Answered step by step

Verified Expert Solution

Question

1 Approved Answer

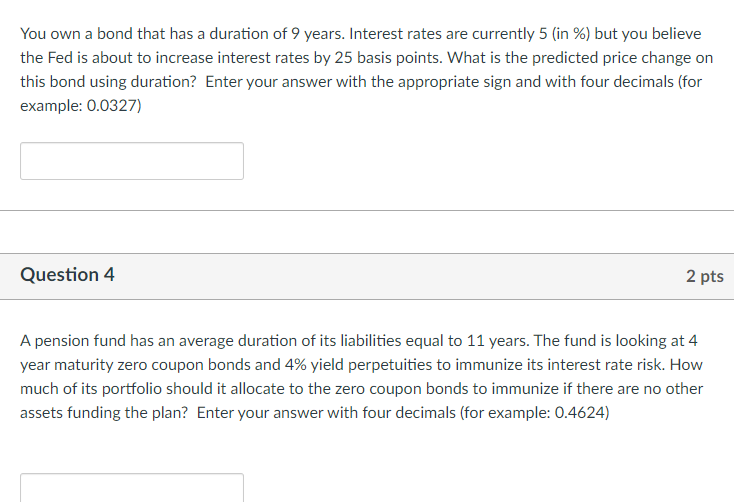

PLEASE ANSWER BOTH WILL UPVOTE You own a bond that has a duration of 9 years. Interest rates are currently 5 (in %) but you

PLEASE ANSWER BOTH WILL UPVOTE

You own a bond that has a duration of 9 years. Interest rates are currently 5 (in \%) but you believe the Fed is about to increase interest rates by 25 basis points. What is the predicted price change on this bond using duration? Enter your answer with the appropriate sign and with four decimals (for example: 0.0327) Question 4 A pension fund has an average duration of its liabilities equal to 11 years. The fund is looking at 4 year maturity zero coupon bonds and 4% yield perpetuities to immunize its interest rate risk. How much of its portfolio should it allocate to the zero coupon bonds to immunize if there are no other assets funding the plan? Enter your answer with four decimals (for example: 0.4624)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started