Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both the questions Margaret Williams unincorporated business has inventories with a fair market value of $47,000 and a tax cost of $55,000. In

please answer both the questions

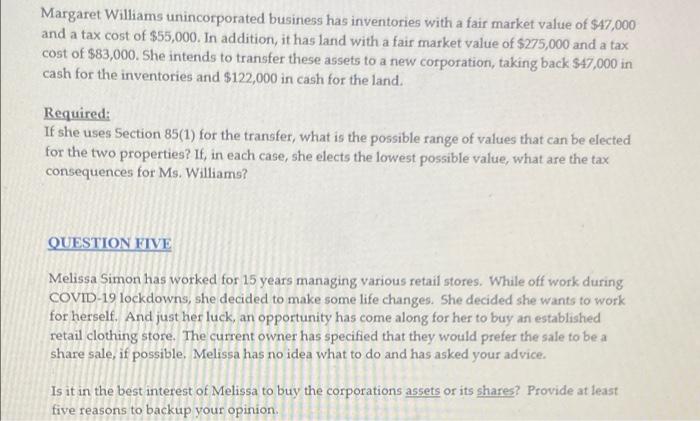

Margaret Williams unincorporated business has inventories with a fair market value of $47,000 and a tax cost of $55,000. In addition, it has land with a fair market value of $275,000 and a tax cost of $83,000. She intends to transfer these assets to a new corporation, taking back $47,000 in cash for the inventories and $122,000 in cash for the land. Required: If she uses Section 85(1) for the transfer, what is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Williams? QUESTION FIVE Melissa Simon has worked for 15 years managing various retail stores. While off work during COVID-19 lockdowns, she decided to make some life changes. She decided she wants to work for herself. And just her luck, an opportunity has come along for her to buy an established retail clothing store. The current owner has specified that they would prefer the sale to be a share sale, if possible, Melissa has no idea what to do and has asked your advice. Is it in the best interest of Melissa to buy the corporations assets or its shares? Provide at least five reasons to backup your opinion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started