Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer Check my work On June 30 of the current year, Blue Ridge Power issued bonds with a $40,000,000 face value and an annual

please answer

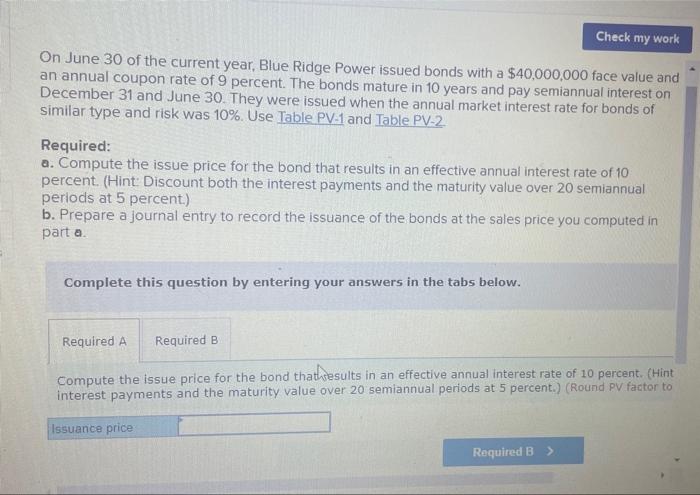

Check my work On June 30 of the current year, Blue Ridge Power issued bonds with a $40,000,000 face value and an annual coupon rate of 9 percent. The bonds mature in 10 years and pay semiannual interest on December 31 and June 30. They were issued when the annual market interest rate for bonds of similar type and risk was 10%. Use Table PV-1 and Table PV-2 Required: a. Compute the issue price for the bond that results in an effective annual interest rate of 10 percent. (Hint: Discount both the interest payments and the maturity value over 20 semiannual periods at 5 percent.) b. Prepare a journal entry to record the issuance of the bonds at the sales price you computed in part a. Complete this question by entering your answers in the tabs below. Required A Required B Compute the issue price for the bond that results in an effective annual interest rate of 10 percent. (Hint interest payments and the maturity value over 20 semiannual periods at 5 percent.) (Round PV factor to Issuance price Required B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started