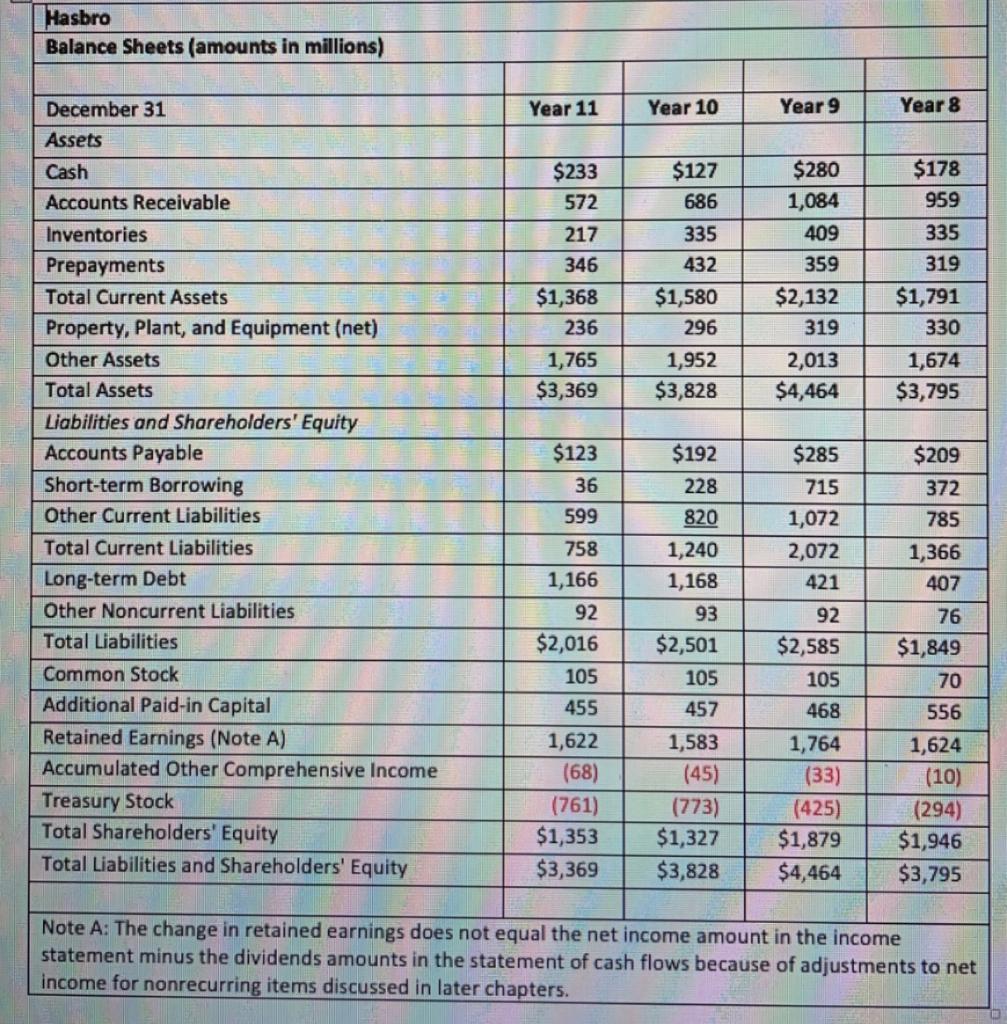

Please answer both questions Question 1 Analyze the changes in ROA and its components of Hasbro over the three-year period, suggesting reasons for the changes

Please answer both questions

Question 1

Analyze the changes in ROA and its components of Hasbro over the three-year period, suggesting reasons for the changes observed. Five or six sentences should be enough.

Question 2

Analyze the changes in ROCE and its components of Hasbro over the three-year period, suggesting reasons for the changes observed. Four or five sentences should be enough.

Hasbro Balance Sheets (amounts in millions) Year 11 Year 10 Year 9 Year 8 $127 686 $178 959 335 319 $233 572 217 346 $1,368 236 1,765 $3,369 335 432 $1,580 296 1,952 $3,828 $280 1,084 409 359 $2,132 319 2,013 $4,464 $1,791 330 1,674 $3,795 December 31 Assets Cash Accounts Receivable Inventories Prepayments Total Current Assets Property, Plant, and Equipment (net) Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Short-term Borrowing Other Current Liabilities Total Current Liabilities Long-term Debt Other Noncurrent Liabilities Total Liabilities Common Stock Additional Paid-in Capital Retained Earnings (Note A) Accumulated Other Comprehensive Income Treasury Stock Total Shareholders' Equity Total Liabilities and Shareholders' Equity $285 715 1,072 2,072 421 $209 372 785 $123 36 599 758 1,166 92 $2,016 105 455 1,622 (68) (761) $1,353 $3,369 $192 228 820 1,240 1,168 93 $2,501 105 457 1,583 (45) (773) $1,327 $3,828 92 $2,585 105 468 1,764 (33) (425) $1,879 $4,464 1,366 407 76 $1,849 70 556 1,624 (10) (294) $1,946 $3,795 Note A: The change in retained earnings does not equal the net income amount in the income statement minus the dividends amounts in the statement of cash flows because of adjustments to net income for nonrecurring items discussed in later chaptersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started