Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer C and D correctly. I posted this question before, and previous for C was 8.00%, and it was wrong, so I couldn't proceed

Please answer C and D correctly.

I posted this question before, and previous for C was 8.00%, and it was wrong, so I couldn't proceed to D.

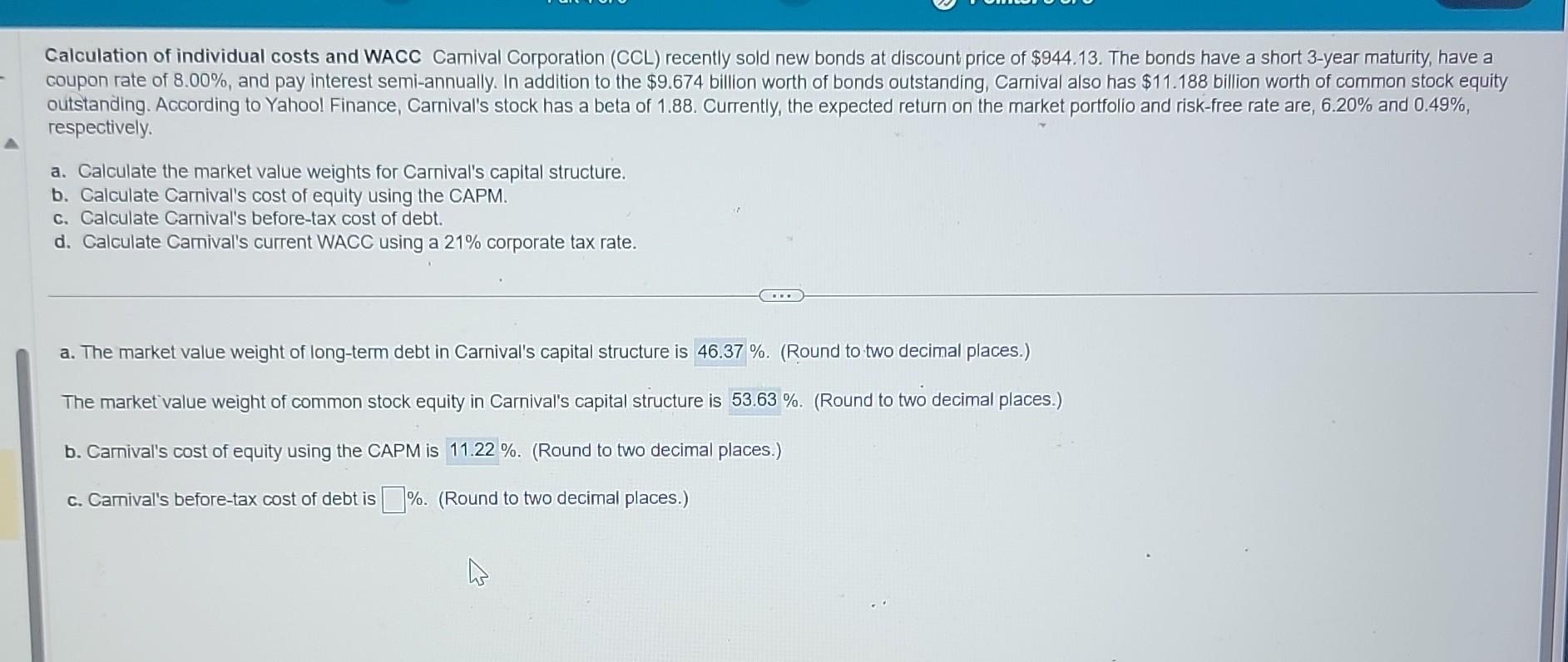

Calculation of individual costs and WACC Camival Corporation (CCL) recently sold new bonds at discount price of $944.13. The bonds have a short 3-year maturity, have a coupon rate of 8.00%, and pay interest semi-annually. In addition to the $9.674 billion worth of bonds outstanding, Carnival also has $11.188 billion worth of common stock equity outstanding. According to Yahool Finance, Carnival's stock has a beta of 1.88 . Currently, the expected return on the market portfolio and risk-free rate are, 6.20% and 0.49%, respectively. a. Calculate the market value weights for Carnival's capital structure. b. Calculate Carnival's cost of equity using the CAPM. c. Calculate Carnival's before-tax cost of debt. d. Calculate Camival's current WACC using a 21% corporate tax rate. a. The market value weight of long-term debt in Carnival's capital structure is 46.37%. (Round to two decimal places.) The market value weight of common stock equity in Carnival's capital structure is \%. (Round to two decimal places.) b. Carnival's cost of equity using the CAPM is \%. (Round to two decimal places.) c. Camival's before-tax cost of debt is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started