Answered step by step

Verified Expert Solution

Question

1 Approved Answer

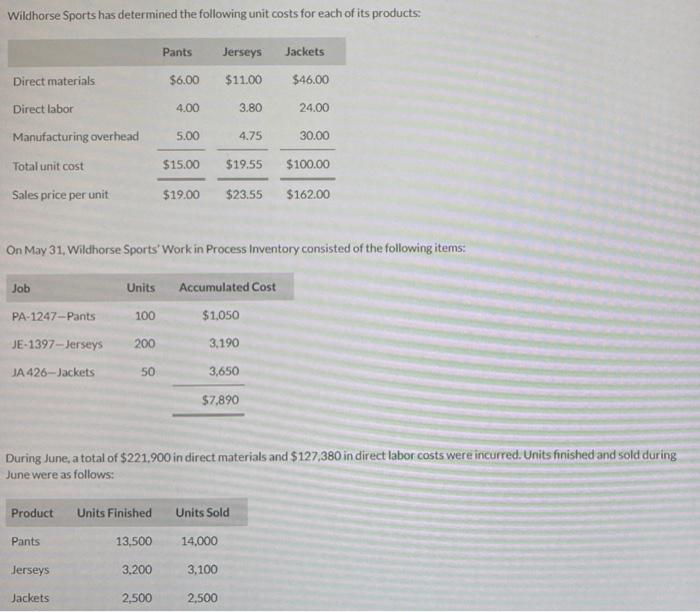

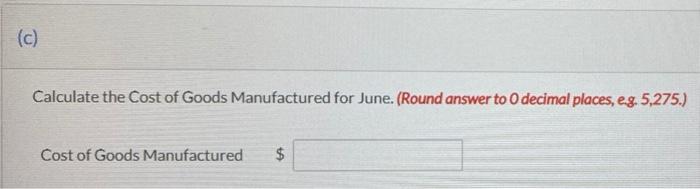

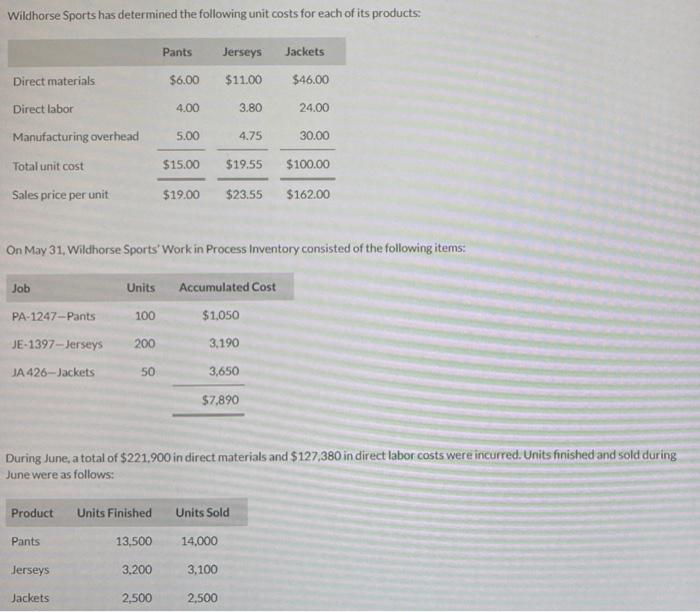

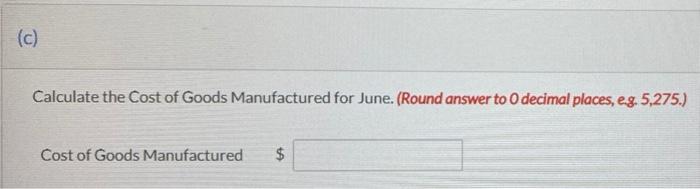

please answer C for thumb's up Wildhorse Sports has determined the following unit costs for each of its products: Pants Jerseys Jackets Direct materials $6.00

please answer C for thumb's up

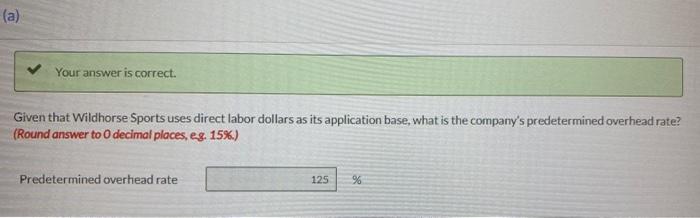

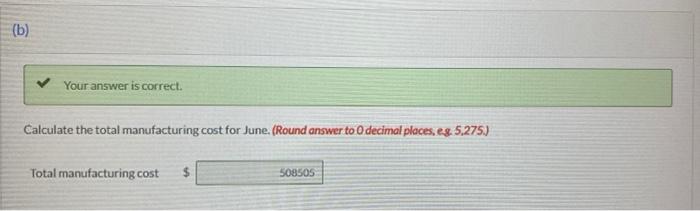

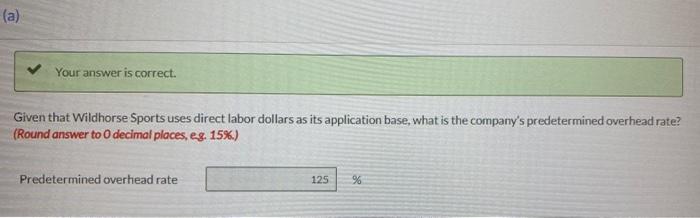

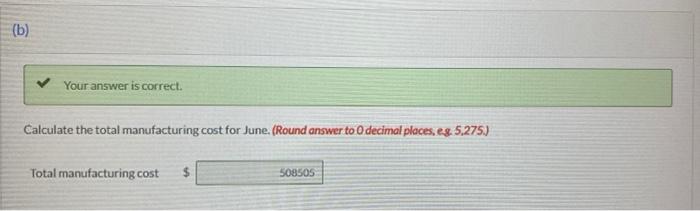

Wildhorse Sports has determined the following unit costs for each of its products: Pants Jerseys Jackets Direct materials $6.00 $11.00 $46.00 Direct labor 4.00 3.80 24.00 Manufacturing overhead 5.00 4.75 30.00 Total unit cost $15.00 $19.55 $100.00 Sales price per unit $19.00 $23.55 $162.00 On May 31, Wildhorse Sports' Work in Process Inventory consisted of the following items: Job Units Accumulated Cost PA-1247-Pants 100 $1,050 JE-1397-Jerseys 200 3,190 JA 426-Jackets 50 3,650 $7,890 During June, a total of $221,900 in direct materials and $127,380 in direct labor costs were incurred. Units finished and sold during June were as follows: Product Units Finished Units Sold Pants 13,500 14,000 Jerseys 3,200 3,100 Jackets 2,500 2,500 (a) Your answer is correct. Given that Wildhorse Sports uses direct labor dollars as its application base, what is the company's predetermined overhead rate? (Round answer to O decimal places, e.g. 15%) Predetermined overhead rate 125 % (b) Your answer is correct. Calculate the total manufacturing cost for June. (Round answer to 0 decimal places, eg. 5,275.) Total manufacturing cost 508505 (c) Calculate the Cost of Goods Manufactured for June. (Round answer to O decimal places, e.g. 5,275.) Cost of Goods Manufactured $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started