Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer completely Also include explanation of mathematical formula used to obtain the answer so that I may learn and practice. Make sure if using

Please answer completely

Also include explanation of mathematical formula used to obtain the answer so that I may learn and practice.

Make sure if using a financial calculator tell me the formula used and numbers to input.

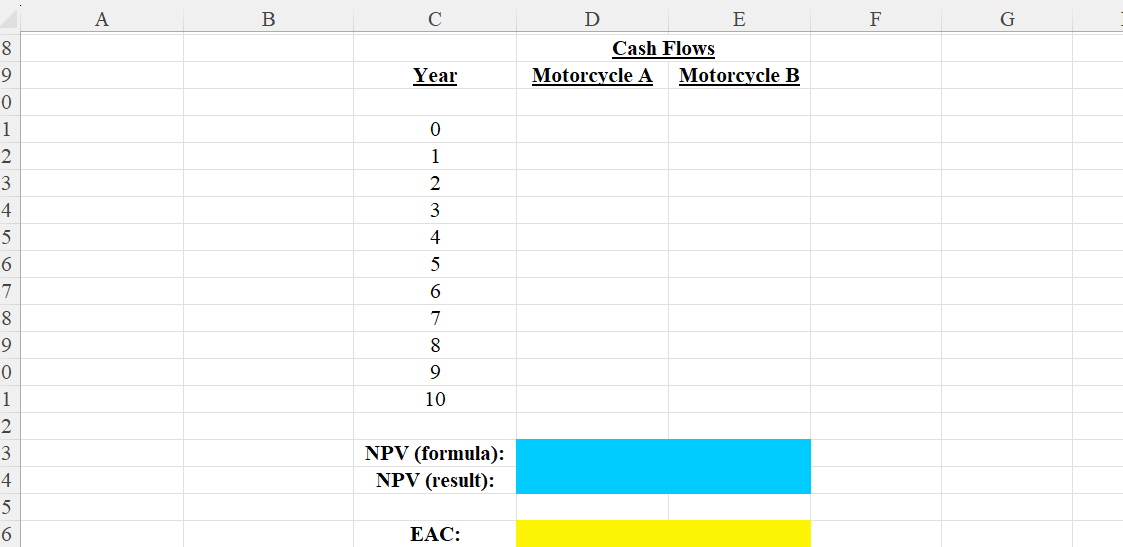

You are starting a family pizza parlor and need to buy a motorcycle for delivery orders. You have two models in mind. Model A costs $ and is expected to run for six years; model B is more expensive, with a price of $ and has an expected life of years. The annual maintenance costs are $ for model A and $ for model B Assume that the opportunity cost of capital is percent.

Which one should I buy and why?

Hint: Calculate the net present value NPV of each motorcycle and then compute the equivalent annual cost EAC Note that since we are dealing with all negative cash flows costs we are looking for the alternative with the least negative EAC.

Initial Investment A: $

Initial Investment B: $

Life in Years A:

Life in Years B:

Annual Maintenance Costs A: $

Annual Maintenance Costs B: $

Cost of Capital:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started