Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer case problem 11.2 . please answer questions a,b,c,d,e,f Gue of the other three issues? If so, which sold bresent bond holdeng into Grace

please answer case problem 11.2 . please answer questions a,b,c,d,e,f

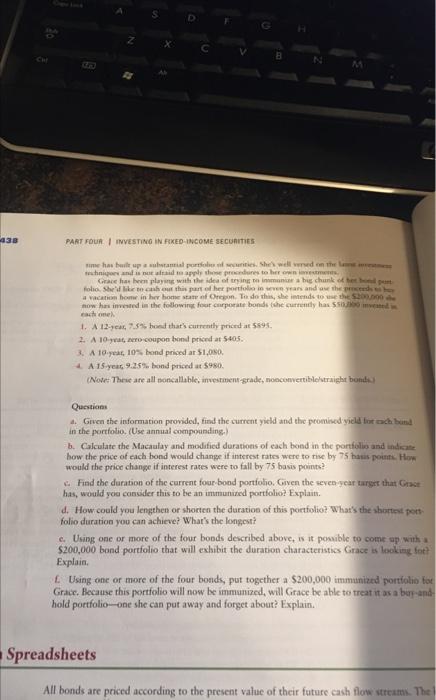

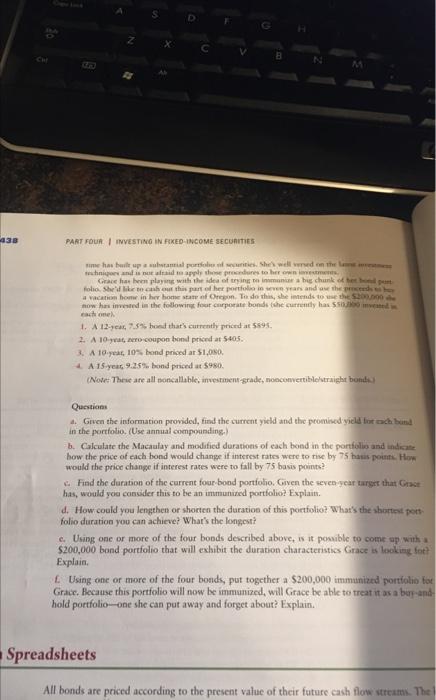

Gue of the other three issues? If so, which sold bresent bond holdeng into Grace Decides to Immunize Her Portfolio Grace Hesketh is the owner of an extremely successful dress boutique in downrown Chicago. Although high fashion is Grace's first love, she's also interested in investments, particularly. bonds and other fixed-income securities. She actively manages her own investments and over. rath areh 1. N 12-yeax, 759 hosid that's currenthy pricird at 589.1. 2. 4 19-gat, ncroicoupon bond pricend at 5.40.5. 3. A teigear, 107 formd prioed ar 51,000 . 4 A 15 .year, 9.25% bond paced at 5980. Quectionas in the prortfolio. (Use annual comporanalinge) b. Calculate the Mlacaalay and modificd durations of each boind in the portiouls and andrate how the price of cach bond wosid change if interest rates were to rive by 75 batis pounte. Hof would the price change if interest rates were to fall by 75 basis porints? c. Fund the dufatan of the current four-bond portioato, Given the seven year arsir that Giast has, would yeic consider this to be an immunired portfolio? Fxplaits. d. How could you lengehen or shoretn the duration of this portholice? What's the ahorteot frath folio diration you can achicae? What's the longest? c. Wsang one or more of the four bobds described above, is it possible to somes api with a 5200,000 band portiolio that will exbrbit. the durarion characteristies Garace is lecker. tor? Explain. f. Using one or more of the four bouds, put together a $200,000 immunized portiolio to Grace. Because this portfolio will now be immunized, will Grace be able to treat it as a ber -and hold portfolio - ane she can put away and forget about? Explain. eadsheets All bonds are priced according to the present value of their future cash flow itrcamk. The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started