Answered step by step

Verified Expert Solution

Question

1 Approved Answer

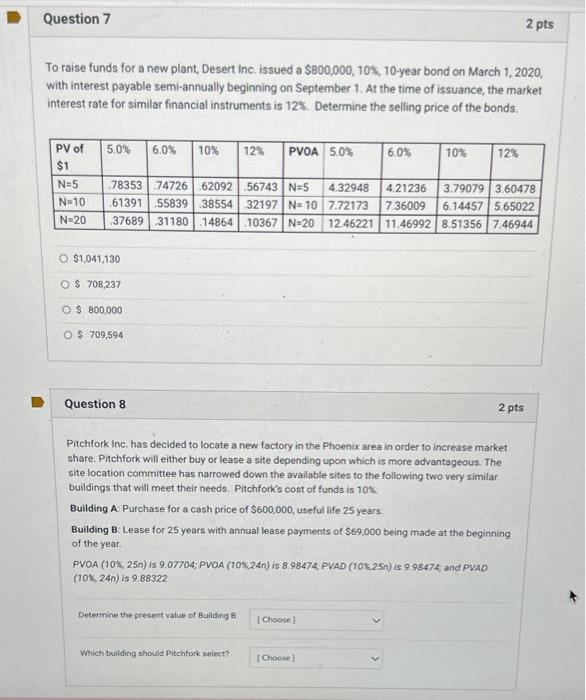

please answer both will upvote To raise funds for a new plant, Desert inc. issued a $800,000,10%, 10-year bond on March 1,2020 , with interest

please answer both will upvote

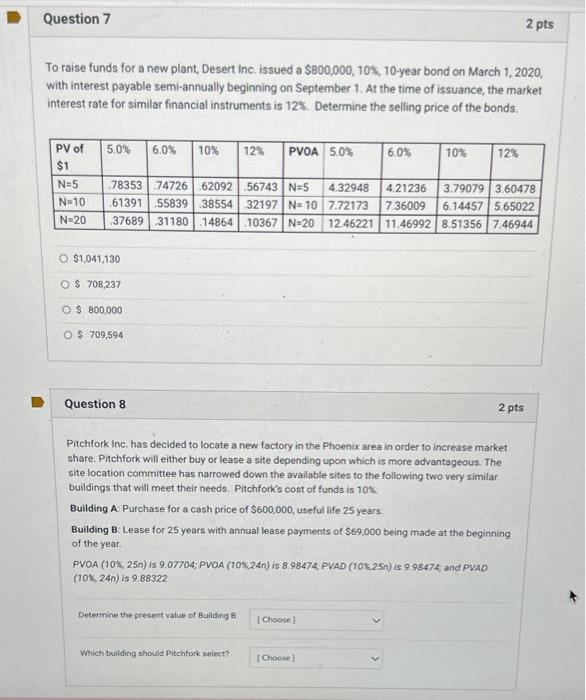

To raise funds for a new plant, Desert inc. issued a $800,000,10%, 10-year bond on March 1,2020 , with interest payable semi-annually beginning on September 1 . At the time of issuance, the market interest rate for similar financial instruments is 12%. Determine the selling price of the bonds. $1,041,130$708,237$800,000$709,594 Question 8 Pitchfork Inc. has decided to locate a new factory in the Phoenix area in order to increase market share. Pitchfork will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following two very similar buildings that will meet their needs. Pitchfork's cost of funds is 10%. Building A: Purchase for a cash price of $600,000, useful life 25 years. Building B: Lease for 25 years with annual lease payments of $69,000 being made at the beginning of the year. PVOA (10%,25n) is 9.07704; PVOA (105,24n) is 8.98474,PVAD(10%25n) is 9.98474, and PVAD (10%,24n) is 9.88322 Determine the present value of Building B Which building should Pitchfork select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started